Compensation decisions for the Group EC

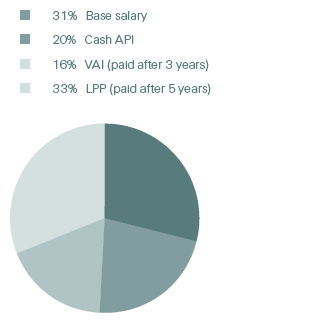

Compensation mix for Group EC 2018

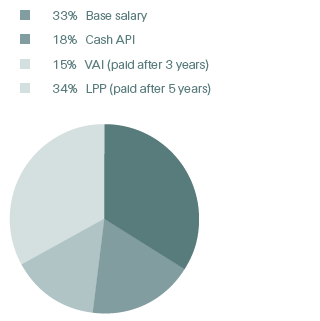

Compensation mix for Group EC 2017

The following table covers payments to 14 members of the Group EC for 2018, of whom 11 were active for the full year. The 2017 payments also cover 14 members of the Group EC, of whom 12 were active for the full year.

| Download |

|

14 members |

14 members |

||||||||||||

CHF thousands |

2017 |

2018 |

||||||||||||

|

||||||||||||||

Base salaries |

12 995 |

12 265 |

||||||||||||

Allowances1 |

861 |

1 159 |

||||||||||||

Funding of pension benefits |

2 132 |

1 928 |

||||||||||||

Total fixed compensation |

15 988 |

15 352 |

||||||||||||

Cash Annual Performance Incentive2 |

7 069 |

7 781 |

||||||||||||

Value Alignment Incentive2 |

5 931 |

6 559 |

||||||||||||

Leadership Performance Plan3 |

13 450 |

13 150 |

||||||||||||

Granted in RSU (50%) |

6 725 |

6 575 |

||||||||||||

Granted in PSU (50%) |

6 725 |

6 575 |

||||||||||||

Total variable compensation |

26 450 |

27 490 |

||||||||||||

Total fixed and variable compensation4 |

42 438 |

42 842 |

||||||||||||

Compensation due to members leaving5 |

721 |

1 411 |

||||||||||||

Total compensation7 |

43 159 |

44 253 |

||||||||||||

The proposed total API amount for 2018 for the Group EC (including the Group CEO) is CHF 14.3 million, which represents a 10.0% increase when compared to 2017 (CHF 13.0 million). This increase should be seen in the context of a very substantial API decrease of circa 29% in 2017 for the Group EC (again including the Group CEO) compared to the previous year. The Compensation Committee and the Board of Directors carefully considered the performance of the Group EC in 2018 and concluded that, given the overall business environment context for the Swiss Re Group and the significant qualitative achievements, a modest API increase compared to last year is warranted. Nevertheless, this amount overall still remains below target levels.

Compensation decisions for the highest-paid member of the Group EC

The table below shows the compensation paid to Christian Mumenthaler, Group CEO (in the role since 1 July 2016):

| Download |

CHF thousands |

2017 |

2018 |

||||||||

|

||||||||||

Base salary |

1 400 |

1 475 |

||||||||

Allowances1 |

35 |

35 |

||||||||

Funding of pension benefits |

178 |

178 |

||||||||

Total fixed compensation |

1 613 |

1 688 |

||||||||

Cash Annual Performance Incentive2 |

810 |

1 063 |

||||||||

Value Alignment Incentive2 |

810 |

1 063 |

||||||||

Leadership Performance Plan3 |

2 000 |

2 000 |

||||||||

Granted in RSU (50%) |

1 000 |

1 000 |

||||||||

Granted in PSU (50%) |

1 000 |

1 000 |

||||||||

Total variable compensation |

3 620 |

4 126 |

||||||||

Total compensation4 |

5 233 |

5 814 |

||||||||

The performance of the Group CEO is evaluated against both quantitative targets (as defined in the Group Plan approved by the Board of Directors) and qualitative goals agreed between the Board of Directors and the Group CEO, designed to support long-term business strategy and to drive sustainable performance across the Swiss Re Group. The quantitative results of the Group have been discussed in detail in Performance outcomes 2018.

The Board was very satisfied with the achievement of the Group CEO on qualitative goals. These include, amongst several others, a constructive relationship with regulators worldwide, strong credit ratings and stable credit spreads, successfully representing the Group to our global client base, developing long-term initiatives to build a strong franchise far into the future (such as the ESG investment strategies, the Swiss Re Institute and employee engagement/diversity) and, in particular, leading the decision-making process in large possible, but discontinued corporate transactions.

Overall, the Board of Directors is very satisfied with how effectively the Group CEO is steering the Group despite very challenging conditions.

Additional information on compensation decisions

For US GAAP and statutory reporting purposes, VAI and LPP awards are accrued over the period during which they are earned. For the purpose of the disclosure required in this Compensation Report, the value of awards granted is included as compensation in the year of performance for the years 2017 and 2018 respectively.

Each member of the Group EC, including the Group CEO, participates in a defined contribution pension scheme. The funding of pension benefits shown in the previous two tables reflects the actual employer contributions.

Other payments to members of the Group EC

During 2018, no payments (or waivers of claims) other than those set out in the section “Compensation disclosure and shareholdings in 2018” were made to current members of the Group EC or persons closely related.

Shares held by members of the Group EC

The following table reflects Swiss Re share ownership by members of the Group EC as of 31 December:

| Download |

Members of the Group EC |

2017 |

2018 |

||||

|

||||||

Christian Mumenthaler, Group CEO |

68 775 |

71 733 |

||||

David Cole, former Group Chief Financial Officer1 |

82 982 |

n/a |

||||

John R. Dacey, Group Chief Financial Officer |

23 671 |

27 124 |

||||

Guido Fürer, Group Chief Investment Officer |

61 077 |

66 007 |

||||

Agostino Galvagni, CEO Corporate Solutions |

94 591 |

99 521 |

||||

Jean-Jacques Henchoz, former CEO Reinsurance EMEA2 |

49 020 |

n/a |

||||

Russell Higginbotham, CEO Reinsurance EMEA |

n/a |

3 918 |

||||

Thierry Léger, CEO Life Capital |

49 841 |

53 785 |

||||

Moses Ojeisekhoba, CEO Reinsurance |

36 194 |

38 998 |

||||

Jayne Plunkett, CEO Reinsurance Asia |

34 288 |

36 264 |

||||

Patrick Raaflaub, Group Chief Risk Officer |

– |

3 944 |

||||

Edouard Schmid, Group Chief Underwriting Officer |

29 161 |

30 936 |

||||

J. Eric Smith, CEO Reinsurance Americas |

21 400 |

24 004 |

||||

Thomas Wellauer, Group Chief Operating Officer |

105 390 |

110 520 |

||||

Total |

656 390 |

566 754 |

||||

Leadership Performance Plan units held by members of the Group EC

The following table reflects total unvested LPP units (RSUs and PSUs) held by members of the Group EC as of 31 December:

| Download |

Members of the Group EC |

2017 |

2018 |

Christian Mumenthaler, Group CEO |

108 779 |

119 029 |

David Cole, former Group Chief Financial Officer |

57 825 |

n/a |

John R. Dacey, Group Chief Financial Officer |

57 825 |

55 178 |

Guido Fürer, Group Chief Investment Officer |

68 394 |

68 971 |

Agostino Galvagni, CEO Corporate Solutions |

57 825 |

55 178 |

Jean-Jacques Henchoz, former CEO Reinsurance EMEA |

46 259 |

n/a |

Russell Higginbotham, CEO Reinsurance EMEA |

n/a |

26 277 |

Thierry Léger, CEO Life Capital |

54 715 |

55 178 |

Moses Ojeisekhoba, CEO Reinsurance |

54 715 |

55 178 |

Jayne Plunkett, CEO Reinsurance Asia |

43 149 |

44 142 |

Patrick Raaflaub, Group Chief Risk Officer |

54 715 |

55 178 |

Edouard Schmid, Group Chief Underwriting Officer |

39 678 |

41 962 |

J. Eric Smith, CEO Reinsurance Americas |

46 259 |

44 142 |

Thomas Wellauer, Group Chief Operating Officer |

57 825 |

55 178 |

Total |

747 963 |

675 591 |

Loans to members of the Group EC

As per Article 27 of the Articles of Association, credits and loans to members of the Group EC may be granted at employee conditions applicable for the Swiss Re Group, with a cap on the total amount of such credits and loans outstanding per member.

In general, credit is secured against real estate or pledged shares. The terms and conditions of loans and mortgages are typically the same as those available to all employees of the Swiss Re Group in their particular locations to the extent possible.

Swiss-based variable-rate mortgages have no agreed maturity dates. The basic preferential interest rates equal the corresponding interest rates applied by the Zurich Cantonal Bank minus one percentage point. Where fixed or floating interest rates are preferential, the value of this benefit has been included under “allowances” in the tables covering compensation decisions for Group EC members.

The following table reflects total mortgages and loans for members of the Group EC as of 31 December:

| Download |

CHF thousands |

2017 |

2018 |

Total mortgages and loans to members of the Group EC |

914 |

900 |

Highest mortgage and loan to an individual member of the Group EC: |

|

|

Edouard Schmid, Group Chief Underwriting Officer |

914 |

900 |

Total mortgages and loans not at market conditions to former members of the Group EC |

4 300 |

4 300 |