Compensation decisions for the Group EC

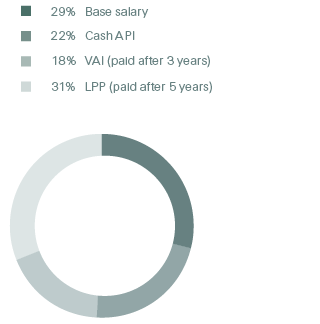

Compensation mix for Group EC 2016

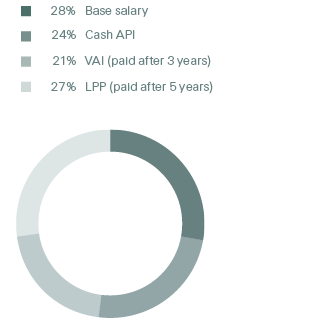

2015

The variable compensation awarded to all members of the Group EC (including the previous and current Group CEO) totalled CHF 32.4 million for 2016, compared to CHF 32.5 million for 2015. The following table covers payments to 14 members for 2016 of whom 12 were employed for the full year. The 2015 payments cover 12 members who were all employed for the full year.

| Download |

|

12 members |

14 members1 |

||||||||||||||

CHF thousands |

2015 |

2016 |

||||||||||||||

|

||||||||||||||||

Base salary |

12 502 |

13 224 |

||||||||||||||

Allowances2 |

403 |

2 745 |

||||||||||||||

Funding of pension benefits |

1 913 |

2 139 |

||||||||||||||

Total fixed compensation |

14 818 |

18 108 |

||||||||||||||

Cash Annual Performance Incentive3 |

11 028 |

9 867 |

||||||||||||||

Value Alignment Incentive3 |

9 314 |

8 396 |

||||||||||||||

Leadership Performance Plan4 |

12 200 |

14 150 |

||||||||||||||

Total variable compensation |

32 542 |

32 413 |

||||||||||||||

Total fixed and variable compensation5 |

47 360 |

50 521 |

||||||||||||||

Compensation due to members leaving6 |

|

909 |

||||||||||||||

Total compensation7 |

47 360 |

51 430 |

||||||||||||||

The compensation increase in 2016 compared to the previous fiscal year is mainly caused by the following factors:

- The 12 members of the Group EC of 2015 received in 2016 total compensation of CHF 45.4 million (including the effects of the Group CEO change from Michel Liès to Christian Mumenthaler as per 1 July 2016 and the promotion of Moses Ojeisekhoba to CEO Reinsurance as per 1 July 2016);

- Additional total compensation of approximately CHF 6 million was paid to the new members of the Group EC: Thierry Léger (new CEO Life Capital) for the full year 2016 and to Jayne Plunkett (new CEO Reinsurance Asia) for the second half of the year 2016. The CHF 45.4 million and CHF 6 million combine to give a total of CHF 51.4 million for the 14 members in 2016 (shown in the table above);

- The aggregate amount for fixed compensation, pensions, social security, allowances and other benefits and for long-term variable compensation of the above mentioned 12 members of the Group EC in 2016 was CHF 29.5 million and therefore within the budget of CHF 31.0 million approved by the AGM 2015 for these 12 members of the Group EC. Such amount included a reserve of 10% which was only partially used, primarily to cover foreign taxes in connection with a change of residence in accordance with Swiss Re’s international assignment rules; and

- The compensation for Thierry Léger and Jayne Plunkett was not originally considered in the CHF 31 million prospective budget for 2016 given their appointments were made post the AGM 2015 (see the explanations on Reconciliation of AGM 2015 resolutions for Group EC compensation).

Compensation decisions for the highest paid member of the Group EC

The table below shows for 2015 the compensation paid to the Group CEO Michel Liès and for 2016 the compensation paid to Christian Mumenthaler, Group CEO since 1 July 2016.

| Download |

CHF thousands |

2015 |

2016 |

||||||||

|

||||||||||

Base salary |

1 600 |

1 300 |

||||||||

Allowances1 |

38 |

43 |

||||||||

Funding of pension benefits |

178 |

178 |

||||||||

Total fixed compensation |

1 816 |

1 521 |

||||||||

Cash Annual Performance Incentive2 |

1 600 |

1 113 |

||||||||

Value Alignment Incentive2 |

1 600 |

1 113 |

||||||||

Leadership Performance Plan3 |

2 000 |

2 500 |

||||||||

Total variable compensation |

5 200 |

4 726 |

||||||||

Total compensation4 |

7 016 |

6 247 |

||||||||

Additional information on compensation decisions

For US GAAP and statutory reporting purposes, VAI and LPP awards are accrued over the period during which they are earned. For the purpose of the disclosure required in this Compensation Report, the value of awards granted is included as compensation in the year of performance for the years 2015 and 2016 respectively.

Each member of the Group EC including the Group CEO participates in a defined contribution pension scheme. The funding of pension benefits shown in the previous two tables reflects the actual employer contributions.

Other payments to members of the Group EC

During 2016, no payments (or waivers of claims) other than those set out in the section compensation disclosure and shareholdings in 2016 were made to current members of the Group EC or persons closely related.

Shares held by members of the Group EC

The following table reflects Swiss Re share ownership by members of the Group EC as of 31 December:

| Download |

Members of the Group EC |

2015 |

2016 |

||||

|

||||||

Christian Mumenthaler, Group CEO |

50 000 |

63 854 |

||||

Michel Liès, previous Group CEO1 |

262 808 |

n/a |

||||

David Cole, Group Chief Financial Officer |

54 207 |

68 061 |

||||

John R. Dacey, Group Chief Strategy Officer |

171 |

7 526 |

||||

Guido Fürer, Group Chief Investment Officer |

42 302 |

56 156 |

||||

Agostino Galvagni, CEO Corporate Solutions |

65 816 |

79 670 |

||||

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

35 476 |

46 817 |

||||

Thierry Léger, CEO Life Capital |

n/a |

57 610 |

||||

Moses Ojeisekhoba, CEO Reinsurance |

26 404 |

27 895 |

||||

Jayne Plunkett, CEO Reinsurance Asia |

n/a |

29 095 |

||||

J. Eric Smith, CEO Reinsurance Americas2 |

6 990 |

13 984 |

||||

Matthias Weber, Group Chief Underwriting Officer |

25 410 |

25 750 |

||||

Thomas Wellauer, Group Chief Operating Officer |

116 111 |

130 224 |

||||

Total |

685 695 |

606 642 |

||||

Vested options held by members of the Group EC

For the years ended 31 December 2015 and 2016, no member of the Group EC held any vested options.

Leadership Performance Plan units held by members of the Group EC

The following table reflects total unvested LPP units (RSUs and PSUs) held by members of the Group EC as of 31 December:

| Download |

|

2015 |

2016 |

Christian Mumenthaler, Group CEO |

49 755 |

75 458 |

Michel Liès, previous Group CEO |

99 490 |

64 125 |

David Cole, Group Chief Financial Officer |

49 755 |

49 426 |

John R. Dacey, Group Chief Strategy Officer |

49 755 |

49 426 |

Guido Fürer, Group Chief Investment Officer |

49 755 |

53 765 |

Agostino Galvagni, CEO Corporate Solutions |

49 755 |

49 426 |

Jean-Jacques Henchoz, CEO Reinsurance EMEA |

39 805 |

39 540 |

Moses Ojeisekhoba, CEO Reinsurance |

39 805 |

43 011 |

Jayne Plunkett, CEO Reinsurance Asia |

n/a |

33 130 |

J. Eric Smith, CEO Reinsurance Americas |

39 805 |

39 540 |

Thierry Léger, CEO Life Capital |

n/a |

43 011 |

Matthias Weber, Group Chief Underwriting Officer |

49 755 |

49 426 |

Thomas Wellauer, Group Chief Operating Officer |

49 755 |

49 426 |

Patrick Raaflaub, Group Chief Risk Officer |

12 435 |

29 791 |

Total |

579 625 |

668 501 |

Loans to members of the Group EC

As per Art. 27 of the Articles of Association, credits and loans to members of the Group EC may be granted at employee conditions applicable for the Swiss Re Group, with a cap on the total amount of such credits and loans outstanding per member.

In general, credit is secured against real estate or pledged shares. The terms and conditions of loans and mortgages are typically the same as those available to all employees of the Swiss Re Group in their particular locations to the extent possible.

Swiss-based variable-rate mortgages have no agreed maturity dates. The basic preferential interest rates equal the corresponding interest rates applied by the Zurich Cantonal Bank minus one percentage point. Where fixed or floating interest rates are preferential, the value of this benefit has been included under “allowances” in the tables covering compensation decisions for Group EC members.

The following table reflects total mortgages and loans for members of the Group EC as of 31 December:

| Download |

CHF thousands |

2015 |

2016 |

||

|

||||

Total mortgages and loans to members of the Group EC |

420 |

0 |

||

Highest mortgages and loans to an individual member of the Group EC1: |

|

|

||

J. Eric Smith, CEO Reinsurance Americas |

420 |

n/a |

||

Total mortgages and loans not at market conditions to former members of the Group EC |

4 300 |

4 300 |

||