Business Units at a glance

Working across diversified insurance risks and businesses to maximise shareholder value

Reinsurance

Reinsurance is Swiss Re’s largest business in terms of income, providing 86% of net premiums and fee income through two segments — Property & Casualty and Life & Health. Reinsurance aims to extend Swiss Re’s industry-leading position with disciplined underwriting, prudent portfolio management and diligent client service.

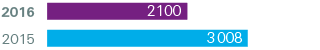

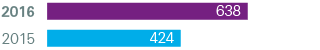

Net premiums earned and fee income (USD billions)

Property & Casualty

Life & Health

Net income (USD millions)

Property & Casualty

Life & Health

Operating performance

Property & Casualty

93.5%

(85.7% 2015)

Combined ratio

Life & Health

10.4%

(12.2% 2015)

Net operating margin

Return on equity

Property & Casualty

16.4%

(Target: 10%-15%)

Life & Health

12.8%

(Target: 10%-12%)

Corporate Solutions

Corporate Solutions serves mid-sized and large corporations, with product offerings ranging from traditional property and casualty insurance to highly customised solutions. Corporate Solutions serves customers from more than 50 offices worldwide.

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Operating performance

101.1%

(93.2% 2015)

Combined ratio

Return on equity

6.0%

(Target: 10%-15%)

Life Capital

Life Capital manages closed and open life and health insurance books. The Business Unit provides alternative access to the life and health risk pool, helping to generate stable returns and seize attractive new opportunities. For our clients and partners, it provides a primary insurance balance sheet, efficient policy administration services, life and health expertise and knowledge for reaching more markets and offering new products.

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Operating performance

721m

(USD 543m 2015)

Gross cash generation

Return on equity

10.4%

(Target: 6%-8%)

Total

(After consolidation)

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Operating performance

10.6%

(13.7% 2015)

Return on equity

Return on equity

+700

At least 700 basis points greater than Swiss Re’s designated risk-free rate, currently ten-year US government bonds.

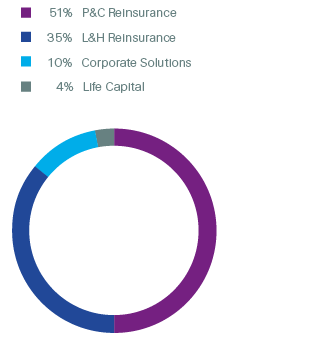

Diversified and global

Net premiums earned and fee income by business segment

(Total USD 33.2 billion)

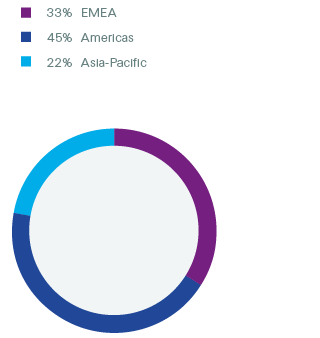

Net premiums earned and fee income

by region

(Total USD 33.2 billion)