Capital management

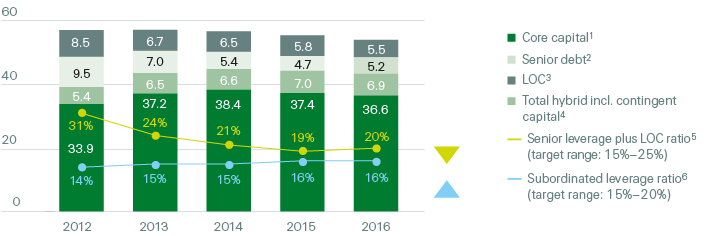

We have achieved our target capital structure to create a stronger, more flexible capital base.

During 2016, Swiss Re surpassed its target of deleveraging USD 4 billion since 2012, further strengthened its capital base with the issuance of innovative capital instruments and continued to direct excess capital from its Business Units to the Group’s holding company, Swiss Re Ltd.

Optimised Group capital structure

Swiss Re’s level of capitalisation and its capital structure are driven by regulatory and rating capital requirements, and by management’s view of risks and opportunities arising from our underwriting and investing activities. As announced at the June 2013 Investors’ Day, we set a target capital structure that aimed to operate efficiently within these constraints by maximising financial flexibility. The structure focused on the reduction of senior leverage, including letters of credit (LOCs), the issuance of innovative capital instruments (such as contingent capital) to replace traditional subordinated debt and extending the Group’s funding platform.

Target deleveraging achieved

1 Core capital of Swiss Re Group is defined as economic net worth (ENW).

2 Senior debt excluding non-recourse positions.

3 Senior debt plus LOCs divided by total capital.

4 Includes subordinated debt facility by Swiss Re Ltd.

5 Unsecured LOC capacity and related instruments (usage is lower).

6 Subordinated debt divided by sum of subordinated debt and ENW.

Achievements since year-end 2012

- Letters of Credit reduction of USD 3 billion

- USD 4.3 billion net reduction in senior debt

- ReAssure GBP 550 million revolving credit facility

- ReAssure inaugural senior debt issuance of EUR 750 million

- Corporate Solutions inaugural subordinated debt issuance of USD 500 million

- Reduction in vanilla subordinated debt of c. USD 1.7 billion

- Issuance of USD 2.9 billion of innovative capital instruments including USD 1.9 billion of pre-funded subordinated debt facilities at Swiss Re Ltd

Key milestones achieved in 2016

5.8 billion

Net deleveraging since year-end 2012 (USD)

Swiss Re passed two important milestones to complete the full implementation of the target capital structure in 2016:

Swiss Re Ltd established two further pre-funded subordinated debt facilities: the first in April 2016, a USD 400 million 15-year facility at an interest rate of 6.05% and the second in June 2016, a USD 800 million 11-year facility at an interest rate of 5.625%. These facilities bring the total amount of our contingent capital platform to around USD 4 billion, achieving our target of having roughly 10% of our total capital base in the form of innovative capital instruments, further enhancing the Group’s financial flexibility while increasing resilience.

Swiss Re Admin Re Ltd (to be renamed Swiss Re ReAssure Ltd) established a capital markets funding platform with an inaugural EUR 750 million 7-year senior bond at an annual interest rate of 1.375%. The proceeds of this issuance were used to repay the bridge facility arranged for the Guardian acquisition.

Overall net Group deleveraging since year-end 2012 stands at USD 5.8 billion, well in excess of the deleveraging target of at least USD 4 billion by 2016.

The Group capital structure is comfortably within the senior leverage (15%–25%) and subordinated leverage (15%–20%) target ranges, providing further financial flexibility.

Legal entity capital management

Our regulated subsidiaries are subject to local regulatory requirements, which for our EU subsidiaries include Solvency II. At the subsidiary level we set the target capital at a level tailored to each entity’s business and the market environment in which it operates. Our underwriting and investment decisions are steered so as to make capital and liquidity fungible to the Group wherever possible, while complying with local regulations and client needs.

Cash dividends paid to Swiss Re Ltd totalled USD 18.8 billion since 2012.

External dividends to shareholders

Based on the Group’s capital strength, the Board of Directors proposes an 5.4% increase in the 2016 regular dividend to CHF 4.85 per share, up from CHF 4.60 in 2015. In addition, the Board of Directors proposes a public share buy-back programme of up to CHF 1.0 billion purchase value, exercisable until the AGM in 2018. The programme will only be launched if excess capital is available, no major loss event has occurred, other business opportunities do not meet Swiss Re’s strategic and financial objectives and the necessary regulatory approvals have been obtained.

The total amount of capital returned to shareholders since the implementation of the new Group structure in 2012 is USD 13.2 billion.

Swiss Re Group’s capital adequacy

Regulatory capital requirements

Swiss Re is supervised at the Group level and for its regulated legal entities domiciled in Switzerland by FINMA. FINMA supervision comprises minimum solvency requirements, along with a wide range of qualitative assessments and governance standards.

Swiss Re provides regulatory solvency reporting to FINMA under the rules of the Insurance Supervision Ordinance. This SST report is based on an economic view. We calculate available capital based on our Economic Value Management (EVM) framework and required capital under the SST using our internal risk model (see Economic Value Management for further information on EVM). The minimum requirement for the SST is a ratio of 100%. Swiss Re’s SST ratio materially exceeds the minimum requirement.

Swiss Re’s capital management aims to ensure our ability to continue operations following an extremely adverse year of losses from insurance and/or financial market events.

Rating agency capital requirements

Rating agencies assign credit ratings to the obligations of Swiss Re and its rated subsidiaries.

The agencies evaluate Swiss Re based on a set of criteria that include an assessment of our capital adequacy.

Each rating agency uses a different methodology for this assessment; A.M. Best and S&P base their evaluation on proprietary capital models.

A.M. Best, Moody’s and S&P rate Swiss Re’s financial strength based upon interactive relationships. The insurance financial strength ratings are shown in the table below.

On 25 November 2016, S&P affirmed the AA-financial strength of Swiss Re and its core subsidiaries. The outlook on the rating is “stable”. The rating reflects Swiss Re’s extremely strong capital adequacy in excess of the ‘AAA’ benchmark and competitive position build on market leadership, long-standing reputation, and wide distribution networks across both life and non-life reinsurance.

On 16 December 2016, A.M. Best affirmed the A+ financial strength rating of Swiss Re and its core subsidiaries. The outlook for the rating is “stable”. The rating affirmation reflects Swiss Re’s excellent consolidated risk-adjusted capitalisation, strong operating performance and superior business profile as a leading global reinsurer.

On 15 December 2015, Moody’s affirmed Swiss Re’s insurance financial strength rating and outlook at “Aa3” stable. The rating reflects Swiss Re’s excellent market position, very strong business and geographic diversification and strong balance sheet in terms of capital and financial flexibility. Moody’s next rating affirmation will take place in the course of 2017.

Swiss Re’s financial strength ratings

| Download |

As of 31 December 2016 |

Financial strength rating |

Outlook |

Last update |

Moody’s |

Aa3 |

Stable |

15 December 2015 |

Standard & Poor’s |

AA– |

Stable |

25 November 2016 |

A.M. Best |

A+ |

Stable |

16 December 2016 |