Property & Casualty Reinsurance

Performance

Net income for 2016 was USD 2.1 billion. The result reflected solid underwriting, a higher large loss burden compared to last year and a lower contribution from positive prior-year development. The investment result was higher in 2016 than in 2015, mainly due to a positive impact from foreign exchange remeasurement.

2016 was impacted by various new large losses, notably wildfires in Canada, an earthquake in New Zealand and Hurricane Matthew. In addition, we strengthened our reserves for the New Zealand earthquakes in 2010 and 2011.

The underwriting result for 2016 was USD 1.1 billion, largely due to the higher large loss burden compared to 2015, a lower contribution from positive prior-year development, and the impact of more proportional business and more casualty business, both of which typically result in a higher combined ratio.

Property & Casualty results

| Download |

USD millions |

2015 |

2016 |

Change in % |

Revenues |

|

|

|

Premiums earned |

15 090 |

17 008 |

13 |

Net investment income |

1 097 |

985 |

–10 |

Net realised investment gains/losses |

445 |

770 |

73 |

Other revenues |

45 |

37 |

–18 |

Total revenues |

16 677 |

18 800 |

13 |

|

|

|

|

Expenses |

|

|

|

Claims and claim adjustment expenses |

–7 892 |

–10 301 |

31 |

Acquisition costs |

–3 836 |

–4 405 |

15 |

Operating expenses |

–1 198 |

–1 204 |

1 |

Total expenses before interest expenses |

–12 926 |

–15 910 |

23 |

|

|

|

|

Income before interest and income tax expense |

3 751 |

2 890 |

–23 |

Interest expenses |

–272 |

–293 |

8 |

Income before income tax expense |

3 479 |

2 597 |

–25 |

|

|

|

|

Claims ratio in % |

52.3 |

60.5 |

|

Expense ratio in % |

33.4 |

33.0 |

|

Combined ratio in % |

85.7 |

93.5 |

|

Net premiums earned

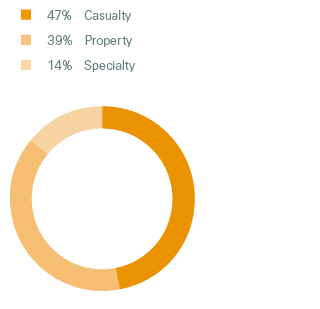

Premiums earned by line of business, 2016

(Total: USD 17.0 billion)

Net premiums earned were USD 17.0 billion in 2016, compared to USD 15.1 billion for 2015. The increase was driven by large and tailored transactions in the US and Europe, partially offset by unfavourable foreign exchange movements. At constant exchange rates, premiums earned increased by USD 2.1 billion.

The composition of gross premiums earned by region changed year on year, with a higher share of premiums generated in the Americas and EMEA in 2016 than in 2015. Based on net premiums earned, the share of proportional business was 72% in 2016, compared to 67% in to 2015.

Combined ratio

P&C Reinsurance reported a combined ratio of 93.5% in 2016, compared to 85.7% in the previous year. The increase was mainly driven by a higher burden from large losses, less favourable prior-year development and continued price softening of the market.

The impact from natural catastrophes in 2016 was 3.3 percentage points below the expected level of 7.4 percentage points. Favourable development from prior accident years improved the 2016 combined ratio by 3.0 percentage points.

Administrative expense ratio

The administrative expense ratio decreased to 7.1% in 2016, compared to 7.9% in 2015, driven by higher premium volume period over period.

Lines of business

Property

The property combined ratio increased to 86.6% in 2016, compared to 72.7% in 2015. 2016 was impacted by various large losses, whereas 2015 profited from an exceptionally benign natural catastrophe loss experience and a higher favourable prior-year claims experience.

Casualty

The casualty combined ratio for 2016 was 103.9%, compared to 99.6% in 2015. Both years include reserve strengthening for US asbestos. The prior year benefited from significant reserve releases.

Specialty lines

The specialty combined ratio decreased to 77.8% in 2016, compared to 80.1% in 2015. 2015 included the impact of the explosion in Tianjin, China.

Investment result

The return on investments for 2016 was 3.1% compared to 3.5% in 2015, reflecting a reduction in net investment income stemming from the impact of lower reinvestment yields as well as a lower contribution from equities and alternative investments.

Net investment income decreased by USD 144 million to USD 892 million in 2016, mainly due to reduced income across government bonds and a lower level of equity-accounted income.

Net realised gains were USD 475 million in 2016 compared to USD 497 million in 2015, due to a lower contribution from interest rate derivatives, which was partially offset by additional gains from sales of equities and alternative investments.

Insurance-related investment results as well as foreign exchange remeasurement are not included in the figures above.

Shareholders’ equity

Common shareholders’ equity was USD 12.7 billion as of 31 December 2016 compared to USD 13.0 billion as of 31 December 2015. The decrease was primarily driven by dividends in the amount of USD 2.5 billion paid to Swiss Re Ltd, partly offset by net income for the period and the impact of foreign exchange movements. The return on equity for 2016 was 16.4% compared to 22.4% in 2015. The decrease was mainly due to lower net income in 2016.

Outlook

While natural catastrophe property rates still experienced pressure due to relatively low loss occurrence and abundant capital in the markets, rate decreases have started to slow down. We deployed less natural catastrophe capacity and will continue to do so where price levels fall below our return hurdles. Specialty lines experienced rate pressure with notable differences by lines of business and markets. Casualty rates overall remained more stable with varying trends based on market and product.

We will continue to pursue our successful differentiation strategy while focusing on the bottom line under current market conditions. This means that we support key partners and expect they will also reflect the support in differential terms. This positions us to access the business we want and achieve above average rates.