Life & Health Reinsurance

Performance

Life & Health Reinsurance met its return on equity target of 10%–12% for 2015 which was announced at the Investors’ Day in June 2013. The management actions taken in relation to the pre-2004 US individual life business, the unwinding of an asset funding structure for a longevity transaction, as well as capital optimisation and asset rebalancing have all contributed to help Life & Health meet the target and set the foundation for future profitable growth. Managing the in-force business will continue to be a key priority for Swiss Re while growing new business in 2016 and beyond.

| Download |

USD millions |

2014 |

2015 |

Change in % |

Revenues |

|

|

|

Premiums earned |

11 212 |

10 914 |

–3 |

Fee income from policyholders |

53 |

49 |

–8 |

Net investment income – non-participating business |

1 544 |

1 331 |

–14 |

Net realised investment gains/losses – non-participating business |

–255 |

310 |

– |

Net investment result – unit-linked and with-profit business |

75 |

42 |

–44 |

Other revenues |

|

5 |

– |

Total revenues |

12 629 |

12 651 |

0 |

|

|

|

|

Expenses |

|

|

|

Life and health benefits |

–9 194 |

–8 290 |

–10 |

Return credited to policyholders |

–99 |

–60 |

–39 |

Acquisition costs |

–2 489 |

–1 986 |

–20 |

Other expenses |

–885 |

–903 |

2 |

Interest expenses |

–438 |

–278 |

–37 |

Total expenses |

–13 105 |

–11 517 |

–12 |

|

|

|

|

Income/loss before income tax expense |

–476 |

1 134 |

– |

Income tax expense/benefit |

63 |

–146 |

– |

Interest on contingent capital instruments |

–49 |

–49 |

0 |

Net income/loss attributable to common shareholders |

–462 |

939 |

– |

|

|

|

|

Management expense ratio in % |

6.9 |

7.3 |

|

Operating margin in % |

2.6 |

9.9 |

|

Net income

Net income for 2015 was USD 939 million, compared to a net loss of USD 462 million in 2014. The strong performance in 2015 reflects significant improvement in operating results, net realised gains and lower interest charges.

The loss in 2014 was mainly due to the management actions in respect of the pre-2004 US individual life business, as well as to net realised losses driven by the unwinding of the asset funding structure.

Net premiums earned and fee income

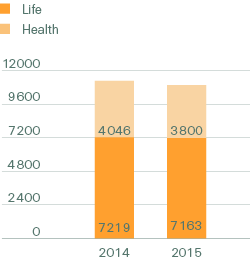

Premiums earned and fee income by L&H segment, 2014–2015

(USD millions)

Net premiums earned and fee income decreased by 2.7% to USD 11.0 billion in 2015, compared to USD 11.3 billion in 2014. At constant exchange rates, premiums earned and fee income were 6.1% higher in 2015. The 2015 figure benefited from several longevity deals in the UK, and large transactions in Australia, Europe and South Africa contributed towards new business growth. In addition, rate increases in the yearly renewable term business in the Americas contributed to the 2015 result.

Operating margin ratio

The operating margin for 2015 was 9.9% compared to 2.6% for 2014. The higher margin stems from the significant improvement in life and health operating income along with lower premiums earned and fee income. The prior-year margin was substantially lower due to the management actions in relation to pre-2004 US individual life business.

Administrative expense ratio

The administrative expense ratio was 7.3% for 2015 compared to 6.9% in 2014 due to an increase in variable compensation.

Operating income

The life segment reported operating income of USD 641 million compared to a loss of USD 66 million in 2014. The current year results benefited from the management actions taken in the prior year in relation to the pre-2004 US individual life business, and a less unfavourable pre-2004 US post-level term business result in the current period. These were partly offset by lower investment income following the unwinding of an asset funding structure supporting a longevity transaction. The loss in 2014 was mainly due to management actions in respect of the pre-2004 US individual life business.

Operating income for the health segment increased to USD 593 million compared to USD 397 million in 2014. The 2015 results benefited from interest rate updates in the valuation of disabled life reserves, and were adversely impacted by reserve strengthening for UK critical illness business. The 2014 results were impacted by an increase in disabled life reserves in the US and UK.

The 2014 operating income of Life & Health does not include the pre-tax charge on the unwinding of the asset funding structure. This charge was included under non-participating realised gains/losses.

Investment result

The return on investments for 2015 was 3.4% compared to 3.2% in 2014, reflecting a lower invested asset base alongside a slight increase in the investment result of USD 2 million. The change in the investment result was driven by an improved result from derivatives and additional gains from sales which were offset by lower net investment income due to net asset outflows from the unwinding of a funding structure in 2014.

Net investment income of USD 1.1 billion in 2015 was lower than USD 1.2 billion in 2014 mainly due to net asset outflows related to the unwinding of a funding structure. The fixed income running yield was 3.5% in the reporting period.

Net realised gains were USD 85 million in 2015 compared to net losses of USD 72 million in 2014, as the prior year included losses from an interest rate hedge.

Insurance-related investment results are not included in the figures above.

Shareholdersʼ equity

Common shareholders’ equity was USD 5.8 billion at the end of 2015, slightly below the shareholders’ equity at the end of 2014. Net income of USD 939 million was offset by unrealised losses, the impact of foreign exchange rate movements and a dividend payment. The return on equity for 2015 was 15.7%. After adjusting for realised gains and one-off model adjustments, and using the equity capital of USD 5.5 billion announced as the basis for our 2015 target at the June 2013 Investors’ Day, return on equity was 11.8%, meeting the target of 10%–12%.

Outlook

In mature markets, the low interest rate environment will continue to have an unfavourable impact on long-term life business. In addition, cession rates in the US are expected to decrease as primary insurers retain more risk. However, high growth markets will see stronger increases in life and health businesses and primary insurers’ cession rates are expected to be stable. As a result, we expect life and health reinsurance business to be relatively flat in mature markets and to increase in high growth markets.

We will continue to pursue growth opportunities in high growth markets and apply our experience to help reduce the protection gap in all regions. We are responding to the expanding need for health protection driven by ageing societies and we are pursuing large transaction opportunities, including longevity deals.