Business Units at a glance

Swiss Re is a leader in wholesale reinsurance, insurance and risk transfer solutions.

Reinsurance

Reinsurance is Swiss Re’s largest business in terms of income and the foundation of our strength, providing about 85% of gross premiums and fee income through two segments — Property & Casualty and Life & Health. The unit aims to extend Swiss Re’s industry-leading position with disciplined underwriting, prudent portfolio management and diligent client service.

Net premiums earned and fee income (USD billions)

Property & Casualty

Life & Health

Net income (USD millions)

Property & Casualty

Life & Health

Return on equity

Property & Casualty

22.2%

(26.7% in 2014)

Life & Health

15.7%

(−7.9% in 2014)

Operating performance

Property & Casualty

86.0%

(83.7% in 2014)

Combined ratio

Life & Health

9.9%

(2.6% in 2014)

Operating margin

Corporate Solutions

Corporate Solutions serves mid-sized and large corporations, with product offerings ranging from traditional property and casualty insurance to highly customised solutions. Corporate Solutions serves customers from over 50 offices worldwide.

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

14.8%

(12.5% in 2014)

Operating performance

93.8%

(93.0% in 2014)

Combined ratio

Admin Re®

Admin Re® provides risk and capital management solutions by which Swiss Re acquires closed books of in-force life and health insurance business, entire lines of business, or the entire capital stock of life insurance companies. As of 1 January 2016, the open and closed life insurance books of the Group, including Admin Re®, are managed under a new Business Unit called Life Capital.

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

7.5%

(0.6% in 2014)

Operating performance

543m

(USD 945m in 2014)

Gross cash generation

Total

(After consolidation)

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

13.7%

(10.5% in 2014)

Diversified and global

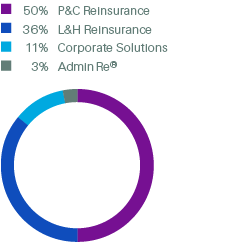

Net premiums earned and fee income by Business Unit

(Total USD 30.2 billion)

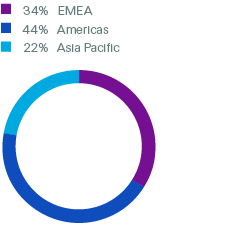

Net premiums earned and fee income by region

(Total USD 30.2 billion)