Performance outcomes 2018

Key considerations for Swiss Re’s annual compensation decisions continue to cover US GAAP and EVM based business results, qualitative factors and Swiss Re’s pay for performance approach.

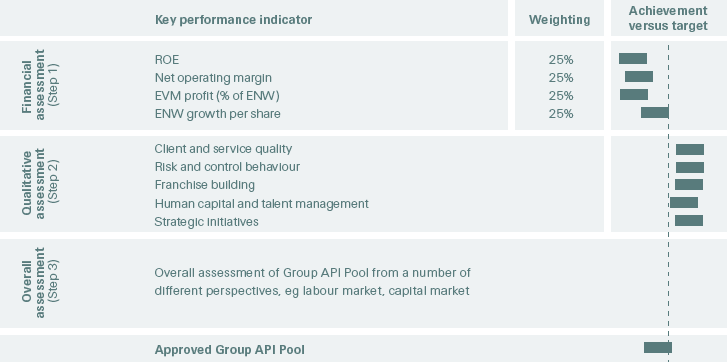

The outcomes of the financial, qualitative and overall assessment, all part of Swiss Re’s three-step funding process (as described in the Annual Performance Incentive section of this Financial Report), again determined the Group API pool for 2018.

Financial assessment (Step 1)

Swiss Re Group and Business Units

In 2018, the Group’s US GAAP performance and EVM results were significantly impacted by large natural catastrophe events and man-made losses: years like this, even in sequence, are not unusual in the context of the business market of Reinsurance. The destructive force of these events was reflected in both the Property & Casualty Reinsurance and Corporate Solutions results. The investment result mirrors challenging financial markets, with credit spread widening and equity market volatility, the latter also negatively impacting US GAAP net income as a result of the new US GAAP guidance on equity investments. Life & Health Reinsurance delivered solid US GAAP and strong economic new business results. Life Capital generated significant gross cash for the Group.

US GAAP financial performance

US GAAP net income of Property & Casualty Reinsurance was adversely affected by large natural catastrophe events and man-made losses, partially offset by favourable prior-year development. The solid performance of Life & Health Reinsurance was mainly driven by large transactions and partially offset by unfavourable mortality experience in the US. Gross premiums written increased compared to 2017, mainly driven by growth across all markets.

Corporate Solutions reported a net loss, reflecting the impact of a combination of large natural catastrophe events and man-made losses. Corporate Solutions is focused on its long-term strategy by continuing to invest in its Primary Lead capabilities and extending its global network coverage. Premiums earned increased compared to 2017, primarily attributable to growth in the Primary Lead business.

Life Capital’s result reflects the unfavourable UK investment market performance in 2018. This was partially offset by net realised investment gains and favourable underwriting experience. The strong gross cash generation was driven by the proceeds from MS&AD’s investment in ReAssure, the underlying surplus on the ReAssure business as well as the favourable finalisation of the 2017 Solvency II position.

For further details and discussion on the US GAAP financial performance, refer to Financial statements of this Financial Report.

EVM financial performance

The EVM underwriting result of Property & Casualty Reinsurance was mainly driven by previous years’ business profit, partially offset by a new business loss due to large natural catastrophe events and man-made losses. The investment loss was primarily due to credit spread widening and mark-to-market losses on equity securities. Life & Health Reinsurance generated a strong new business profit, mainly due to large transactions in Asia and good core business development in the US. Investment activities were impacted by spread widening on credit investments as well as unfavourable interest rate movements on a net long duration position.

Corporate Solutions generated an EVM underwriting loss primarily driven by large natural catastrophe events and man-made losses. A loss on investment activities added to the unfavourable result, driven by the impact of credit spread widening and unfavourable performance from equity investments.

The strong EVM underwriting result of Life Capital was primarily driven by a profit on previous years’ business. This was more than offset by a loss on investment activities due to credit spread widening and underperformance from the implied equity exposure arising from unit-linked business. For further details on the EVM financial performance, refer to the EVM chapter of this Financial Report.

Qualitative assessment (Step 2)

In 2018, Swiss Re again performed well on its qualitative dimension: the Group grew transaction volumes, optimised business retention, strengthened the franchise value and provided client solutions.

Technology played an important role, such as i) in Property & Casualty Reinsurance’s partnership with BMW when developing a vehicle-specific insurance rating that primary insurers worldwide can use to calculate car insurance premiums, and ii) in Life & Health Reinsurance’s market-leading automated underwriting solution, enabling primary insurance clients to automate the assessment and decision-making process, and providing useful data insights. Corporate Solutions extended its global network and now has servicing capabilities in over 120 countries. Life Capital’s open book businesses have grown strongly and the increased MS&AD share demonstrates a strong equity story, creating positive momentum for the potential initial public offering of the UK closed life book business ReAssure.

Swiss Re’s clients and service quality is assessed on an annual basis through leading external benchmarks. Clients positively perceive Swiss Re’s engagement and client advisory beyond the traditional risk transfer. Thought leadership at major industry events (such as the G20 and World Economic Forum) in the field of mitigating climate risk, building societal resilience and driving digital insurance solutions continues to establish Swiss Re as the go-to provider for solving resilience challenges.

Contributing to sustainability (including social development and financial inclusion) throughout the whole value chain remained key: by supporting clients in sustainable underwriting and by investing responsibly. The ESG (Environment, Social, Governance) approach stood out and the global industry dialogue across policymakers and peers continued to advance.

A comprehensive array of innovative solutions was launched, such as the award-winning service helping people back to wellbeing after cancer treatment. New modelling and risk transfer solutions were developed to counter environment- related losses such as from floods and drought. On many occasions, there was close cooperation with Swiss Re’s clients, and public and private partners. For example, together Swiss Re i) established the first global mechanism dedicated to supporting famine prevention, response and recovery, ii) designed a new type of insurance to protect the coral reefs and iii) launched the first health coverage for women in Egypt.

Swiss Re’s 14 943 talented employees achieved all this. In the global employee engagement survey, staff commended empowerment and autonomy, open and safe dialogue with management, and diversity. The Group’s open mind, inclusive of individual differences, was also recognised externally: Swiss Re was rewarded by inclusion in the Bloomberg Gender-Equality index for its focus and transparency on gender-related topics in the workplace.

Reinsurance and risk are intrinsically linked. The continuous assessment by Swiss Re’s Assurance functions keeps the Group focused: there is a robust risk governance framework with a clear risk appetite and accountability for managing risk. A strong tone at the top supports an effective culture for risk management activities, such as open discussion and effective challenge within the decision-making process where risk and options are evaluated.

Overall assessment (Step 3)

The labour market review concluded that Swiss Re is acting in line with the majority of reinsurance organisations, which have projected an increase in their annual incentive pools, though pool levels are still below target levels. The capital market review highlighted that the proportionality of proposed value sharing in terms of revenue sharing with employees is below peers’ historical three-year median levels, giving a higher percentage distribution to shareholders.

Performance targets used for the financial assessment are considered to be commercially sensitive to the business, and disclosure of such may provide an unfair advantage to Swiss Re’s competitors. However, to further increase transparency on the bonus-setting process, indicative achievements against the targets are disclosed.

Performance outcomes

Group API pool outcome 2018

Annual Performance Incentive

Both the Compensation Committee and the full Board of Directors assessed in depth the 2018 performance of Swiss Re Group. The US GAAP performance was below target, but higher than last year, and would have been even better without the impact of the new US GAAP accounting guidance on equity investments. Combined with the Group’s strong qualitative performance, this has resulted in variable compensation payouts that are below target levels but higher than last year. This payout decision is supported by our long-standing practice where we have positive but not excessive variable compensation payouts in years with relatively benign natural catastrophe environments, and conversely, lower but proportionate variable compensation payouts in adverse environments. This allows us to carefully manage key talent retention risk.

Value Alignment Incentive

VAI performance is measured for the Group and each underlying business area. The performance factor for each participant is determined based on the business area that the participant worked on 31 December of the year preceding the award (see the Value Alignment Incentive section for a detailed description of the VAI). The VAI 2015 (awarded 2016) performance factor of 100.0% for the Swiss Re Group is based on the three-year average previous years’ business performance for years 2016, 2017 and 2018. The main drivers were previous years’ business profits in Property & Casualty Reinsurance offset by previous years’ business losses in Life & Health Reinsurance and Corporate Solutions.

| Download |

VAI plan year |

Performance period remaining as of 31 December 2018 |

Swiss Re Group performance factor |

2011 (awarded 2012) |

Closed |

103.0% |

2012 (awarded 2013) |

Closed |

101.5% |

2013 (awarded 2014) |

Closed |

100.3% |

2014 (awarded 2015) |

Closed |

99.9% |

2015 (awarded 2016) |

– |

100.0% |

2016 (awarded 2017) |

1 year |

to be determined |

2017 (awarded 2018) |

2 years |

to be determined |

Leadership Performance Plan

The LPP award is consistently linked to the Group’s future achievement of multi-year performance conditions (ROE and relative TSR), keeping the focus on the long-term success of the Group. Swiss Re made LPP grants in 2018 consistent with this rationale. The LPP is generally part of total compensation (see the Leadership Performance Plan section for a detailed description of the LPP).

The RSU component is measured against an ROE performance condition. At the end of each year, the performance is assessed and one third of the RSUs are locked in within a range of 0% to 100%. At the end of the three-year period, the total number of units locked in vests. For the LPP 2015 and LPP 2016, the average performance factor for the RSUs was 66.7% and 32.3% respectively for the three-year period.

The PSU component is based on relative TSR, measured against a predefined basket of peers, and vests within a range of 0% to 200%. For both the LPP 2015 and LPP 2016, the performance factor for the PSUs was 0% for the three-year period. The table below gives an overview of the RSU and PSU performance achievement for the previous LPP plan years:

| Download |

LPP plan year |

Performance period remaining as of 31 December 2018 |

RSU average performance factor for the three-year period |

PSU performance factor for the three-year period |

2012 |

Closed |

99.7% |

200.0% |

2013 |

Closed |

99.7% |

60.0% |

2014 |

Closed |

99.7% |

81.0% |

2015 |

Closed |

66.7% |

0.0% |

2016 |

– |

32.3% |

0.0% |

2017 |

1 year |

to be determined |

to be determined |

2018 |

2 years |

to be determined |

to be determined |