The global economy and financial markets

Global growth remained moderate in 2013. Benchmark government bond yields increased from very low levels while stock markets performed well.

Global growth remained moderate in 2013. The advanced economies saw modest growth which gained strength over the course of the year, while the pace of expansion in the emerging economies slowed a little from the relatively robust levels of 2012. Monetary policy in the major markets remained accommodative. Expectations of stronger growth and reduced monetary stimulus in the US, however, led to a marked increase in benchmark government bond yields. Equity markets continued to perform well, supported by the easy monetary conditions and improving growth in the advanced economies.

Global economy

3.0%

10-year US government bond yield

(2012: 1.75%)

US growth was restrained by tax increases and spending cuts, but even so, the economy remained resilient. The Eurozone emerged from recession in the second quarter but growth was fragile. Some member states remained in recession with tight fiscal and credit conditions and deleveraging of the private sector weighing on economic activity. The Japanese economy gained momentum helped by expansionary fiscal and monetary policies which weakened the yen (see economic indicators table below). The UK economy also faced fiscal headwinds but managed to accelerate nonetheless.

Despite the improving economic environment, political uncertainties continued. In Europe, the struggle to reach agreement on bail-out terms almost led to an exit of Cyprus from the monetary union. Also, the political ability, or will, to tackle urgently needed structural reforms remained weak in several countries. The pace of reform at a Europe-wide level was moderate, with some progress towards a banking union. In the US, the ongoing impasse on the budget ultimately led to a government shutdown for 16 days in October. A US sovereign debt default was only narrowly averted by a last-minute deal to postpone the debate over increasing the debt ceiling until 2014.

Growth in emerging markets was more robust than in advanced markets but slower than in previous years. In addition, expectations of tighter monetary policy by the US Federal Reserve (the Fed) led to capital outflows from some emerging markets. Those economies with large current account deficits, elevated debt levels and high inflation proved especially vulnerable.

Inflation remained moderate in most economies with the exception of a few emerging markets, notably India. In the US and the Eurozone, inflation declined during 2013 to end the year well below their respective central bank target levels.

Interest rates

Monetary policy remained highly accommodative through 2013. The European Central Bank (ECB) lowered its benchmark rate twice to reach 0.25%. The Fed and the Bank of England (BoE) kept interest rates unchanged while attempting to steer expectations by providing guidance on their expectations of the future rate path. Meanwhile, the Bank of Japan (BoJ), in an effort to increase inflation to 2% by 2015, announced a doubling of the monetary base by March 2015.

2.0%

Bank of Japan consumer price index inflation target

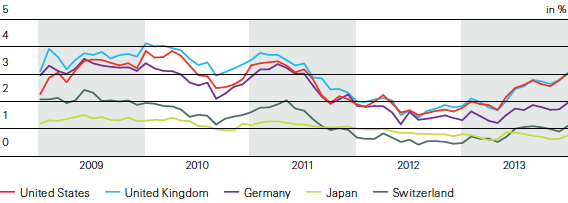

Despite low policy rates, benchmark government bond yields rose significantly during the summer as markets began to anticipate a reduction in monthly asset purchases by the Fed. However, with ongoing political uncertainty and only modest employment growth, the Fed decided to delay its tapering actions. As a result, bond yields dropped, but increased again towards the end of the year, with US and German 10-year government bond yields about 120 and 60 basis points above their respective previous year-end levels (see interest rate chart above).

By contrast, bond yields of the peripheral Eurozone economies declined. The narrowing yield spreads versus the German benchmark reflected lower perceived risk given improved growth prospects and likely support from the ECB. Corporate credit spreads also narrowed as growth in the advanced economies improved.

Stock market performance

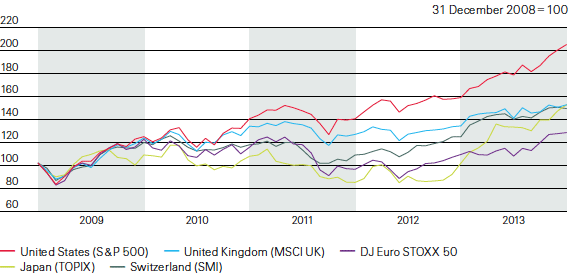

Global stock markets suffered a brief setback in the early summer as investors worried about the Fed unwinding its asset purchase programme. Overall, however, all major markets performed well in 2013 (see stock markets chart below). The MSCI UK was up 14%, the Eurostoxx50 18%, the Swiss Market Index 20% and the S&P 500 30%. Japanese equities performed particularly well, supported by the BoJ’s monetary easing. The TOPIX gained 51% over the year.

Stock markets 2009–2013

Source: Datastream

Currency movements

The BoJ’s accommodative monetary stance also prompted a continued weakening of the Japanese yen, particularly during the first few months of the year. The yen ended the year down 17% versus the US dollar. Other foreign exchange moves were less pronounced. The US dollar strengthened a little against other key currencies in the first half of the year but reversed those gains in the second half. It ended the year 2%–4% weaker versus the UK pound, the euro and the Swiss franc.

Economic indicators 2012–2013

| Download |

|

|

USA |

Eurozone |

UK |

Japan |

China |

|||||||||||||

|

|

2012 |

2013 |

2012 |

2013 |

2012 |

2013 |

2012 |

2013 |

2012 |

2013 |

||||||||

|

||||||||||||||||||

|

Real GDP growth1 |

2.8 |

1.9 |

–0.6 |

–0.4 |

0.3 |

1.9 |

1.4 |

1.6 |

7.7 |

7.7 |

||||||||

|

Inflation1 |

2.1 |

1.5 |

2.5 |

1.4 |

2.8 |

2.6 |

0.0 |

0.2 |

2.7 |

2.6 |

||||||||

|

Long-term interest rate2 |

1.8 |

3.0 |

1.3 |

1.9 |

1.8 |

3.0 |

0.8 |

0.7 |

3.6 |

4.6 |

||||||||

|

USD exchange rate2,3 |

– |

– |

132 |

138 |

162 |

166 |

1.15 |

0.95 |

16.0 |

16.5 |

||||||||