Share performance

Swiss Re shares

Swiss Re had a market capitalisation of CHF 36.4 billion on 31 December 2015, with 370.7 million shares outstanding, of which 337.7 million are entitled to dividends. Swiss Re shares are listed in accordance with the main standard on the SIX Swiss Exchange (SIX) and are traded under the ticker symbol SREN.

General information on Swiss Re shares

| Download |

|

|||||

Identification numbers |

Share |

ADR |

|

||

Swiss Security Number (Valorennummer) |

12688156 |

– |

|

||

ISIN (International Securities Identification Number) |

CH0126881561 |

US8708861088 |

|

||

|

|

|

|

||

Ticker symbols |

Bloomberg |

Telekurs |

Reuters |

||

Share |

SREN:VX |

SREN |

SREN.VX |

||

ADR1 |

SSREY:US |

SSREY |

SSREY.PK |

||

American Depositary Receipts (ADR)

In the US Swiss Re maintains an ADR level I programme (OTC symbol SSREY). In June 2015 Swiss Re changed the ratio of American Depositary Shares (ADS) to Swiss Re shares from 1:1 to 4:1, increasing liquidity and bringing the ADS trading price closer to typical trading prices of U.S. securities.

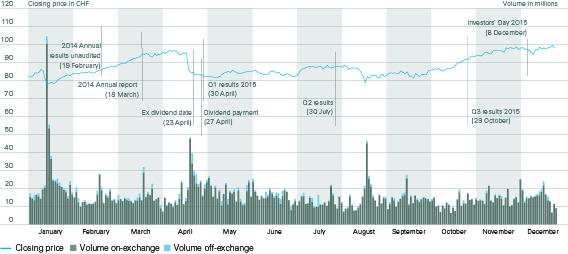

Share price performance

Swiss Re shares opened the year at CHF 83.65. On 15 January 2015, the day on which the Swiss National Bank discontinued the CHF to EUR exchange rate floor, the shares experienced an intra-day low of CHF 74.95. An intra-day high of CHF 99.75 was achieved on 29 December 2015. The year-end share price was CHF 98.15.

During 2015 the STOXX Europe 600 Insurance index (SXIP) increased by 14.0% and the broader index of Swiss blue chips (SMI) decreased by 1.8%. The Swiss Re share increased by 17.3%.

Swiss Re share price and trading volume in 2015

Share trading

The average on-exchange daily trading volume for 2015 was 1.5 million shares. Trading volume peaked at 10.0 million shares on 15 January 2015.

Swiss Re’s dividend policy

Swiss Re’s dividend policy is a central element of Swiss Re’s capital management priorities. The Group aims to ensure a superior capitalisation at all times and maximise financial flexibility, growing the regular dividend with long-term earnings and at a minimum maintaining it. Swiss Re will then deploy capital for business growth where it meets its strategy and profitability requirements and repatriate further excess capital to shareholders, with the preferred form of future capital repatriation being share buy-back progammes.

Dividends are typically paid out of current earnings and Swiss Re pays its dividend annually. Shares are ex-dividend two working days after the Annual General Meeting (AGM). Dividend payment is typically two working days after the ex-dividend date. The corresponding dates in 2016 are 26 and 28 April.

Dividends

The Board of Directors proposes a regular dividend of CHF 4.60 per share for 2015. As the tax privileged legal reserves from capital contributions were exhausted with the payment of the 2014 dividend, the dividend paid for 2015 will be subject to 35% Swiss withholding tax.

Public share buy-back programme

The Board of Directors launched on 12 November 2015 the public share buy-back programme authorised by the AGM 2015. This programme was completed on 2 March 2016. For further information please visit www.swissre.com/investors/shares/share_buyback/

The Board of Directors proposes to authorise the company to repurchase own shares for the purpose of cancellation by way of a public share buy-back programme of up to CHF 1.0 billion at any time ahead of the 2017 AGM. Swiss Re will ask the AGM in April 2017 permission to cancel the repurchased shares.

Index representation

In addition to its relevant industry indices, Swiss Re is also represented in various Swiss, European and global indices, including the SMI and the SXIP.

Swiss Re is also a member of various sustainability indices, including the Dow Jones Sustainability and FTSE4Good index families. Swiss Re has been named as the insurance industry sector leader in the Dow Jones Sustainability indices for 2015. This is the ninth time since 2004 that Swiss Re has led the insurance sector in these rankings.

Weighting in indices

| Download |

As of 31 December 2015 |

Index weight (in %) |

Swiss/blue chip indices |

|

SMI |

2.61 |

SPI |

3.13 |

|

|

Insurance indices |

|

STOXX Europe 600 Insurance |

6.09 |

Bloomberg Europe 500 Insurance |

6.37 |

FTSEurofirst 300 Insurance |

7.24 |

Dow Jones Insurance Titans 30 |

2.92 |

|

|

Sustainability indices |

|

Dow Jones Sustainability Europe |

0.41 |

Dow Jones Sustainability World |

0.90 |

FTSE4Good Global |

0.19 |

Information for investors

More information on Swiss Re’s shares is available in the Investor Relations section on Swiss Re’s website at: www.swissre.com/investors

Key share statistics 2011–20151

| Download |

As of 31 December 2015 |

2011 |

2012 |

2013 |

2014 |

2015 |

||||||||||||||||||||||

|

|||||||||||||||||||||||||||

Shares outstanding2 |

370 706 931 |

370 706 931 |

370 706 931 |

370 706 931 |

370 706 931 |

||||||||||||||||||||||

of which Treasury shares and shares reserved for corporate purposes |

27 970 432 |

27 537 673 |

28 511 298 |

28 507 491 |

32 967 2263 |

||||||||||||||||||||||

Shares entitled to dividend |

342 736 499 |

343 169 258 |

342 195 633 |

342 199 440 |

337 739 705 |

||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||

CHF unless otherwise stated |

|

|

|

|

|

||||||||||||||||||||||

Dividend paid per share |

2.75 |

3.00 |

3.504 |

3.855 |

4.256 |

||||||||||||||||||||||

Dividend yield7 (in %) |

5.70 |

4.60 |

4.30 |

4.60 |

4.33 |

||||||||||||||||||||||

Earnings per share8 |

6.79 |

11.13 |

12.04 |

9.33 |

12.93 |

||||||||||||||||||||||

Book value per share9 |

80.74 |

87.76 |

82.76 |

101.12 |

96.04 |

||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||

Price per share year-end |

47.87 |

65.90 |

82.05 |

83.65 |

98.15 |

||||||||||||||||||||||

Price per share year high (intra-day) |

60.75 |

68.10 |

84.75 |

86.55 |

99.75 |

||||||||||||||||||||||

Price per share year low (intra-day) |

35.12 |

47.25 |

66.10 |

69.25 |

74.95 |

||||||||||||||||||||||

Daily trading volume (in CHF millions) |

73.00 |

58.00 |

78.00 |

95.00 |

134.00 |

||||||||||||||||||||||

Market capitalisation10 (in CHF millions) |

17 746.00 |

24 430.00 |

30 417.00 |

31 010.00 |

36 385.00 |

||||||||||||||||||||||

ADR price at year-end (in USD) |

50.55 |

72.30 |

92.38 |

84.57 |

24.5311 |

||||||||||||||||||||||