A solid foundation for the road ahead

A strong 2015 performance and a new strategic framework set the foundation for 2016 and beyond.

“All three Business Units contributed to our strong performance.”

Dear shareholders,

Since Swiss Re was founded in 1863, we have managed risk and absorbed extreme events in many forms. From earthquakes to terrorism, we have enabled society to thrive and progress. However, protection alone is not enough — resilience is our ultimate goal. This vision permeates our daily actions and continues to inform our strategy.

It also contributed to our success in 2015: I am very pleased to report that we managed to navigate the challenging environment and can report another positive set of results, driven by strong performances from all three of our Business Units. Group net income reached USD 4.6 billion — one of our highest ever — up from USD 3.5 billion in 2014. These results clearly differentiate us in the industry. With the updated strategic framework we unveiled in December 2015, we believe we are well placed to continue to focus on profitable growth, strong capitalisation and unique client experience.

Our 2011–2015 Group financial targets

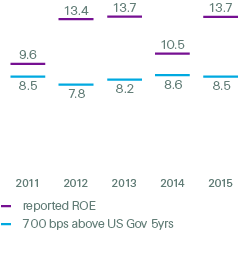

Return on equity

(in %)

700 bps above risk free average over five years

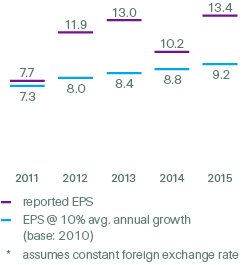

Earnings per share

(in USD*)

10% average annual growth rate, adjusted for special dividends

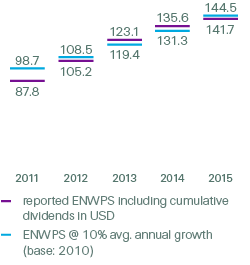

Economic net worth per share

10% average per share growth plus dividends over five years

Property & Casualty Reinsurance portfolio delivers; Life & Health Reinsurance meets target

The underwriting performance of P&C Re remained solid in 2015, generating USD 3.0 billion in net income and reflecting the underlying quality of our portfolio, as well as a relatively benign natural catastrophe experience. L&H Re has met the return on equity target we set for it at the June 2013 Investors’ Day, in turn delivering a strong net income of USD 939 million.

Corporate Solutions continues to deliver in challenging market conditions and remains committed to disciplined underwriting, generating USD 340 million of net income for the year. The focus on high growth markets is as strong as ever, notably with the acquisition of Sun Alliance Insurance China Limited, which enables us to operate in mainland China, one of the world’s most promising markets.

In 2015, we took an important step to tap into a growing market segment with the creation of the Life Capital Business Unit. Life Capital is managing closed and open life and health insurance books since 1 January 2016, including our Admin Re® business. We believe that consolidating these activities will fit our goal of diversifying our business and providing our clients with the expertise and capabilities they need to help them seize new opportunities. Admin Re®, which is the cornerstone of Life Capital, delivered a strong performance in 2015, with strong gross cash generation and a net income of USD 422 million. In January 2016, it completed the acquisition of UK-based Guardian Financial Services, a move that is in line with our strategy to become a leading closed life book consolidator in the UK.

Our new financial targets

Looking at 2016 and beyond, our new Group targets are focused on profitability and economic growth.

The ‘over the cycle’ timeframe provides a long-term goal, without being distorted by outlying years.

The new targets are fully consistent with Swiss Re’s capital priorities.

Return on equity

At least 700 basis points greater than the risk-free rate, as measured by ten-year US government bonds.

Economic net worth per share

10% growth per annum, using year-end Economic Net Worth (ENW) plus dividends, divided by previous year-end ENW.

Delivering on our targets

Over the last five years, we have grown the regular dividend and we have executed our internal growth initiatives while making sensible acquisitions. At the same time we distributed excess capital to our shareholders and maintained our very strong capital position. We have successfully reached the return on equity (ROE) and earnings per share (EPS) targets we set five years ago in very different circumstances. This is an impressive achievement under any conditions, though especially so in light of the turbulent markets and uncertain macroeconomic conditions that prevailed during much of the 2011–2015 target period. At 9.6%, we almost achieved our economic net worth per share (ENWPS) average annual growth target of 10%, following the previously announced agreement to acquire Guardian Financial Services.

Where do we go from here?

“We remain confident that we will continue to capture attractive business opportunities.”

Our vision “We make the world more resilient” is supported by our mission — to create smarter solutions for our clients through fresh perspectives, knowledge and capital. The combination of these strengths makes Swiss Re a partner of choice for our clients. Together, we believe we can close the gap between the rising costs of natural disasters and other hazards and the share of those costs that is covered by re/insurance solutions.

In 2015, the world experienced some tragic events and great uncertainty — an evolving terrorism threat, wars and epidemics, a fragile global economy. Against this backdrop, the re/insurance industry needs to step up its game and extend the boundaries of insurability, building a safety net around those who need it most.

2016 has been off to a volatile start amid concerns about the strength of the global economy. Many of the challenges we’ve experienced over the past years, such as continued low interest rates and ample capital in our core business areas, will continue to exist. As communicated in December 2015, we believe our four pillar strategic framework equips us with an agile business model that makes us able to respond more quickly and effectively to change and to drive change ourselves. This is why we remain confident that we will continue to capture attractive business opportunities and we thank you, our shareholders, for placing your confidence in us.

No strategic framework can be put to good use without the help and dedication of our people. We need our employees’ enthusiasm and commitment to bring our vision closer to reality. We’d like to thank them for their hard work: without them, we couldn’t celebrate another successful year.

As you can see I am passionate about Swiss Re’s future. I am convinced that Christian Mumenthaler and his team will further strengthen the role of Swiss Re in our industry and our society more generally. It is an honour and a privilege to work for this great company. I will always be proud to have been part of Swiss Re.

Zurich, 16 March 2016

Michel M. Liès

Group Chief Executive Officer