Risk modelling and risk measures

Swiss Re uses a proprietary integrated risk model to determine the economic capital required to support the risks on the company’s books, as well as to allocate risk-taking capacity to the different lines of business. The Group’s internal risk model provides a meaningful assessment of the risks to which the company is exposed and is an important tool for managing the business. It is used for determining capital requirements for internal purposes as well as for regulatory reporting under the Swiss Solvency Test (SST) and Solvency II for our legal entities in continental Europe. The model provides the basis for capital cost allocation in Swiss Re’s Economic Value Management (EVM) framework, which is used for pricing, profitability evaluation and compensation decisions (see Economic Value Management for further information on EVM).

Swiss Re’s internal model is based on two important principles. First, it applies an asset-liability management approach, which measures the net impact of risk on the economic value of both assets and liabilities. Second, it adopts an integrated perspective, recognising that a single risk factor can affect different sub-portfolios and that different risk factors can have mutual dependencies.

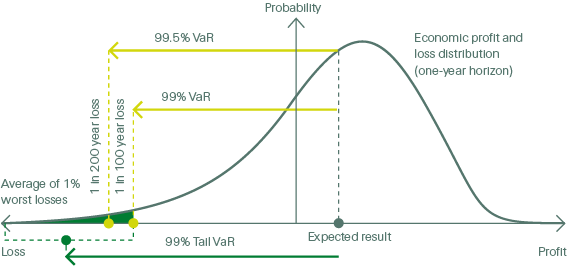

The model generates a probability distribution for the Group’s economic profit and loss over a one-year time horizon, specifying the likelihood that the outcome will fall within a given range. The risk measures derived from the model are expressed as economic loss severities taken from the total economic profit and loss distribution. In line with the SST, the Group measures its total risk capital requirement at the 99% shortfall (tail VaR) level. This represents an estimate of the average annual loss likely to occur with a frequency of less than once in one hundred years, thus capturing the potential for severe, but rare, aggregate losses.

In addition, the model is used to calculate value at risk (VaR) measures including 99.5% VaR, which is used in other regulatory regimes such as Solvency II. 99.5% VaR represents the loss likely to be exceeded in only one year out of two hundred and is thus more severe than the 99% VaR measure, which estimates the loss likely to be exceeded in one year out of one hundred.

Swiss Re’s risk model assesses the potential economic loss at a specific confidence level. There is thus a possibility that actual losses may exceed the selected threshold. In addition, the reliability of the model may be limited when future conditions are difficult to predict. For this reason, the model and its parameters are continuously reviewed and updated to reflect changes in the risk environment and current best practice. In addition, the Group complements its risk models by ensuring a sound understanding of the underlying risks within the company and by applying robust internal controls.

In November, the Luxembourg regulator approved our internal model to be used for our legal entities in continental Europe, which report under the Solvency II regime.

A major enhancement in 2015 was the development of a new model for European winter storm risk. This proprietary model is used for underwriting, business steering and risk management purposes. It draws on state-of-the-art research and technology with a particular emphasis on expanding the knowledge of historical winter storms over the past 140 years.