Our Corporate Responsibility Map and how we determine materiality

A key question for any company that understands corporate responsibility as taking a long-term view and enabling sustainable progress is what this means in the context of its own business and industry: which topics are “material” to achieving this goal?

In order to identify these material Corporate Responsibility Topics, we use both our internal risk expertise and ongoing dialogue with our stakeholders.

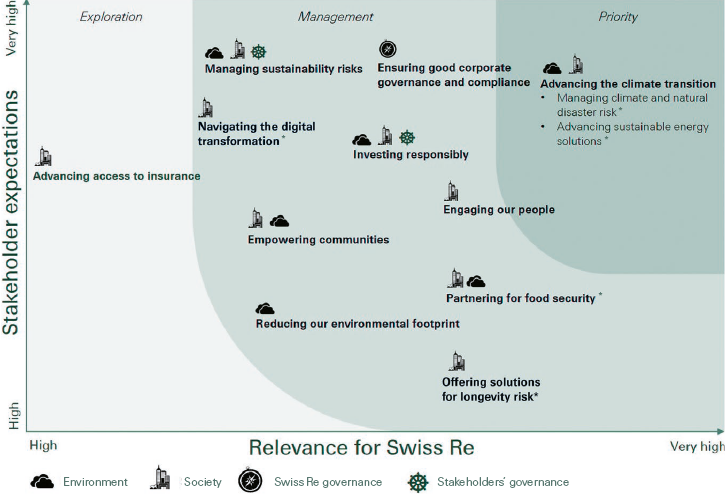

Currently, we focus on a total of twelve such topics and display them in a Corporate Responsibility Map.

Reflecting our two main insight sources and in line with current best practice, eg the recommendations of the Global Reporting Initiative (www.globalreporting.org), this map is structured along the two axes of “Stakeholder expectations” and “Relevance for Swiss Re” – in terms of risks as well as opportunities. The topics are positioned within three areas expressing different stages of relevance and maturity:

Priority: Topics with high stakeholder expectations as well as high internal relevance. Require continuous high attention and effort.

Management: Topics recognised as being relevant and for which we have well-established management procedures. Stakeholder interest in them varies, though.

Exploration: Topics with increasing relevance from an internal perspective and an expected increase in stakeholder inquiries. Warrant further analysis.

OUR CORPORATE RESPONSIBILITY MAP

* These Corporate Responsibility Topics are also covered by the risk knowledge topics of our stakeholder dialogue. See “Exploring and shaping the risk landscape”.

Insights from our internal risk expertise

As a leading re/insurer, we act as ultimate risk taker in society, which requires us to have a very sound understanding of the risk landscape. This risk expertise embedded in our company and the deep understanding of re/insurance markets also give us a solid foundation to identify material sustainability issues. In many areas of our business, we have special teams, functions and processes to identify and address issues relevant to sustainable development.

In our core re/insurance business there are units such as our Public Sector Solutions global function, the Environmental & Commodity Markets unit in our Corporate Solutions Business Unit, the P&C Structured Solutions unit in our Reinsurance Business Unit and many more that identify underinsured markets and risks, and seek to expand re/insurance protection through commercially viable solutions.

In our risk management, meanwhile, we have a process and the capabilities to identify risks we feel we should not re/insure, be it for ethical reasons, because they might lead to losses, or both. We conduct this analysis through our Sustainability Risk Framework and other tailor-made risk management tools.

We also maintain a formal process to identify emerging risks called SONAR ("Systematic observation of notions associated with risk"). This enables us to spot, at an early stage, newly developing or changing risks that may have an impact on our business, including risks related to environmental, social and governance (ESG) issues.

Insights from dialogue with our stakeholders

Our role as ultimate risk taker in society means that we have an intrinsic interest in maintaining active and ongoing dialogue with our key stakeholders. Generally speaking, this dialogue works in both directions: our partners expect us to share our risk expertise, thus helping them – and society at large – to form effective responses. In turn, we also benefit from this exchange, because it helps us to sharpen our understanding of key risks, including ESG issues, and to set priorities.

- With regard to such issues, we consider the following groups as our principal stakeholders:

- Financial community: investors/shareholders, rating agencies, shareholder associations and stock exchanges in addressing sustainability concerns;

- Clients: cedents, brokers and corporate clients;

- Employees;

- Political and legal entities: multilateral organisations (UN), governments, regulators, standard-setting boards;

- Civil society: general public, NGOs, media, academia.

Launched in March 2017, the Swiss Re Institute plays a key role in our stakeholder dialogue. It incorporates successful Swiss Re brands, such as the sigma publication series and the Centre for Global Dialogue, our own in-house conference venue near Zurich. The institute further acts as a coordination point for research output from research-focused business lines within Swiss Re and from external partners. Our renowned expertise publications form another important element of our stakeholder dialogue.

Complementing the insights we gain directly through dialogue with our stakeholders, we also evaluate and use data provided by specialised third-party organisations such as RepRisk (www.reprisk.com), Sigwatch (www.sigwatch.com), MSCI (www.msci.com) and Sustainalytics (www.sustainalytics.com) as well as the results of academic research.

Our process to identify Corporate Responsibility Topics

When identifying material Corporate Responsibility Topics, we draw both on our internal, embedded risk expertise and the insights we gain from our stakeholder dialogue. In addition, we take into account the views of various standard setters on materiality, eg: reporting requirements, materiality definitions by sustainability rating agencies, multilateral discussions such as the UN Sustainable Development Goals (see Our Corporate Responsibility topics, goals and achievements), relevant academic research and regulatory developments.

To process the information from these three key sources, we use the following steps:

- Expert analysis by our Group Sustainability Risk unit;

- Interviews with key internal decision makers, our sustainability risk stakeholders (eg investor meetings, events at the Centre for Global Dialogue, project and business related interactions) and external experts (academia, NGOs, consulting firms);

- Validation of final topics by the Group Sustainability Risk unit;

- Approval and endorsement by the Risk Management Executive Team, Group Executive Committee, Board of Directors;

- List of material topics finalised by Group Sustainability Risk unit;

- Development/adjustment of sustainability strategy based on final Corporate Responsibility Map.