Compensation highlights in 2018

Pay for performance

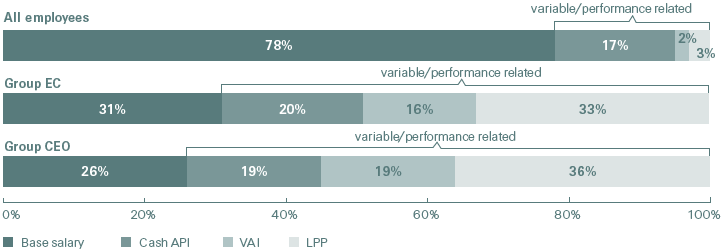

The Compensation Committee ensures that Group EC compensation is linked to the business performance of Swiss Re by delivering a substantial portion of compensation in the form of variable and performance-related incentives.

| Download |

|

Base salary |

Variable/performance related |

Of which deferred |

All employees |

78% |

22% |

21% |

Group EC |

31% |

69% |

72% |

Group CEO |

26% |

74% |

74% |

The Compensation Committee monitors how compensation is aligned with specific business metrics, including US GAAP net income and EVM profit.

| Download |

USD millions (unless otherwise stated) |

2016 |

2017 |

Change |

2018 |

Change |

||||||

|

|||||||||||

US GAAP net income |

3 558 |

331 |

–91% |

421 |

27% |

||||||

EVM profit |

1 399 |

–9 |

– |

–693 |

– |

||||||

Regular dividend payments (CHF)1 |

4.85 |

5.00 |

3% |

5.60 |

12% |

||||||

Financial strength rating (Standard & Poor’s) |

AA– |

AA– |

|

AA– |

|

||||||

Total equity |

35 716 |

34 294 |

–4% |

28 727 |

–16% |

||||||

Regular staff worldwide |

14 053 |

14 485 |

|

14 943 |

|

||||||

Aggregate compensation for all employees |

2 265 |

2 165 |

–4% |

2 208 |

2% |

||||||

Group EC members3 |

14 |

14 |

|

14 |

|

||||||

Aggregate Group EC compensation |

51 430 |

43 159 |

–16% |

44 253 |

3% |

||||||

Attribution of Group income to key stakeholders

| Download |

USD millions (unless otherwise stated) |

2016 |

% |

2017 |

% |

2018 |

% |

||||

|

||||||||||

Income before tax and variable compensation |

4 773 |

100% |

814 |

100% |

863 |

100% |

||||

Variable compensation |

466 |

10% |

351 |

43% |

373 |

43% |

||||

Income tax expense |

749 |

16% |

132 |

16% |

69 |

8% |

||||

US GAAP net income attributable to shareholders |

3 558 |

|

331 |

|

421 |

|

||||

of which paid out as dividend1 |

1 559 |

33% |

1 592 |

196% |

1 692 |

196% |

||||

of which share buy-back |

1 006 |

21% |

1 032 |

127% |

1 0222 |

118% |

||||

of which added to retained earnings within shareholders’ equity |

993 |

20% |

–2 293 |

|

–2 293 |

|

||||