Corporate responsibility in context: expanding re/insurance protection

For 151 years, we have provided our clients with effective financial protection against the risks they face. Traditionally, our most important client groups are insurers and large corporations. We offer them a large range of products covering many different types of losses.

With new challenges and new needs for risk protection emerging around the world, we have made considerable efforts in recent years to widen the reach of our re/insurance solutions. An important part of this has been to look beyond our established client base and traditional business model. We believe there is significant unmet demand for effective, commercially viable re/insurance protection, but offering suitable solutions requires innovative thinking on several levels.

Identifying risks with a protection gap

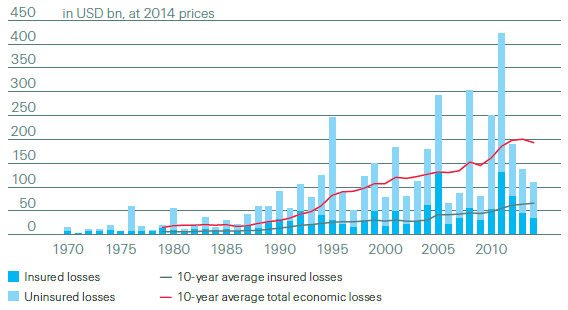

In many parts of the world, re/insurance protection against key risks remains limited. For example, natural catastrophes such as windstorms, earthquakes and floods tend to have huge social and financial impacts. Yet, the global gap between total and insured natural catastrophe losses is still massive (see illustration below).

Insured losses vs uninsured losses, 1970–2014

Source: Swiss Re Economic Research & Consulting

Agriculture is another case in point, especially in emerging and developing countries. All too often, farmers there face the devastating effects of adverse weather without insurance protection. What is more, both natural catastrophe and agricultural risks are expected to increase and become more unpredictable as a result of climate change.

Working with different clients and partners

To provide effective re/insurance protection for such risks, we need to cooperate with a wider range of partners, ranging from governments, supranational organisations, private companies and NGOs to “aggregators” such as financial institutions or service providers. We actively seek to build such client and partner relationships, depending on the specific risk to be addressed. To offer tailor-made solutions and expertise to public sector clients, for example, we established our Global Partnerships function several years ago.

Moving into new markets

It stands to reason that many underinsured risks are located in countries where insurance markets are less developed. This means that a special effort is required to gain a foothold in these markets and to develop a good understanding of local needs, conditions and challenges. Selecting and working with the right partner organisations can greatly help this. To intensify our efforts in Africa, for example, we have dedicated market development teams in both Reinsurance and Corporate Solutions.

Developing innovative risk transfer instruments

If we want to expand the reach of our re/insurance covers, we must take into account special requirements. For example, effective protection against natural catastrophe risks means that funds for relief and emergency measures need to be available quickly, so financing arrangements must be in place before an event (“ex-ante financing”). Likewise, agricultural insurance schemes in emerging and developing markets need to add real value, yet be affordable.

Parametric and index insurance products are suitable for these purposes, because they enable automatic payouts and have low administrative costs. As they are considered acceptable collateral by banks and input providers, they help secure and raise incomes. Swiss Re is an acknowledged leader in the development, structuring and pricing of such products.

Key terms: what they mean

Public-private partnerships

Effectively reducing and financing catastrophic risks requires a combined response by both private and public sector players. While the public sector plays a key role in setting a legal framework that enables the development of a private insurance sector, it is the primary role of private insurers and reinsurers to develop appropriate risk transfer solutions and to absorb and manage those risks most effectively.

In developed countries with a functioning insurance market, there is no need for the government to actively absorb natural catastrophe risks. In countries where the insurance market is not yet sufficiently developed, however, the government may need to assume a more active role as an enabler of risk transfer. In addition, governments themselves may choose to buy private insurance coverage in order to pre-finance public disaster expenses.

Microinsurance

Although the concept of microinsurance is gaining in popularity across the globe, there is no commonly accepted definition. The term typically refers to insurance products designed for low-income individuals. The word “micro” represents the relatively small transaction size or lower premiums, a concept similar to microfinance with small ticket loans. Microinsurance differs from traditional insurance in many ways, such as the size of premiums, coverage limits, product features, distribution, policy administration and target customers.

Parametric insurance

Parametric insurance uses measured or modelled parametric data to determine payouts. The payout model aims to closely mirror the actual damage on the ground and is usually based on the physical parameters of a catastrophic event or an index of such parameters, eg wind speed, geographic location of a hurricane or earthquake magnitude. Parametric insurance enables a more rapid payment than indemnity insurance because it requires no loss adjustments to assess the actual damage after an event.

Parametric insurance products can be further distinguished based on how payment is determined:

- Pure parametric triggers: using location and physical parameters;

- Parametric index triggers: a refined form of pure parametric triggers, using more granular loss data and giving relative weights to the locations;

- Modelled loss triggers: using a third-party model to calculate losses (and determine payouts).

Insurance products with a parametric index trigger – or index-based insurance products – are used to provide protection against both natural catastrophes and adverse weather conditions harming crops. In the latter case, they are particularly suited to protecting smallholder farmers in emerging and developing countries. Three types of products are popular:

Index-based products used in crop insurance:

Area-yield index products

The payout is made at any time the realised average yield (eg over a valley, a country or a defined geographic unit) falls below some threshold yield, regardless of the realised yield on the insured farm.

Weather index products

The payout is made at any time an objective weather parameter (eg rainfall, temperature, or soil moisture) triggers a defined threshold.

Remote sensing index products

The payout is made at any time an objective weather parameter derived from a satellite (eg rainfall and ”normalised differenced vegetation index“ for crop and livestock) triggers a defined threshold.

Insurance-linked securities

Insurance-linked securities (ILS), such as catastrophe bonds, are a means of ceding insurance-related risks to the capital markets. They usually rely on index-based payout mechanisms. Since the first cat bond in 1997, ILS have been used to transfer a wide range of risks from natural catastrophes to life insurance risks (see section “Natural catastrophes and climate change”).

Sources:

- Closing the financial gap – New partnerships between the public and private sectors to finance disaster risks (2011)

- The fundamentals of insurance-linked securities (2011)

- Sub-Saharan Africa – breadbasket for a growing population (2014)