Allocation of tasks within the Board of Directors

Chairman of the Board of Directors

The Chairman of the Board of Directors leads the Board of Directors, convenes the Board and committee meetings, establishes the agendas and presides over Board meetings. The Chairman coordinates the work of the Board committees together with the respective Chairpersons and ensures that the Board is kept informed about the committees’ activities and findings. In cases of doubt, the Chairman makes decisions about the authority of the Board or its committees and about interpreting and applying the SRL Bylaws.

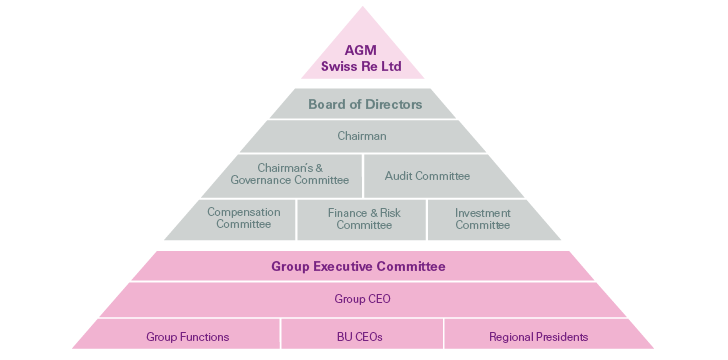

Swiss Re’s governance framework

The Chairman chairs the Chairman’s and Governance Committee and develops and continually adapts Swiss Re’s governance to regulatory and corporate requirements. He keeps himself informed about the activities within the Group and may sit on Group EC and Business Unit Executive Committee meetings as he deems necessary. He also has access to all corresponding documentation and minutes. He ensures adequate reporting by the Group EC and the Group CEO to the Board of Directors and facilitates their communication with the Board. He annually assesses the Group CEO’s performance and discusses with the Group CEO the annual performance assessment of the Group EC members.

The Chairman presides over General Meetings of shareholders and represents the Swiss Re Group towards its shareholders, in industry associations and in the interaction with other stakeholders such as the media, political and regulatory authorities, governmental officials and the general public. Specifically, the Chairman keeps regular contact with our Group regulator (FINMA).

The Chairman arranges introduction for new Board members and appropriate training for all Board members.

If the office of the Chairman is vacant, the Board of Directors may appoint a new Chairman from among its members for the remaining term of office. Such a resolution requires both the presence of all remaining members of the Board of Directors, physically or by telephone or video conference, and a majority of at least three-quarters.

Vice Chairman

The Vice Chairman deputises, if the Chairman is prevented from performing his duties or in a potential conflict of interest situation. The Vice Chairman may prepare and execute Board resolutions on request of the Board and liaises between the Board and the Group EC in matters not reserved to the Chairman.

Lead Independent Director

The Vice Chairman or another member of the Board of Directors may also assume the role of the Lead Independent Director. The Lead Independent Director acts as an intermediary between the Swiss Re Group and its shareholders and stakeholders in the absence of the Chairman or in particular when a senior independent member of the Board is required. He may convene and chair sessions where the Chairman is not present. He will communicate the outcome of these sessions to the Chairman.

Committees of the Board of Directors

As determined by applicable law and the Articles of Association, the Board of Directors has inalienable and non-transferable responsibilities and authorities. The Board of Directors has established Board committees which support the Board in fulfilling its duties. The Board of Directors has delegated certain responsibilities, including the preparation and execution of its resolutions, to the following five committees: the Chairman’s and Governance Committee, the Audit Committee, the Compensation Committee, the Finance and Risk Committee and the Investment Committee.

Board Committee memberships

| Download |

Name |

Chairman’s and Governance Committee |

Audit Committee |

Compensation Committee |

Finance and Risk Committee |

Investment Committee |

|||||

Walter B. Kielholz |

X |

(chair) |

|

|

|

|

|

|

|

|

Renato Fassbind |

X |

|

X |

(chair) |

X |

|

|

|

|

|

Raymond K.F. Ch’ien |

|

|

|

|

X |

|

|

|

X |

|

Mary Francis |

|

|

X |

|

|

|

X |

|

|

|

Rajna Gibson Brandon |

|

|

|

|

|

|

X |

|

X |

|

C. Robert Henrikson |

X |

|

|

|

X |

(chair) |

X |

|

|

|

Trevor Manuel |

|

|

X |

|

|

|

|

|

X |

|

Jay Ralph |

|

|

|

|

|

|

X |

|

|

|

Joerg Reinhardt |

|

|

|

|

X |

|

|

|

|

|

Philip K. Ryan |

X |

|

X |

|

|

|

X |

(chair) |

|

|

Sir Paul Tucker |

|

|

|

|

|

|

X |

|

X |

|

Jacques de Vaucleroy |

|

|

|

|

|

|

|

|

X |

|

Susan L. Wagner |

X |

|

|

|

|

|

X |

|

X |

(chair) |

Each committee consists of a chairperson and at least three other members elected from among the Board of Directors. The members of the Compensation Committee are annually elected by the Annual General Meeting of shareholders.

The term of office of a Board committee member is one year, beginning with the appointment at the constituting Board meeting following an Annual General Meeting of shareholders and ending at the Board meeting following the subsequent Annual General Meeting of shareholders. For the Compensation Committee members the term of office begins with the election at the Annual General Meeting of shareholders until completion of the next Annual General Meeting of shareholders.

Each committee is governed by a Charter which defines the committee’s responsibilities. The committees operate in line with the SRL Bylaws and according to their respective Charters.

The committees have the following overall responsibilities:

Chairman’s and Governance Committee

Responsibilities

The Chairman’s and Governance Committee’s primary function is to act as counsellor to the Chairman and to address corporate governance issues affecting the Group and impacting the legal and organisational structure. It is in charge of the succession planning at the Board of Directors level and oversees the annual performance assessment and self-assessment at both the Board of Directors and the Group EC level.

Members

- Walter B. Kielholz, Chair

- Renato Fassbind

- C. Robert Henrikson

- Philip K. Ryan

- Susan L. Wagner

Audit Committee

Responsibilities

The central task of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities as they relate to the integrity of Swiss Re’s and the Group’s financial statements, the Swiss Re Group’s compliance with legal and regulatory requirements, the external auditor’s qualifications and independence, and the performance of Group Internal Audit (GIA) and the Group’s external auditor. The Audit Committee monitors independently and objectively Swiss Re’s and the Group’s financial reporting process and system of internal control, and facilitates ongoing communication between the external auditor, Group EC, Business Units, GIA, and the Board with regard to the Swiss Re Group’s financial situation.

Members

- Renato Fassbind, Chair

- Mary Francis

- Trevor Manuel

- Philip K. Ryan

Independence and other qualifications

All members of the Audit Committee are non-executive and independent. In addition to the independence criteria applicable to Board members in general, additional independence criteria apply to members of the Audit Committee. They are required to possess such additional attributes as the Board of Directors may, from time to time, specify. Each member of the Audit Committee has to be financially literate. At least one member must qualify as an Audit Committee financial expert, as determined appropriate by the Board of Directors. Members of the Audit Committee should not serve on audit committees of more than four listed companies outside the Swiss Re Group. Audit Committee members have to advise the Chairman of Swiss Re Ltd before accepting any further invitation to serve on an audit committee of another listed company outside the Group and observe the limitations set in the Articles of Association in relation to external mandates (see other mandates, activities and functions).

Compensation Committee

Responsibilities

The Compensation Committee supports the Board of Directors in establishing and reviewing Swiss Re Ltd’s compensation strategy and guidelines and performance criteria as well as in preparing the proposals to the General Meeting of shareholders regarding the compensation of the Board of Directors and of the Group EC. It proposes compensation principles in line with legal and regulatory requirements and the Articles of Association for the Swiss Re Group to the Board of Directors for approval and, within those approved principles, determines the establishment of new (and amendments to existing) compensation plans, and determines, or proposes as appropriate, individual compensation as outlined in its Charter. The Compensation Committee also ensures that compensation plans do not encourage inappropriate risk-taking within the Swiss Re Group and that all aspects of compensation are fully compliant with remuneration disclosure requirements.

Members

- C. Robert Henrikson, Chair

- Raymond K.F. Ch’ien

- Renato Fassbind

- Joerg Reinhardt (since AGM 2017)

- Carlos E. Represas (until AGM 2017)

Finance and Risk Committee

Responsibilities

The Finance and Risk Committee annually reviews the Group Risk Policy and proposes it for approval to the Board of Directors, reviews risk and capacity limits approved by the Group EC as well as their usage across the Swiss Re Group and reviews the Risk Control Framework. It reviews the most important risk exposures in all major risk categories as well as new products or strategic expansions of the Swiss Re Group’s areas of business. It reviews the risk aspects of Control Transactions. In terms of risk and economic performance measurement it reviews critical principles used in internal risk measurement, valuation of assets and liabilities, capital adequacy assessment and economic performance management. It also reviews the capital adequacy and the Swiss Re Group’s treasury strategy.

Members

- Philip K. Ryan, Chair

- Mary Francis

- Rajna Gibson Brandon

- C. Robert Henrikson

- Sir Paul Tucker

- Susan L. Wagner

- Jay Ralph (since AGM 2017)

Investment Committee

Responsibilities

The Investment Committee endorses the strategic asset allocation and reviews tactical asset allocation decisions. It reviews the performance of the financial assets of the Swiss Re Group and endorses or receives information on Participations and Principal Investments.

It reviews the risk analysis methodology as well as the valuation methodology related to each asset class and ensures that the relevant management processes and controlling mechanisms in asset management are in place.

Members

- Susan L. Wagner, Chair

- Raymond K.F. Ch’ien

- Rajna Gibson Brandon

- Trevor Manuel

- Sir Paul Tucker

- Jacques de Vaucleroy (since AGM 2017)