Significant shareholders and shareholder structure

Under the Financial Markets Infrastructure Act (FMIA), anyone holding shares in a company listed on SIX Swiss Exchange is required to notify the company and SIX Swiss Exchange if its direct or indirect holding reaches, falls below or exceeds the following thresholds: 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights pursuant to the entry into the commercial register, whether or not the voting rights can be exercised.* Notifications must also include financial instruments, regardless of whether cash or physically settled, constituting a purchase or a sale position. Upon receipt of such notifications, the company is required to inform the public by publishing within two trading days the notification on the electronic platform of SIX Swiss Exchange.

The following table provides a summary of the disclosure notifications of major shareholders holding more than 3% of the voting rights:

Significant shareholders

| Download |

Shareholder1 |

Number of shares |

% of voting rights and share capital |

Creation of the obligation to notify |

||||

|

|||||||

|

|

|

|

||||

BlackRock, Inc. |

17 037 4452 |

5.03 |

27 December 2018 |

||||

|

|

|

|

||||

In addition, Swiss Re Ltd and Swiss Reinsurance Company Ltd held, as of 31 December 2018, directly and indirectly, 38 575 324 shares, which includes 10 050 442 shares repurchased under the public share buy-back programme Swiss Re Ltd launched on 7 May 2018. This represents 11.4% of voting rights and share capital. The public share buy-back programme was completed on 15 February 2019. Neither Swiss Re Ltd nor the Group companies can exercise the voting rights of these shares. All notifications received in 2018 are published at www.swissre.com/investors/shares/disclosure_of_shareholdings/

For further details on the share buy-back programmes please visit: www.swissre.com/investors/shares/share_buyback/

* According to Article 120(1) FMIA, anyone who directly or indirectly or acting in concert with third parties acquires or disposes shares or acquisition or sale rights relating to shares of a company with its registered office in Switzerland whose equity securities are listed in whole or in part in Switzerland, or of a company with its registered office abroad whose equity securities are mainly listed in whole or in part in Switzerland, and thereby reaches, falls below or exceeds the thresholds of 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights, whether exercisable or not, must notify this to the company and to the stock exchanges on which the equity securities are listed. According to Article 120(3) FMIA, anyone who has the discretionary power to exercise the voting rights associated with equity securities in accordance with Article 120(1) FMIA is also subject to the notification. The person or group is obliged to make a notification in writing to the company (issuer) and the stock exchange no later than four trading days after the creation of the obligation to notify (conclusion of a contract).

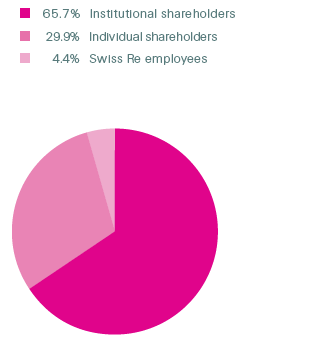

Registered shareholdings by type

As of 31 December 2018

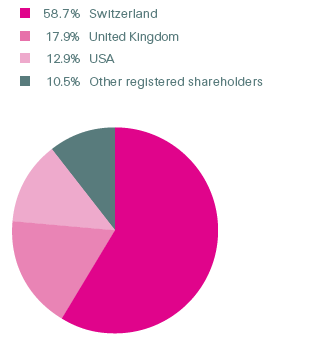

Registered shareholdings by country

As of 31 December 2018

Shareholder structure

Registered — unregistered shares

| Download |

As of 31 December 2018 |

Shares |

in % |

||

|

||||

Registered shares1 |

175 680 523 |

51.9 |

||

Unregistered shares1 |

124 363 618 |

36.7 |

||

Shares held by Swiss Re |

28 524 882 |

8.4 |

||

Share buy-back programme |

10 050 442 |

3.0 |

||

Total shares issued |

338 619 465 |

100.0 |

||

Registered shares with voting rights by shareholder type

| Download |

As of 31 December 2018 |

Shareholders |

in % |

Shares |

in % |

Individual shareholders |

78 343 |

87.8 |

52 537 878 |

29.9 |

Swiss Re employees |

6 864 |

7.7 |

7 663 333 |

4.4 |

Total individual shareholders |

85 207 |

95.5 |

60 201 211 |

34.3 |

Institutional shareholders |

4 017 |

4.5 |

115 479 312 |

65.7 |

Total |

89 224 |

100.0 |

175 680 523 |

100.0 |

Registered shares with voting rights by country

| Download |

As of 31 December 2018 |

Shareholders |

in % |

Shares |

in % |

Switzerland |

76 941 |

86.2 |

103 088 947 |

58.7 |

United Kingdom |

1 463 |

1.6 |

31 366 390 |

17.9 |

USA |

1 464 |

1.6 |

22 693 849 |

12.9 |

Other |

9 356 |

10.6 |

18 531 337 |

10.5 |

Total |

89 224 |

100.0 |

175 680 523 |

100.0 |

Registered shares with voting rights by size of holding

| Download |

As of 31 December 2018 |

Shareholders |

in % |

Shares |

in % |

Holdings of 1–2 000 shares |

83 123 |

93.2 |

31 362 696 |

17.8 |

Holdings of 2 001–200 000 shares |

6 017 |

6.7 |

55 615 847 |

31.7 |

Holdings of > 200 000 shares |

84 |

0.1 |

88 701 980 |

50.5 |

Total |

89 224 |

100.0 |

175 680 523 |

100.0 |

Cross-shareholdings

Swiss Re has no cross-shareholdings in excess of 5% of capital or voting rights with any other company.

More information

More information on the Swiss Re shares, such as the price performance and trading volume in 2018, Swiss Re’s dividend policy and dividends, the share buy-back programme and an overview on the key share statistics since 2014, is included in the section Share performance of this Financial Report.