Share performance

Swiss Re shares

Swiss Re had a market capitalisation of CHF 31.9 billion on 31 December 2017, with 349.5 million shares outstanding, of which 314.6 million were entitled to dividends. Swiss Re shares are listed in accordance with the International Reporting Standard on the SIX Swiss Exchange (SIX) and are traded under the ticker symbol SREN.

General information on Swiss Re shares

| Download |

Identification numbers |

Share |

ADR |

|

||

|

|||||

Swiss Security Number (Valorennummer) |

12688156 |

— |

|

||

ISIN (International Securities Identification Number) |

CH0126881561 |

US8708861088 |

|

||

|

|

|

|

||

Ticker symbols |

Bloomberg |

Telekurs |

Reuters |

||

Share |

SREN:SW |

SREN |

SREN.SW |

||

ADR1 |

SSREY:US |

SSREY |

SSREY.PK |

||

American Depositary Receipts (ADR)

In the US Swiss Re maintains an ADR level I programme (OTC symbol SSREY).

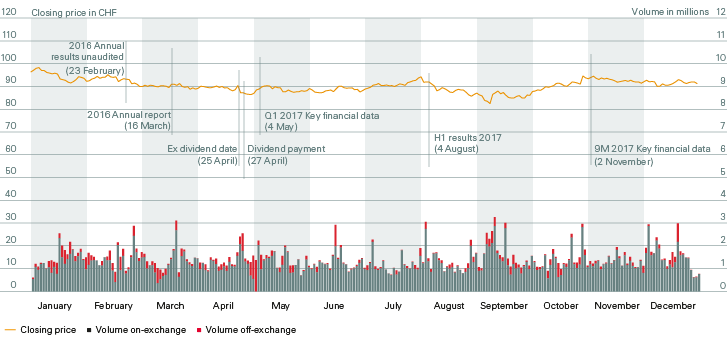

Share price performance

Swiss Re shares opened the year at CHF 97.15. An intra-day high of CHF 98.50 was achieved on 4 January 2017. On 8 September 2017, the shares experienced an intra-day low of CHF 81.65. The year-end share price was CHF 91.25.

During 2017 the STOXX Europe 600 Insurance index (SXIP) increased by 6.9% and the broader index of Swiss blue chips (SMI) increased by 14.1%. The Swiss Re share decreased by 5.4%.

Swiss Re share price and trading volume in 2017

Share trading

The average on-exchange daily trading volume for 2017 was 1.3 million shares. Trading volume peaked at 2.9 million shares on 11 September 2017.

Swiss Re’s dividend policy

Swiss Re’s dividend policy is a central element of Swiss Re’s capital management priorities.

The Group aims to ensure a superior capitalisation at all times and maximise financial flexibility, growing the regular dividend with long-term earnings and at a minimum maintaining it. Swiss Re will then deploy capital for business growth where it meets its strategy and profitability requirements and finally repatriate further excess capital to shareholders, with the preferred form of future capital repatriation being share buy-back programmes.

Dividends are typically paid out of current earnings and Swiss Re pays its dividend annually. Shares are ex-dividend two working days after the Annual General Meeting (AGM). Dividend payment is typically two working days after the ex-dividend date. The corresponding dates in 2018 are 24 and 26 April.

Dividends

The Board of Directors proposes a regular dividend of CHF 5.00 per share for 2017. As the tax privileged legal reserves from capital contributions were exhausted with the payment of the 2014 dividend, the dividend paid for 2017 will be subject to 35% Swiss withholding tax.

Public share buy-back programme

The Board of Directors launched on 3 November 2017 the public share buy-back programme authorised by the 2017 AGM. This programme was completed on 16 February 2018.

For further information please visit www.swissre.com/investors/shares/share_buyback/

The Board of Directors proposes to the 2018 AGM to authorise the company to repurchase own shares for the purpose of cancellation by way of a public share buy-back programme of up to CHF 1.0 billion purchase value to be executed before the 2019 AGM.

Unlike in previous years, beyond the Board of Directors’ and regulatory approval, and considering the Group’s capital management priorities, there will be no other pre-conditions to the commencement of the new programme.

Swiss Re will ask the AGM in April 2019 permission to cancel the repurchased shares by way of share capital reduction.

Index representation

In addition to its relevant industry indices, Swiss Re is also represented in various Swiss, European and global indices, including the SMI and the SXIP. Swiss Re is also a member of various sustainability indices, including the Dow Jones Sustainability World and Europe, FTSE4Good, Euronext Vigeo Europe 120, the MSCI ESG Leaders and MSCI Global Socially Responsible (2017) index families. In May 2017, Swiss Re received a AAA rating on the MSCI ESG assessment.

Weighting in indices

| Download |

As of 31 December 2017 |

Index weight (in %) |

Swiss/blue chip indices |

|

SMI |

3.01 |

SPI |

2.16 |

|

|

Insurance indices |

|

STOXX Europe 600 Insurance |

5.02 |

Bloomberg Europe 500 Insurance |

4.73 |

FTSEurofirst 300 Insurance |

5.77 |

Dow Jones Insurance Titans 30 |

2.22 |

|

|

Sustainability indices |

|

Dow Jones Sustainability Europe |

0.71 |

Dow Jones Sustainability World |

0.29 |

FTSE4Good Global |

5.00 |

Information for investors

More information is available on Swiss Re’s website: www.swissre.com/investors

Key share statistics 2013–2017

| Download |

As of 31 December 2017 |

2013 |

2014 |

2015 |

2016 |

2017 |

||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

Shares outstanding1 |

370 706 931 |

370 706 931 |

370 706 931 |

360 072 561 |

349 452 281 |

||||||||||||||||||||||||

of which Treasury shares and shares reserved for corporate purposes |

28 511 298 |

28 507 491 |

32 967 2262 |

34 093 8343 |

34 866 5164 |

||||||||||||||||||||||||

Shares entitled to dividend |

342 195 633 |

342 199 440 |

337 739 705 |

325 978 727 |

314 585 765 |

||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

CHF unless otherwise stated |

|

|

|

|

|

||||||||||||||||||||||||

Dividend paid per share |

3.505 |

3.856 |

4.257 |

4.60 |

4.85 |

||||||||||||||||||||||||

Dividend yield8 (in %) |

4.30 |

4.60 |

4.33 |

4.77 |

5.32 |

||||||||||||||||||||||||

Earnings per share9 |

12.04 |

9.33 |

12.93 |

10.55 |

1.02 |

||||||||||||||||||||||||

Book value per share10 |

82.76 |

101.12 |

96.04 |

107.64 |

103.37 |

||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

Price per share year-end |

82.05 |

83.65 |

98.15 |

96.50 |

91.25 |

||||||||||||||||||||||||

Price per share year high (intra-day) |

84.75 |

86.55 |

99.75 |

97.85 |

98.50 |

||||||||||||||||||||||||

Price per share year low (intra-day) |

66.10 |

69.25 |

74.95 |

79.00 |

81.65 |

||||||||||||||||||||||||

Daily trading volume (in CHF millions) |

78 |

95 |

134 |

120 |

129 |

||||||||||||||||||||||||

Market capitalisation11 (in CHF millions) |

30 417 |

31 010 |

36 385 |

34 747 |

31 888 |

||||||||||||||||||||||||

ADR price at year-end (in USD) |

92.38 |

84.57 |

24.5312 |

23.76 |

23.38 |

||||||||||||||||||||||||