Our business

Swiss Re is a leader in wholesale reinsurance, insurance and risk transfer solutions. Our clients include insurance companies, corporations and public sector bodies. Our knowledge and capital strength enable the risk-taking on which economies depend.

The Swiss Re Group

Reinsurance

We cover reinsurance needs in the areas of Property & Casualty and Life & Health.

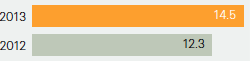

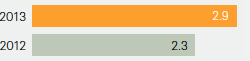

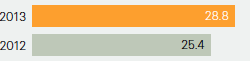

Net premiums earned and fee income (USD billions)

Property & Casualty

Life & Health

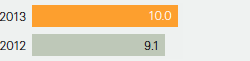

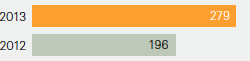

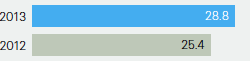

Net income (USD millions)

Property & Casualty

Life & Health

Return on equity

Property & Casualty

26.4%

(26.7% in 2012)

Life & Health

5.4%

(8.9% in 2012)

Operating performance

Property & Casualty

83.3%

(80.7% in 2012)

Combined ratio

Life & Health

5.2%

(8.6% in 2012)

Operating margin

Corporate Solutions

We offer innovative, high-quality insurance capacity to mid-sized and large multinational corporations.

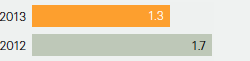

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

9.6%

(7.4% in 2012)

Operating performance

95.1%

(96.2% in 2012)

Combined ratio

Admin Re®

We acquire closed in-force life and health books of business, which we administer through Admin Re®.

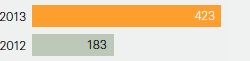

Net premiums earned and fee income (USD billions)

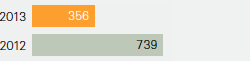

Net income (USD millions)

Return on equity

6.8%

(2.6% in 2012)

Operating performance

521m

(USD 1 196m in 2012)

Gross cash generation

Total

(after consolidation)

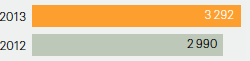

Net premiums earned and fee income (USD billions)

Net income (USD millions)

Return on equity

13.7%

(13.4% in 2012)

Diversified and global

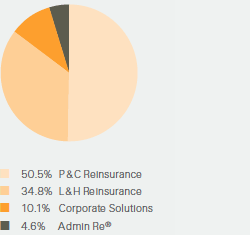

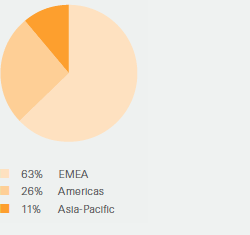

Net premiums earned in 2013

(Total: USD 28.8 billion)

Employees

(Total: 11 574 regular staff1)

1 as of 31 December 2013