Risk modelling and risk measures

We use a proprietary integrated risk model to determine the capital required to support the risks on Swiss Re’s books, and to allocate risk-taking capacity to the different lines of business. Our internal model is based on two important principles. First, it applies an asset-liability management (ALM) approach, which measures the net impact of risk on the economic value of both assets and liabilities. Second, it adopts an integrated perspective, recognising that a single risk factor can affect different sub-portfolios and that different risk factors can have mutual dependencies.

Swiss Re’s risk model provides a meaningful assessment of the risks to which the company is exposed and is an important tool for managing our business. It is used for determining capital requirements for internal purposes and for regulatory reporting under the Swiss Solvency Test (SST). The model provides the basis for capital cost allocation in our Economic Value Management (EVM) framework, which is used for pricing, profitability evaluation and compensation decisions (see chapter Economic Value Management for further information on EVM).

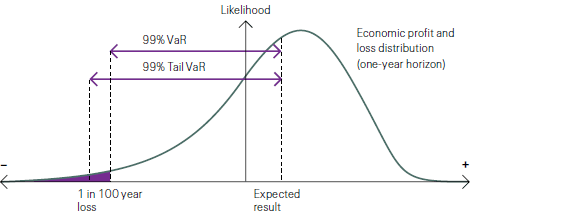

The model generates a probability distribution for the Group’s annual economic profit and loss, specifying the likelihood that the outcome will fall within a given range. From this distribution, we derive a base capital requirement that captures the potential for severe, but rare, aggregate losses over a one-year time horizon.

Swiss Re’s risk model assesses the potential economic loss at a specific confidence level. There is thus a possibility that actual losses may exceed the selected threshold. In addition, the reliability of the model may be limited when future conditions are difficult to predict. For this reason, we continuously review and update our model and its parameters to reflect changes in the risk environment and current best practice. We complement our risk models by ensuring a sound understanding of the underlying risks and applying robust internal controls.

In April 2012, a new financial market risk model was introduced, which comprises a new fat tail approach to better reflect extreme market movements as well as a new calibration framework, a refined treatment for credit risk of asset-backed securities and an improved risk factor mapping for indirect private equity.

The risk measures derived from the integrated risk model are expressed as economic loss severities taken from the total economic profit and loss distribution. In line with SST, Swiss Re measures its total capital requirement at 99% Tail VaR (expected shortfall). This represents an estimate of the average annual loss likely to occur with a frequency of less than once in one hundred years. A less conservative measure is the 99% value at risk (VaR), which measures the loss likely to be exceeded in only one year out of one hundred. 99.5% value at risk (VaR) measures the loss likely to be exceeded in only one year out of two hundred.