Risk appetite framework

Risk Appetite framework

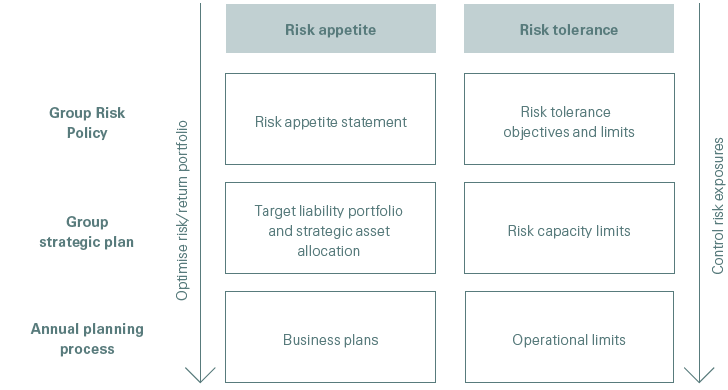

The risk appetite framework establishes the overall approach through which Swiss Re practices controlled risk-taking throughout the Group. The framework is set out in the Group Risk Policy and consists of two interlinked components: risk appetite and risk tolerance.

In the context of business strategy and planning, the risk appetite statement facilitates discussions about where and how Swiss Re should deploy its capital, liquidity and other resources under a risk/return view, while the risk tolerance sets clear boundaries to risk-taking.

During strategic planning and target-setting, Risk Management provides an opinion on the proposed strategy and targets to the Group Executive Committee and ultimately the Group Board. The opinion focuses on the risk impact of the proposed strategy and the risks related to its implementation. The strategic plan, risk appetite and capital allocation ambition are expressed in a target portfolio for the Group’s assets and liabilities, which should ultimately deliver the Group’s targeted performance.

Swiss Re’s risk appetite outlines the Group’s principles on acceptable risks and provides key directions for risk-taking and risk controlling as part of implementing Swiss Re’s strategy: achieving targeted performance, providing liquidity and financial flexibility, managing capital adequacy, and protecting and growing franchise value.

The Group Board further details Swiss Re’s risk appetite through its approval or review of the following key steering frameworks as part of the Group’s planning process: target liability portfolio, strategic asset allocation and the Group’s target capital structure.

Swiss Re’s risk tolerance describes the extent to which the Group Board has authorised executive management to assume risk. It represents the amount of risk that Swiss Re is willing to accept within the constraints imposed by its capital and liquidity resources, its strategy, and the regulatory and rating agency environment within which it operates.

The Group’s risk tolerance is based on three objectives:

- To protect the shareholders’ franchise by ensuring that the Group is able to continue operating the business following an extreme loss event

- To maintain capital and liquidity at respectability levels that are sufficiently attractive from a client perspective, and that meet regulatory requirements and expectations

- To avoid material operational risks that could subject the Group to large operational losses with corresponding consequences from an economic, reputational or regulatory perspective

To meet the first objective, the Group Risk Policy defines an extreme loss absorption limit with conditions that must be fulfilled following the realisation of a loss corresponding to a 99% Group shortfall event. To meet the second objective, the Group’s risk tolerance criteria includes respectability limits, which need to be met under normal operating conditions. These limits ensure that Swiss Re has adequate capital and liquidity above minimum requirements to be considered a respectable counterparty by external stakeholders. To meet the third objective, the Group has established a Group-wide risk matrix methodology in which key operational risks are assessed against an acceptable level of expected losses.

The risk tolerance respectability criteria for the Swiss Re Group are set out in the Group Risk Policy. The Group Board is responsible for approving the risk tolerance criteria, as well as for monitoring and reviewing risk tolerance through its Finance and Risk Committee. Breaches or anticipated breaches of limits established to control the risk tolerance criteria must be communicated to the Group Finance and Risk Committee.

Swiss Re’s risk-taking is governed by a limit framework in order to ensure that accumulation risk and large losses remain at an acceptable level, as well as to steer the allocation of available risk capacity. The limit framework is rooted in the risk appetite and risk tolerance objectives set in the Group Risk Policy and helps to translate these objectives into concrete, measurable criteria. In addition, lower level limits are implemented to allocate scarce capacity. The limit framework also allows for risk monitoring and thus supports risk controlling during the execution of the plan.