Annual Performance Incentive

Purpose

The API is a performance-based, variable component of compensation. Combined with the base salary, it provides competitive total cash compensation when both business and individual performance targets are achieved.

Structure

Swiss Re operates a Target API (TAPI) system along with a performance management framework that provides equal weighting to results-oriented and behaviour-related performance criteria for all employees. API is awarded for both objectives achieved and the demonstration of desired behaviours.

Group API pool funding process

A TAPI is set based on multiple factors, but primarily on the role being performed and market benchmarks. Similar to the determination of the base salary, the employee’s total compensation and overall pay mix are taken into account when setting the TAPI. The possible payout for the API ranges from 0 to 2 × TAPI.

For Group EC members an additional cap applies which is 3 × annual base salary.

In 2018, for the members of the Group EC including the Group CEO, the total of the aggregate TAPIs amounted to CHF 15.52 million. This is a slight decrease from the prior year, which is due to the number of Group EC members being reduced from 13 to 12 in 2018. For the Group CEO, the TAPI was CHF 2.5 million for the same year. The Group CEO’s TAPI has increased by 11% (from CHF 2.25 million) to account for his greater experience in the role.

Funding

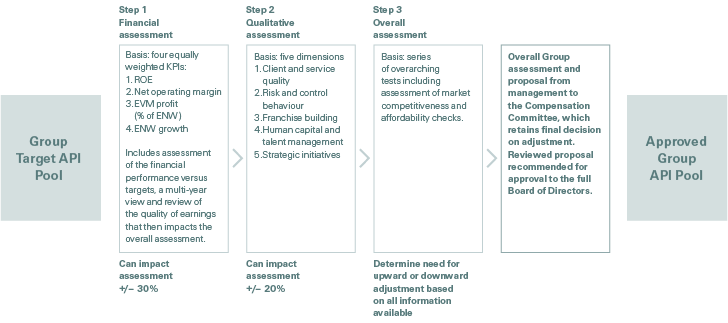

Swiss Re uses a three-step process to assess business performance to help determine the overall Group API pool. The process comprises a financial, a qualitative and an overall assessment. The financial assessment covers four equally weighted performance factors: ROE, net operating margin, EVM profit (% of economic net worth/ENW) and ENW growth measured for both the Group and each Business Unit individually. Also, multi-year comparisons and an assessment of the quality of earnings are considered. The qualitative assessment is based on the achievement of key objectives that aim to reinforce the success of Swiss Re’s strategy. For each Business Unit/Group Function, an assessment is made considering five defined dimensions: client and service quality, risk and control behaviour, franchise building, human capital and talent management and strategic initiatives. The preliminary Group API pool is then reviewed considering a number of different perspectives including pay for performance linkage, reasonableness in the market context and proportionality of value sharing among employees and shareholders. The chart below gives more detail on the criteria used to determine the size of the pool.

Allocation

The approved Group API pool is further allocated to the Senior Leadership pool and to pools of different Business Units/Group Functions. This allocation is agreed by the Group CEO based on the assessment of financial and qualitative performance factors for the respective business area.

The individual API is determined considering the TAPI, business and individual performance. Individual performance is assessed against the individual’s established goals and Swiss Re’s behaviour expectations and corporate values.

Settlement

API is generally settled in cash. When the total API level for an employee exceeds a predefined amount, the award is split into two components: an immediate cash incentive payment (cash API) and a deferred API (VAI).

Forfeiture of unsettled awards and clawback provisions for settled awards apply in a range of events, enabling Swiss Re to seek repayment where appropriate. Examples of such events are acts which can be considered as malfeasance, fraud or misconduct.