Expanding re/insurance protection

Throughout our long history, we have provided our clients with financial protection against risk. Traditionally, our most important client groups are insurers and large corporations. We offer them a wide range of products covering many different types of losses.

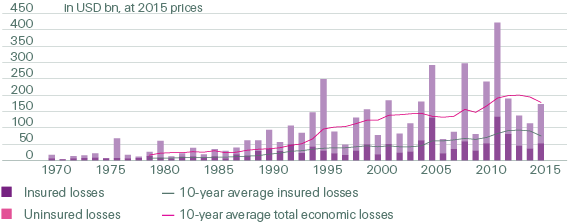

However, there remains significant unmet demand for effective, commercially viable re/insurance protection. As the graph below illustrates, the gap between insured and uninsured losses remains substantial. Given this protection gap, we look beyond our established client base and traditional business model. In particular, we aim to expand re/insurance protection by focusing on underinsured risks, new markets, different clients and innovative risk transfer products.

Some of the pioneering transactions we completed in 2015 are outlined below, ranging from large state-subsidised insurance funds to pilot projects in uncharted territory.

Insured losses vs uninsured losses, 1970–2015

Source: Swiss Re Economic Research & Consulting

Protecting the Florida Hurricane Catastrophe Fund

The State of Florida has over USD 3 trillion of coastal assets, one of the highest concentrations anywhere in the world. But as the State lies within the infamous “hurricane alley,” its population faces a latent disaster risk. In response, the state-run Florida Hurricane Catastrophe Fund (FHCF) established its first-ever reinsurance programme in 2015 and chose Swiss Re as one of its leaders.

Although ten years have passed since a major hurricane last made landfall in Florida, the FHCF recognises that it is only a matter of time until one strikes again. As the 2005 hurricane season showed, the financial consequences for local insurers, and ultimately homeowners, can be severe. It is the task of the FHCF to ensure that insurers can pay claims from such extreme events and to reduce the impact on taxpayers.

This is why the FHCF has purchased reinsurance protection for the first time in its 22-year history: by adding USD 1 billion of private capital it can further build the financial stability it needs to ensure Florida’s economic resilience in the face of disasters.

Strengthening earthquake resilience in Turkey

In Turkey, we supported the Turkish Catastrophe Insurance Pool (TCIP) to further improve insurance protection against earthquakes in Istanbul. With a population of 14 million, the metropolis generates a significant share of Turkey’s GDP while living under the constant threat of severe earthquakes.

Originally set up in response to the strong Kocaeli and Düzce earthquakes of 1999, TCIP has done much over the years to improve insurance protection in the country. In addition to the support we provide through traditional reinsurance, in 2015 Swiss Re Capital Markets co-structured a USD 100 million catastrophe bond sponsored by the TCIP. Covering Istanbul’s large metropolitan area, the three-year bond has a parametric trigger that will pay out if the specified earthquake conditions are met. It was well received by investors and ensures that TCIP will have access to additional reconstruction funds in the event of a major earthquake.

Supporting the African Risk Capacity

As a provider of reinsurance capacity and expertise, we helped to launch the African Risk Capacity (ARC) in 2014, the continent’s first parametric natural disaster insurance pool. It offers governments insurance protection against drought, which poses a recurring threat in large parts of Africa and puts the livelihoods of millions of citizens at risk.

Through ARC’s in-house risk modelling platform, Africa RiskView, the participating governments can assess the drought risk they face and decide how much they want to insure at what loss threshold. Based on satellite rainfall data, payouts are then made automatically to the governments when the agreed drought thresholds are exceeded. To take part in the scheme, countries need to have contingency plans in place that show how payouts will be used to support the affected population.

In its initial 2014/2015 season, ARC offered drought insurance for a total of USD 129 million to four governments: Kenya, Mauritania, Niger and Senegal. Less than a year into the programme, the latter three received payouts totaling more than USD 26 million, following a severe drought in the Sahel. In the 2015/16 season, further countries joined the risk pool, thereby increasing total coverage.

Helping to develop insurance markets in China

Throughout 2015, we continued to take an active role in the expanding insurance markets of China. For example, we helped to develop China’s first weather index insurance programme to protect cotton production against low temperatures. It was launched as a pilot in the Xinjiang region, which grows 60% of the country’s cotton. While perils such as drought, hail and wind are covered by a government-subsidised agricultural insurance programme, this has not been the case for yield losses due to low temperatures. If the pilot providing protection of RMB 7.6 million (USD 1.2 million) proves to be effective, it will be expanded to the whole region.

We also signed a Memorandum of Cooperation with the provincial government of Heilongjiang on the future roll out of a pilot index-based insurance programmes covering natural disaster risks to its agricultural sector. This builds on previous efforts we have undertaken to improve insurance protection in Heilongjiang, which, as China’s biggest crop producer, is key to its food security.

Protecting Vietnamese farmers against livestock loss

We also helped to relaunch an important agricultural insurance pilot in Vietnam. It will protect the livelihoods of poor smallholder farmers in the two provinces of Vinh Phuc and Ha Giang by insuring them against the effects a major natural catastrophe or disease may have on their livestock. In total, the scheme covers more than 150 000 head of cattle and buffalo.

To develop a sustainable product that meets actual needs, the scheme has pursued a holistic approach from the beginning, involving all key stakeholders in a public-private partnership. Stakeholders include various government ministries, the Vietnam National Reinsurance Corporation (in the role of aggregator and bridge between the government and local insurers), local insurers and their branch offices, as well as local people’s committees and authorities. The scheme has got off to a promising start and the intention is to expand it rapidly to other provinces.