Swiss Re at a glance

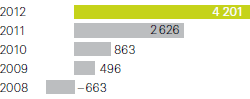

Net income

(USD millions)

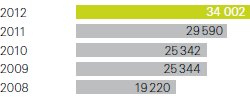

Shareholders’ equity

(USD millions)

Proposed dividend per share for 2012 (CHF)*

3.50

(CHF 3.00 for 2011)

* Swiss withholding tax exempt distribution out of legal reserves from capital contributions

4.00

Proposed special dividend per share for 2012 (CHF)*

* Swiss withholding tax exempt distribution out of legal reserves from capital contributions

Financial highlights

For the twelve months ended 31 December

| Download |

|

USD millions, unless otherwise stated |

2011 |

2012 |

Change in % | ||||

| |||||||

|

Group |

|

|

| ||||

|

Net income attributable to common shareholders |

2 626 |

4 201 |

60 | ||||

|

Premiums earned and fee income |

22 176 |

25 446 |

15 | ||||

|

Earnings per share in CHF |

6.79 |

11.13 |

64 | ||||

|

Shareholders’ equity |

29 590 |

34 002 |

15 | ||||

|

Return on equity1 in % |

9.6 |

13.4 |

| ||||

|

Return on investments in % |

4.4 |

4.0 |

| ||||

|

Number of employees2 (31.12.2011/31.12.2012) |

10 788 |

11 193 |

4 | ||||

|

|

|

|

| ||||

|

Property & Casualty Reinsurance |

|

|

| ||||

|

Net income attributable to common shareholders |

1 099 |

2 990 |

172 | ||||

|

Premiums earned |

10 135 |

12 329 |

22 | ||||

|

Combined ratio in % |

104.0 |

80.7 |

| ||||

|

Return on equity1 in % |

11.0 |

26.7 |

| ||||

|

|

|

|

| ||||

|

Life & Health Reinsurance |

|

|

| ||||

|

Net income attributable to common shareholders |

1 664 |

739 |

–56 | ||||

|

Premiums earned and fee income |

8 404 |

9 122 |

9 | ||||

|

Benefit ratio in % |

74.5 |

75.5 |

| ||||

|

Return on equity1 in % |

21.2 |

8.9 |

| ||||

|

|

|

|

| ||||

|

Corporate Solutions |

|

|

| ||||

|

Net income attributable to common shareholders |

81 |

196 |

142 | ||||

|

Premiums earned |

1 929 |

2 284 |

18 | ||||

|

Combined ratio in % |

107.9 |

96.2 |

| ||||

|

Return on equity1 in % |

3.7 |

7.4 |

| ||||

|

|

|

|

| ||||

|

Admin Re® |

|

|

| ||||

|

Net income attributable to common shareholders |

329 |

183 |

–44 | ||||

|

Premiums earned and fee income |

1 686 |

1 705 |

1 | ||||

|

Return on equity1 in % |

5.0 |

2.6 |

| ||||