Property & Casualty Reinsurance

Property & Casualty Reinsurance reported a net loss for 2017 of USD 413 million compared to a net income of USD 2.1 billion in 2016. The decrease was mainly driven by the adverse large loss experience (estimated total insurance claims of USD 3.7 billion) mainly stemming from Cyclone Debbie, hurricanes Harvey, Irma and Maria in the Americas, the two earthquakes in Mexico and the wildfires in California. These losses were only partially offset by favourable prior-year development and a strong overall investment result. The net operating margin was –1.3% in 2017, down from 15.4% in 2016.

The overall investment result was USD 1.6 billion in 2017 compared to USD 1.8 billion in 2016. Net investment income was USD 1.0 billion in 2017, reflecting higher income from alternative investments. Net realised gains of USD 613 million decreased compared to 2016 by USD 157 million, as the prior year included a favourable impact from foreign exchange remeasurement.

Property & Casualty results

| Download |

USD millions |

2016 |

2017 |

Change in % |

Revenues |

|

|

|

Gross premiums written |

18 149 |

16 544 |

–9 |

Net premiums written |

17 768 |

16 031 |

–10 |

Change in unearned premiums |

–760 |

636 |

— |

Premiums earned |

17 008 |

16 667 |

–2 |

Net investment income |

985 |

1 017 |

3 |

Net realised investment gains/losses |

770 |

613 |

–20 |

Other revenues |

37 |

48 |

30 |

Total revenues |

18 800 |

18 345 |

–2 |

|

|

|

|

Expenses |

|

|

|

Claims and claim adjustment expenses |

–10 301 |

–13 172 |

28 |

Acquisition costs |

–4 405 |

–4 253 |

–3 |

Operating expenses |

–1 204 |

–1 159 |

–4 |

Total expenses before interest expenses |

–15 910 |

–18 584 |

17 |

|

|

|

|

Income/loss before interest and income tax expense |

2 890 |

–239 |

— |

Interest expenses |

–293 |

–280 |

–4 |

Income/loss before income tax expense |

2 597 |

–519 |

— |

Income tax expense/benefit |

–479 |

125 |

— |

Net income/loss before attribution of non-controlling interests |

2 118 |

–394 |

— |

|

|

|

|

Income/loss attributable to non-controlling interests |

1 |

|

— |

Net income/loss after attribution of non-controlling interests |

2 119 |

–394 |

— |

|

|

|

|

Interest on contingent capital instruments, net of tax |

–19 |

–19 |

— |

Net income/loss attributable to common shareholders |

2 100 |

–413 |

— |

|

|

|

|

Claims ratio in % |

60.5 |

79.0 |

|

Expense ratio in % |

33.0 |

32.5 |

|

Combined ratio in % |

93.5 |

111.5 |

|

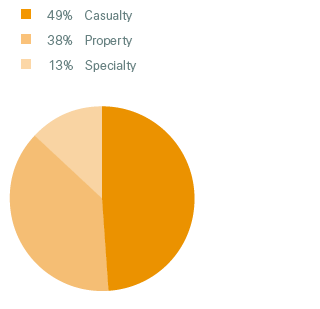

Premiums

Premiums earned by line of business, 2017

Total: USD 16.7 billion

Net premiums earned were USD 16.7 billion in 2017 (–2.0%) compared to USD 17.0 billion in 2016. The decline in gross premiums written to USD 16.5 billion in 2017 (–8.8%) compared to USD 18.1 billion in 2016 was the result of a reduction in deployed capacity where prices did not meet Swiss Re’s profitability expectations.

Combined ratio

Property & Casualty Reinsurance reported a combined ratio of 111.5% for 2017, compared to 93.5% in the prior year. The impact from natural catastrophes in 2017 was 14.8 percentage points above the expected level for 2017 of 7.1 percentage points. The favourable development of prior accident years improved the combined ratio by 3.3 percentage points in 2017, compared to a 3.0 percentage point improvement in 2016.

Administrative expense ratio

The administrative expense ratio of 7.0% in 2017 was in line with the 7.1% ratio in 2016.

Lines of business

The Property combined ratio increased to 119.9% in 2017, compared to 86.6% in 2016, primarily due to the large natural catastrophe loss burden in 2017.

The Casualty combined ratio increased to 108.8% in 2017, compared to 103.9% in 2016, driven by adverse developments in Motor in both EMEA and the US.

The Specialty combined ratio increased to 98.4% for 2017, compared to 77.8% in 2016, primarily due to large losses in the marine lines of business from hurricanes in the Americas and Cyclone Debbie in Australia.

Investment result

The return on investments was 3.5% for 2017, compared to 3.1% in 2016, reflecting an increase in the investment result of USD 155 million.

Net investment income increased by USD 30 million to USD 922 million for 2017, mainly due to additional income from alternative investments.

Net realised gains were USD 590 million for 2017, compared to USD 475 million for the prior year, with the increase stemming from additional gains from sales of equity securities, partially offset by a reduction in gains from sales of fixed income securities.

Insurance-related investment results as well as foreign exchange gains/losses are not included in the figures above.

Shareholders’ equity

Common shareholders’ equity decreased to USD 10.8 billion as of 31 December 2017 from USD 12.7 billion as of 31 December 2016, primarily driven by dividends paid to the Group of USD 1.95 billion and the net loss for the year. The return on equity for 2017 was –3.5% compared to 16.4% in 2016. The decrease was due to the net loss in 2017.

Outlook

Recent natural catastrophe events led to rate increases for Property in loss-affected markets with ranges depending on the client and market loss. Rates have increased more moderately in most other markets.

We observed notable differences by line of business for Specialty lines with rate increases for loss-affected lines and markets, and moderately improving conditions in general.

Pressure on general contract provisions also eased. Overall, trading conditions improved for most Property and Specialty lines.

For Casualty, rates increased in segments where price levels appeared inadequate due to claims emergence (eg. UK Motor, US Motor and Liability). We also saw commissions reducing to address non performance.

Lastly, we continued to see some good opportunities for transactions and participated on those that met our requirements.

For Property and Casualty generally, we reduced our participation or exited accounts where we could not get the rate adjustment or terms and conditions that we deemed appropriate. Our focus remains on the bottom line in a recovering but still challenging market environment.

We seek to execute our successful differentiation strategy and to support our clients to reach their ambitions.