Insurance companies as long-term investors: opportunity for the real economy

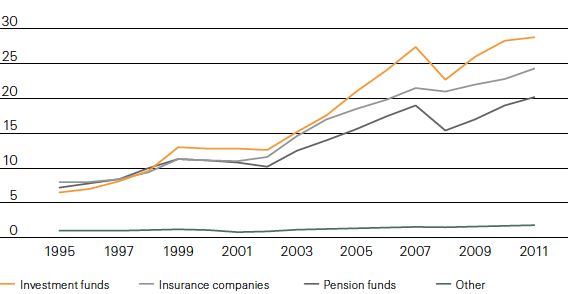

Long-term investors are important to the global economic recovery, especially in an environment of high public deficits and volatile financial markets. The re/insurance sector is well-suited to take part in that recovery given its business model and liability structure as well as its USD 24 trillion in assets in the OECD (see chart 1).

Chart 1: Total assets by institutional investors in the OECD (in USD trn)

Source: G20/OECD, 2013

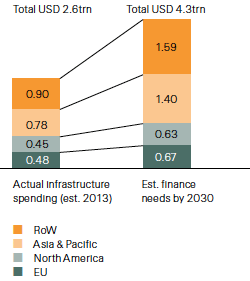

As illustrated in chart 2, current global infrastructure spending is estimated at USD 2.6 trillion, whereas by 2030 financing needs are projected to be over USD 4 trillion. Re/insurers can help mitigate this emerging financing gap. Given that re/insurers’ liabilities are long-term, they are well placed to make investments in transport, water, energy and communications.

Chart 2: Annual infrastructure spending vs. needs

Source: Swiss Re, McKinsey, Dealogic, IMF, OECD, ASCE. Global infrastructure spending expected to grow at 3% p.a. to reach total of USD 60trn through 2030

In order for this to happen, the investment and regulatory environment needs to be more supportive of long-term investing. In particular regulatory incentives (ie capital charges for longer-term assets) need to be aligned, policy uncertainty needs to be minimised, and appropriate financial market instruments need to be available. Taking appropriate action to develop the supporting framework is key to increase the potential investment appetite and capacity of re/insurers as long-term investors.

Facilitating infrastructure investment

Bank loans continue to be the predominant instrument for financing infrastructure and related projects. Changes in bank regulation and capital rules, however, are making this business less attractive to the banking sector.

Infrastructure loans/debt meet several institutional investor needs, such as regular cash flows, attractive risk-adjusted yields, and generally lower default risk beyond the construction phase. The high credit quality of infrastructure debt has been largely demonstrated in the Moody’s report on infrastructure default and recovery rates1.

Standardising financial instruments for infrastructure project investing could potentially attract more institutional investors. Current infrastructure financing deals are complex, often involve a syndicate of banks and have relatively low investment ratings. Furthermore, no generally accepted benchmark is yet available for this asset class. Efforts such as the World Bank’s Global Infrastructure Facility, the FSB Monitoring of regulatory impacts on long-term investing and the EU/EIB Project Bond initiative have all been undertaken in recognition of the importance of long-term investment for the real economy. Coordination and concrete implementation of initiatives is needed on a global level.

Swiss Re remains engaged in public consultations with policymakers to unlock the potential of long-term investors for growth.

In infrastructure financing, the efforts should ultimately be geared towards creating an asset class with all its desired features. To this end, standardisation and a more supportive regulatory stance could help narrow the financing gap. In Europe, a tradable and harmonised “Pan-European Project Bond”, which would build on the EU/EIB project bond initiative and integrate a pool structure as well as enhance the financing capacity by partnering with the re/insurance sector, could be one possible model to meet the challenges ahead.

1 “Infrastructure Default and Recovery Rates, 1983–2012H1”, December 2012