Group results

Our Group delivered a strong net income of USD 4.6 billion.

“Our Business Units reported multiple successes across 2015.”

Michel M. Liès

Group Chief Executive Officer

Swiss Re reported a strong net income of USD 4.6 billion for 2015, compared to USD 3.5 billion for 2014. Earnings per share were USD 13.44 or CHF 12.93, up from USD 10.23 (CHF 9.33) for 2014. All three Business Units contributed to this result. The underwriting performance of Property & Casualty Reinsurance and Corporate Solutions remained solid, reflecting the high quality of those portfolios. Life & Health Reinsurance met its return on equity target after the management actions of 2014. Admin Re® again generated significant gross cash for the Group.

Net income for Reinsurance was USD 3.9 billion in 2015, compared to USD 3.1 billion in 2014. Property & Casualty Reinsurance contributed USD 3.0 billion, a modest decrease from the prior-year period, reflecting continued solid underwriting performance supported by benign natural catastrophe experience and favourable prior-year development. Life & Health Reinsurance reported net income of USD 939 million, reflecting a strong operating result, net realised gains and lower interest charges, compared to a loss of USD 462 million for 2014, which was mainly due to management actions addressing the pre-2004 US individual life business.

Corporate Solutions delivered net income of USD 340 million in 2015, compared to USD 319 million in 2014, reflecting continued profitable business performance across most lines of business and investment activities.

Admin Re® reported net income of USD 422 million for 2015, compared to USD 34 million for 2014, driven mainly by higher realised gains, favourable UK linked investment performance and one-off tax benefits, partially offset by costs for the acquisition of Guardian Financial Services. The 2014 result was impacted by the loss of USD 203 million on the sale of Aurora National Life Assurance Company (Aurora).

Common shareholders’ equity, excluding non-controlling interests and the impact of contingent capital instruments, decreased to USD 32.4 billion at the end of 2015 from USD 34.8 billion at the end of 2014. The decrease was due to the distribution of the 2014 regular and special dividends of USD 2.6 billion, the launch of the share buy-back programme in mid-November, unrealised losses on fixed income securities and unfavourable foreign exchange rate movements, partially offset by higher net income. Book value per common share decreased to USD 95.98 or CHF 96.04 at the end of 2015 compared to USD 101.78 (CHF 101.12) 12 months earlier. Return on equity increased to 13.7% for 2015 from 10.5% for 2014.

Business performance

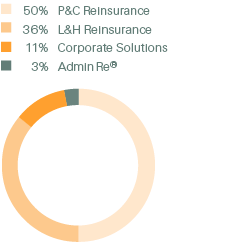

Net premiums and fees earned by Business Unit, 2015

(Total: USD 30.2 billion)

Premiums earned and fee income for the Group totalled USD 30.2 billion for 2015, compared to USD 31.3 billion for 2014, mainly reflecting unfavourable foreign exchange rate movements. At constant exchange rates, premiums and fees increased by 3.7%.

Premiums earned by Property & Casualty Reinsurance in 2015 were USD 15.1 billion, compared to USD 15.6 billion in the same period last year. At constant exchange rates, premiums earned increased by 3.4%, driven by increased premiums in casualty and specialty, partly offset by decreases in property. The Property & Casualty Reinsurance combined ratio was 86.0% in 2015, compared to 83.7% in 2014. Both periods benefited from a better than expected natural catastrophe experience and favourable prior-year reserve developments.

Life & Health Reinsurance premiums earned and fee income were USD 11.0 billion, compared to USD 11.3 billion in 2014. At constant exchange rates, premiums and fees increased by 6.1%. The operating margin for Life & Health Reinsurance was 9.9% in 2015, compared to 2.6% in 2014, mainly reflecting the improvement in operating income in both life and health segments.

Corporate Solutions premiums earned were USD 3.4 billion. At constant exchange rates, premiums earned increased by 1.7%. The Corporate Solutions combined ratio was 93.8% in 2015, compared to 93.0% in 2014, impacted by higher large man-made losses.

Admin Re® generated gross cash of USD 543 million in 2015, down from USD 945 million in 2014. Gross cash generation in 2015 was driven by UK assumption updates, primarily to annuitant mortality rates, and by the UK half-year valuation. The 2014 amount included a release of USD 225 million in surplus reserves held against the risk of credit default, a one-time benefit of USD 234 million following the finalisation of the 2013 year-end UK statutory valuation and proceeds of USD 217 million from the sale of Aurora.

Investment result and expenses

The return on investments was 3.5% for 2015, compared to 3.7% for 2014, with the decrease mainly attributable to lower net investment income from equity-accounted investments.

The Group’s non-participating net investment income was USD 3.4 billion for 2015, compared to USD 4.1 billion for 2014. The decrease mainly related to net asset outflows and lower market value gains on equity-accounted investments. The Group’s fixed income running yield for 2015 was 3.0%, compared to 3.3% for 2014.

The Group reported non-participating net realised investment gains of USD 1.2 billion for 2015, compared to USD 567 million for 2014. The current period result was primarily driven by sales of government bonds and equity securities, partly offset by impairments.

Acquisition costs for the Group slightly decreased to USD 6.4 billion in 2015. At constant foreign exchange rates, acquisition costs increased by 4.0% due to a higher share of proportional business written.

Other expenses were USD 3.3 billion in 2015, a slight increase from the previous period, fully accounted for by the release of a premium tax provision in Asia in the third quarter of 2014.

Interest expenses amounted to USD 579 million in 2015, down from USD 721 million in 2014, mainly due to the unwinding of an asset funding structure supporting a longevity transaction in Life & Health Reinsurance in the fourth quarter of 2014.

The Group reported a tax charge of USD 651 million on a pre-tax income of USD 5.3 billion for 2015, compared to a charge of USD 658 million on a pre-tax income of USD 4.2 billion for 2014. This translated into an effective tax rate in the current and prior-year reporting periods of 12.2% and 15.6%, respectively. The lower tax rate in 2015 was largely driven by a tax benefit arising from a local statutory accounting adjustment for restructuring of subsidiaries, higher tax benefits from foreign currency translation differences between statutory and US GAAP accounts, and the release of valuation allowances partially offset by tax on profits earned in higher tax jurisdictions.