Group results

Swiss Re reported annual net income of USD 4.2 billion in 2012, compared to net income of USD 2.6 billion in 2011. Earnings per share were CHF 11.13 or USD 11.85, compared to CHF 6.79 or USD 7.68 in 2011.

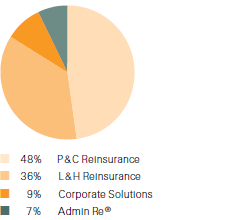

Net premiums earned by Business Unit, 2012

(Total: USD 25.4 billion)

The Group results in 2012 reflect a strong underlying performance together with prior-year reserve releases and significant realised gains on investments.

Property & Casualty Reinsurance reported net income of USD 2 990 million driven by strong underwriting performance, a continuation of strong underlying margins and favourable development of prior-year reserves. Life & Health Reinsurance delivered net income of USD 739 million, compared to USD 1 664 million in 2011. The result for 2012 reflects lower investment income and a continuation of the negative performance of business written in the Americas prior to 2004. In 2011 the result included exceptionally large mark-to-market gains on the foreign exchange portfolio that was designated as trading.

Corporate Solutions delivered net income of USD 196 million reflecting profitable business growth.

Admin Re® reported net income of USD 183 million, which includes a loss of USD 399 million due to the sale of the Admin Re® US business. Excluding the effects of the sale, Admin Re®’s net income was USD 582 million during the year driven by an improvement in investment performance, including higher realised gains. In addition, management actions provided one-off benefits to the result.

The Group’s combined ratio improved significantly to 83.1% in 2012, compared to 104.7% in 2011. The net impact from natural catastrophes on the combined ratio in 2012 was 8.0 percentage points, which is 0.6 percentage points below the expected level. In 2011, natural catastrophe experience was approximately 19.4 percentage points higher than expected.

Both periods benefited from better than expected development of prior accident years, amounting to a 7.4 percentage point impact for the 2012 combined ratio, after 11.0 percentage points in 2011.

The return on investments for 2012 was 4.0%, compared to 4.4% in 2011. Excluding the impact of foreign exchange, return on investments was 4.2% in 2012, compared to 3.7% in 2011. On a full year basis, the Group running yield declined to 3.2%, compared to 3.7% during 2011.

Shareholders’ equity increased USD 4.4 billion to USD 34.0 billion compared to 31 December 2011, driven by net income partially offset by the Group’s dividend. Furthermore, during the year the Group issued two contingent capital instruments with an aggregate face value of USD 1.1 billion that are reported as components of shareholders’ equity.

Return on equity increased to 13.4% in 2012 from 9.6% in 2011 driven by the strong earnings in the period.

During the year non-controlling interests decreased by USD 1.7 billion reflecting the sale of Swiss Re Private Equity Partners AG and the acquisition of the ownership interest in New California Holdings, Inc.

Book value per common share was USD 95.87 or CHF 87.76 at the end of December 2012, compared to USD 86.35 or CHF 80.74 at the end of 2011. Book value per common share is based on common shareholders’ equity and excludes non-controlling interests and the impact of contingent capital instruments.

For information on segment shareholders’ equity, please see Note 17.

Full-year 2012 Group operating results

Property & Casualty Reinsurance reported USD 12.3 billion in premiums earned, an increase of 22% compared to the prior-year period. The increase reflects successful renewals in 2012 and continued earnings from large quota share treaties written in 2011. Life & Health Reinsurance premiums earned and fee income increased 9%, driven by health business growth in Europe and Asia, new longevity transactions and higher rates in the Americas. Corporate Solutions premiums earned increased 18% to USD 2.3 billion, reflecting successful organic growth across all major lines of business.

The Property & Casualty Reinsurance claims and claim adjustment expenses decreased 15% in 2012 compared to 2011. This reflects natural catastrophe experience within expected levels for 2012, despite the impact from Hurricane Sandy in the last quarter of 2012. Both reporting periods benefited from reserve releases due to favourable development of prior accident years.

The Corporate Solutions claims and claim adjustment expenses were stable year on year. 2012 reflects higher business volumes and fewer large losses compared to 2011. Loss occurrence was in line with expectations compared to a higher than average burden in 2011.

Life & Health Reinsurance benefits increased 8% to USD 6.8 billion compared to 2011, mainly due to health business growth in Europe and Asia and continued lapses from the business written in the Americas prior to 2004. The benefit ratio increased slightly to 75.5% in 2012, compared to 74.5% in 2011.

Returns credited to policyholders reflect the investment performance on the underlying assets, mainly backing unit-linked and with-profit policies, which are passed through to policyholders. In 2012, returns credited to policyholders were USD 3.0 billion, compared to USD 61 million in the prior year.

Acquisition costs for the Group increased 13% to USD 4.5 billion, reflecting higher business volumes.

Administrative expenses increased 7% to USD 2.9 billion, driven by higher variable compensation reflecting the strong underlying performance of the Group, various initiatives related to the implementation of the new Group structure and strategic growth initiatives. Other expenses decreased USD 21 million to USD 300 million.

Interest expenses were USD 0.7 billion, a decrease of 14% over 2011, mainly due to lower average debt outstanding during the year compared to 2011.

The Group reported a tax expense of USD 1.1 billion on a pre-tax income of USD 5.5 billion in 2012, compared to an expense of USD 77 million on a pre-tax income of USD 2.9 billion in 2011. The results reflect an effective tax rate in the current and prior year of 20.4% and 2.7%, respectively. The higher effective tax rate in the current year was a result of lower tax benefits from reductions in the local statutory valuations of investments in subsidiaries and changes in local country tax rates.