Liquidity management

As a re/insurance group, our core business generates liquidity primarily through premium income. Our exposure to liquidity risk stems mainly from two sources: the need to cover potential extreme loss events and regulatory constraints that limit the flow of funds within the Group.

To manage these risks, we have a range of liquidity policies and measures in place. In particular, we aim to ensure that:

- sufficient liquidity is held to meet funding requirements even under adverse circumstances;

- funding is charged at an appropriate market rate through our internal transfer pricing;

- diversified sources are used to meet Swiss Re’s residual funding needs; and

- the long-term liquidity needs are taken into account as part of our asset-liability management approach to controlling financial market risk.

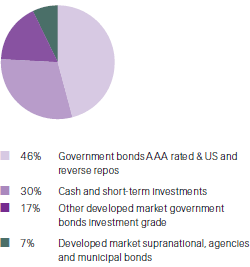

Composition of spot liquidity in the Swiss Reinsurance Company Ltd liquidity pool as of 31 December 2012

(Total USD 18.3 billion)

Liquidity risk management

Our core liquidity policy is to retain sufficient liquidity, in the form of unencumbered liquid assets and cash, to meet potential funding requirements arising from a range of possible stress events. To allow for regulatory restrictions on intra-Group funding, liquidity is managed within pools of entities. The main pool comprises Swiss Reinsurance Company Ltd (SRZ) as well as those of its subsidiaries whose funds are freely transferable to SRZ.

The amount of liquidity held is largely determined by internal liquidity stress tests, which estimate the potential funding requirements stemming from extreme loss events. These funding requirements under stress would include:

- cash and collateral outflows, as well as potential capital and funding support required by subsidiaries as a result of loss events;

- repayment or loss of all maturing unsecured debt and credit facilities;

- additional collateral requirements associated with a potential ratings downgrade;

- further contingent funding requirements related to asset downgrades; and

- other large committed payments, such as expenses, commissions and tax.

The stress tests also assume that funding from assets is subject to conservative haircuts, that intra-Group funding is not available if it is subject to regulatory approval, that no new unsecured funding is available, and that funding from new reinsurance business is reduced.

The primary liquidity stress test is based on a one-year time horizon, a loss event corresponding to 99% Tail VaR (see chapter Risk assessment), and a three notch ratings downgrade.

Swiss Re’s liquidity stress tests are reviewed regularly and their main assumptions are approved by the Group Risk and Capital Committee.

Liquidity position of SRZ liquidity pool

The estimated total liquidity sources in the SRZ liquidity pool available within one year after haircuts and net of short-term loans from Swiss Re Ltd amounted to USD 22.5 billion as of 31 December 2012, compared to USD 23.2 billion on the same date in 2011. This total includes USD 18.3 billion of liquid assets and cash, referred to as “spot liquidity”, compared to USD 20.5 billion on the same date in 2011. Based on the internal liquidity stress tests described above, we estimate that SRZ liquidity pool held surplus liquidity on 31 December 2012. Part of the surplus liquidity was used in 2012 to pay USD 2.6 billion in dividends to Swiss Re Ltd.