Compensation context and highlights in 2015

Pay for performance

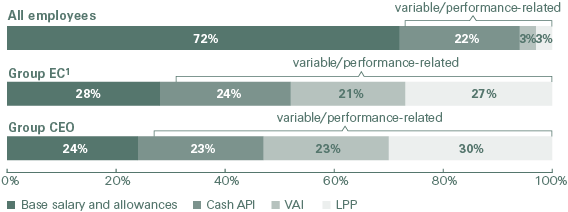

The Compensation Committee ensures that executive management compensation is linked to the business performance of Swiss Re by delivering a substantial portion of compensation in the form of variable and performance-related incentives.

| Download |

|

Fixed |

Variable/ |

of which deferred |

||

|

|||||

All employees |

72% |

28% |

22% |

||

Group EC1 |

28% |

72% |

66% |

||

Group CEO |

24% |

76% |

69% |

||

1 Including Group CEO

The Compensation Committee monitors how compensation is aligned with specific business metrics, including US GAAP net income and EVM profit.

| Download |

USD millions (unless otherwise stated) |

2013 |

2014 |

change |

2015 |

change |

||||||||

|

|||||||||||||

US GAAP net income |

4 444 |

3 500 |

–21% |

4 597 |

31% |

||||||||

EVM profit |

4 007 |

1 336 |

–67% |

480 |

–64% |

||||||||

Regular dividend payments (CHF)1 |

3.85 |

4.25 |

10% |

4.60 |

8% |

||||||||

Financial Strength Rating (Standard & Poor’s) |

AA- |

AA- |

|

AA- |

|

||||||||

Total equity |

32 977 |

36 041 |

9% |

33 606 |

–7% |

||||||||

Regular staff worldwide |

11 574 |

12 224 |

|

12 767 |

|

||||||||

Aggregate compensation for all employees (CHF m)2 |

2 065 |

2 081 |

1% |

2 213 |

6% |

||||||||

Group EC members3,4 |

12 |

13 |

|

12 |

|

||||||||

Aggregate Group EC compensation (CHF thousands)2 |

45 902 |

42 612 |

–7% |

47 360 |

11% |

||||||||

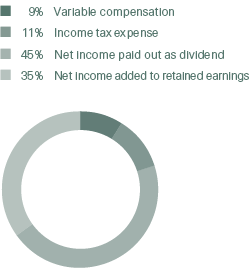

Attribution of Group income to key stakeholders

| Download |

USD millions (unless otherwise stated) |

2013 |

% |

2014 |

% |

2015 |

% |

||||

|

||||||||||

Income before tax and variable compensation |

5 262 |

100% |

4 629 |

100% |

5 758 |

100% |

||||

Variable compensation |

506 |

10% |

471 |

10% |

510 |

9% |

||||

Income tax expense |

312 |

6% |

658 |

14% |

651 |

11% |

||||

US GAAP net income attributable to shareholders |

4 444 |

|

3 500 |

|

4 597 |

|

||||

of which paid out as dividend1 |

3 129 |

59% |

2 608 |

57% |

1 549 |

27% |

||||

of which share buyback2 |

|

|

|

|

1 040 |

18% |

||||

of which added to retained earnings within shareholders’ equity |

1 315 |

25% |

892 |

19% |

2 008 |

35% |

||||

Attribution of 2015 Group income (in USD millions)

Key Developments

In addition to a continued focus on linking pay to performance, changes in 2015 mainly related to the implementation of the simplified Value Alignment Incentive (VAI) as well as the review of the performance conditions for the Leadership Performance Plan (LPP).

Activities in 2015

Performance and compensation

- Implementation of the simplified VAI structure.

- The risk-free rate of the Restricted Share Unit (RSU) component of the LPP for the 2016 award will be set at the 10-year US government bond rate.

- Continued embedding of the two-dimensional performance rating on the ‘what’ and the ‘how’ (achievements and behaviours) for all employees.

Legal and regulatory oversight

Regulatory aspects covered the continued interaction with FINMA and the monitoring of Solvency II developments to ensure alignment of the compensation framework with the new requirements which entered into force on 1 January 2016.

Additionally, reviews of compliance with new local legal and regulatory requirements were conducted.

Annual General Meeting (AGM)

- At the AGM on 21 April 2015, shareholders voted for the first time on the aggregate prospective compensation of the members of the Board of Directors (86.74% approval). Shareholders voted also on the aggregate prospective fixed compensation and variable long-term compensation and aggregate retrospective variable short-term compensation of the Group Executive Committee (Group EC). The vote outcomes were 90.37% and 90.00% approval respectively.

- As in previous years, the 2014 Compensation Report was subject to a consultative vote and was approved by 88.64% of the shareholder votes.

- The members of the Compensation Committee were re-elected with an average of 97.87% of the shareholder votes.

Outlook 2016

The Compensation Committee will continue focusing on legal and regulatory oversight in addition to monitoring and further improving the overall compensation framework and plans.

The interaction with key shareholders and regulators will also be maintained in 2016.

The binding votes on the compensation proposals for the Group EC and the members of the Board of Directors and the consultative vote on the 2015 Compensation Report are taking place at the AGM on 22 April 2016.