Rural and urban resilience in China

In October 2016, the city of Shanwei in the Guangdong province was struck by super-typhoon Haima, which smashed into the region after battering Hong Kong and the northern Philippines. The typhoon had already claimed 13 lives in the Philippines and brought heavy winds, rainfall and an increased risk of flash flooding and landslides. The storm also rekindled fears of 2013’s Typhoon Haiyan, which took thousands of lives, forced the evacuations of many areas and caused massive disruptions of air and rail traffic. But this time around, just one week after the storm, insurance companies were making a payout to Shanwei, with the funds quickly channelled to support immediate recovery and rebuild infrastructure.

Quicker recovery

The payout was the first from an innovative Swiss Re-led parametric insurance programme for China launched in 2016. The programme has the potential to transform the way public authorities prepare for disasters, and thus to make the world more resilient.

In August 2016 a first scheme was announced, covering 28 rural counties in Heilongjiang province against flood, excessive rain, drought and low temperatures. This is an important support for the area’s significant low-income population — mainly farming families, whose livelihoods depend heavily on the weather. A second scheme followed in October 2016, focusing on ten prefectures in the economic powerhouse of Guangdong, where over USD 1 trillion of China’s GDP is generated. The maximum protection provided by the two schemes is USD 680 million, representing the two largest commercial natural disaster protection schemes ever established in China.

China experiences frequent natural disasters. Earthquakes, floods, typhoons and even droughts hammer it regularly, often causing deaths and widespread damage. Despite this experience, and the expectation that the frequency and severity of such events will increase in the years to come, governments at all levels lack the funds to finance relief and reconstruction. This is compounded by the lack of a comprehensive catastrophe insurance system in China, making people even more vulnerable.

A complicated environment

China’s heterogeneity, with vast rural areas and many urban hotspots, is an added complication. While extreme weather events can take a heavy toll on communities that depend on farming to live, they can also hurt China’s booming economic hubs that see a greater concentration of assets, people and technology and can affect global supply chains and economic development over the longer term.

The pioneering models, which stem from a close and fruitful collaboration with Chinese authorities and regulators, aim to increase both urban and rural resilience, and bear testimony to the flexibility of this kind of insurance tool. In these solutions, parameters such as cyclone wind speed or rainfall amounts can trigger policy claims. This makes the process quicker as it no longer relies on surveys and lengthy damage assessments, as in more traditional insurance schemes.

Local governments can count on readily available funds to help the population in the immediate aftermath of a natural catastrophe and to start reconstructing after the event — both of which cause a significant financial burden on public budgets in the absence of an insurance scheme. Also, a delay in recovery can hamper long-term economic prospects for the whole region and reverse hard-won development gains, making the risk of slipping into poverty very high for those affected.

Scaleable and replicable

The goal of the models, developed with a pool of local insurers, is to pave the way for other scaleable and replicable public private partnership schemes, including in other large countries with a comparable diversity of environments.

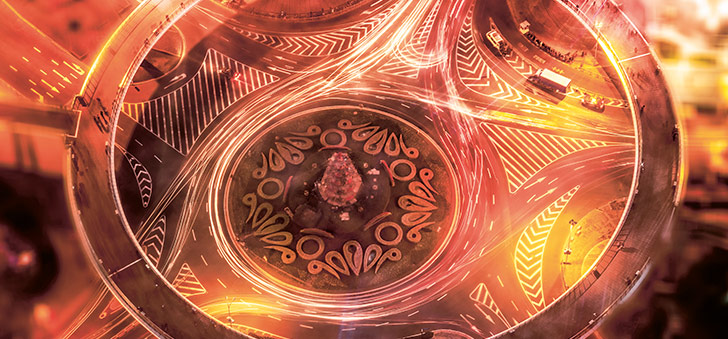

True resilience: insurance helps rural families cope with natural disasters and stay out of poverty.