Performance outcomes 2017

Key considerations for annual compensation decisions cover US GAAP and EVM based business results, qualitative factors and Swiss Re’s pay-for-performance approach.

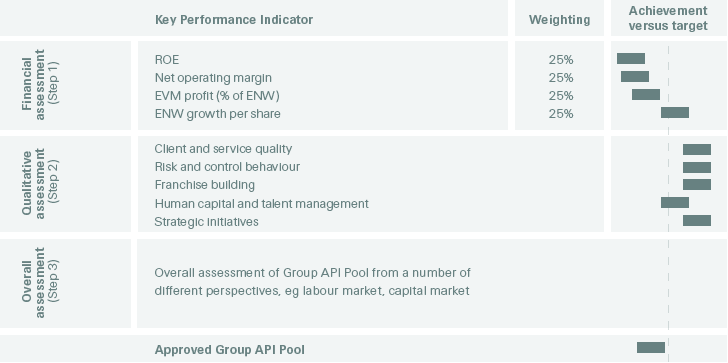

The outcomes of the financial, qualitative and overall assessment, all part of Swiss Re’s three-step funding process (as described in the Annual Performance Incentive section of this Financial Report), again determined the Group API pool for 2017.

Financial assessment (Step 1)

Swiss Re Group and Business Units

In 2017, the Group’s US GAAP performance and EVM results were significantly impacted by large natural catastrophe events including Cyclone Debbie in Australia, the North Atlantic hurricanes, the Mexican earthquakes and the wildfires in California. The destructive force of these events was reflected in both the Property & Casualty Reinsurance and Corporate Solutions results. The very strong investment results across all Business Units partially offset the impact from the large natural catastrophe losses. Life & Health Reinsurance delivered solid US GAAP and economic results, additionally benefiting from a good underwriting performance. Life Capital delivered a strong performance across all metrics and generated significant gross cash for the Group.

US GAAP financial performance

Property & Casualty Reinsurance reported a net loss in 2017, stemming from insurance claims in the aftermath of the large natural catastrophes during the year. Life & Health Reinsurance continued to report good US GAAP results, demonstrating sustainability in its performance, driven by a good underwriting result and continued strong investment performance. Premium growth reflects growth in the Americas and Asia.

The Corporate Solutions result was heavily impacted by the large natural catastrophes, resulting in a net loss for the year. Investment for long-term growth continues (organic and inorganic), despite the challenging market. The joint venture with Bradesco Seguros in Brazil began in July 2017. Corporate Solutions is now focused on the integration of Bradesco’s large-risk portfolio and the use of its established distribution network. Premiums earned increased slightly compared to 2016.

Life Capital delivered strong results, although large one-off gains on the investment portfolio reported in the prior-year period were not repeated in 2017. A strong investment result, mainly stemming from realised gains on sales of fixed income securities and favourable linked market movements, added to a solid underlying performance. The gross cash generation in the current year was driven by strong underlying surplus on the ReAssure business, and further benefited from an update to mortality assumptions and the finalisation of the 2016 year-end statutory valuation.

For further details on the US GAAP financial performance, refer to the Financial statements of this Financial Report.

EVM financial performance

The EVM underwriting result of Property & Casualty Reinsurance was driven by adverse large-loss experience, stemming from the large natural catastrophe events in 2017. This was partially offset by investment performance across equities and alternative investments as well as a positive impact from spread tightening on credit investments. The Life & Health Reinsurance underwriting profit was strong, mainly due to large transactions in EMEA, as well as continued growth in both the core life business in the US and the health business in Asia. Investment activities further contributed to the positive result, primarily driven by credit spread tightening as well as performance from equity securities.

Corporate Solutions generated an EVM new business loss primarily driven by large natural catastrophe losses, and the non-recognition of intangible assets (including goodwill) related to the Bradesco joint venture as well as continued pricing pressure and large man-made losses. This was partially offset by profit from investment activities, with a positive impact from spread tightening as well as performance from equity securities.

Life Capital reported an EVM underwriting profit primarily driven by a favourable result from large transactions. Investment activities further contributed to the positive result, mainly driven by the impact of spread tightening on UK credit investments and profit from implied equity exposure arising from the unit-linked business.

For further details on the EVM financial performance, refer to the EVM chapter of this Financial Report.

Qualitative assessment (Step 2)

Swiss Re performed well on its qualitative dimension in 2017. The positive efforts on client centricity were reflected in high client satisfaction scores in various external benchmarks.

The focus on strengthening the franchise remained strong: we continued to demonstrate thought leadership externally and strengthened our recognised voice in long-term investing policy dialogue at major industry events such as the G20, World Economic Forum and Monte Carlo. A highlight was the nomination as industry leader in Responsible Investing for our sustainable approach to long-term value creation. We closely co-operated with our clients and public and private partners to create innovative solutions in the areas of climate, natural disaster and agricultural risks, sustainable energy and funding longer lives.

Our innovation capabilities were again recognised by the market resulting in numerous awards for various products.

The assurance functions continually assess our risk and control related behaviour, and concluded that our tone at the top continues to be clear and appropriate. They also confirmed that we promote an open and transparent risk culture, and appropriate priority and direction are given to the risks and controls in strategic decisions. Judgement around limits and risk tolerance remained effective.

We also fostered and supported an inclusive corporate culture and leadership climate that embraced diversity of thought and opinion. This is reflected in our global employee engagement survey scores, which have again increased: these are well over the industry benchmark and close to the high performance norm. Some improvements were made in gender diversity but much more can be achieved here and this remains a critical focus area for 2018. The focus on talent management across the Group continued to be strong.

Overall assessment (Step 3)

The labour market review concluded that we are acting in line with many reinsurance organisations which have projected a decline in their annual incentive pools. The capital market review has highlighted that the proportionality of our proposed value sharing with employees is below peers in terms of revenue and profit sharing, giving a higher distribution percentage to shareholders.

Group API pool outcome 2017

Annual Performance Incentive

Both the Compensation Committee and the Board of Directors assessed in depth the 2017 performance of the Group. The financial performance was significantly lower than 2016 and heavily impacted by a series of large natural catastrophes. In years with relatively benign natural catastrophe environments, variable compensation payouts were positive but not excessive. Conversely, in adverse environments, the negative impact shall be substantive but also proportionate, given the need to carefully manage key talent and retention risk. This financial context, the strong qualitative performance and the value sharing measurement for shareholders have resulted in lower but still balanced variable compensation payouts.

Value Alignment Incentive

VAI performance is measured for the Group and each underlying business area. The performance factor for each participant is determined based on the business area that the participant was in at the time of award. In March 2017, the Group VAI 2013 (awarded in 2014) vested with a performance factor of 100.3% (see Value Alignment Incentive section for a detailed description of the VAI).

The VAI 2013 performance factor of 100.3%, which applies to all Group functions, reflected the reserving accuracy for the underwriting year 2013, with small developments between 2014 and 2016 and a slightly positive contribution for the investment performance.

| Download |

VAI plan year |

Performance period remaining as of 31 December 2017 |

Swiss Re Group performance factor |

2011 (awarded 2012) |

Closed |

103.0% |

2012 (awarded 2013) |

Closed |

101.5% |

2013 (awarded 2014) |

Closed |

100.3% |

2014 (awarded 2015) |

— |

to be determined |

2015 (awarded 2016) |

1 year |

to be determined |

2016 (awarded 2017) |

2 years |

to be determined |

Leadership Performance Plan

The LPP award is consistently linked to the Group’s future achievement of multi-year performance conditions (ROE and relative TSR), keeping the focus on the long-term success of the Group. Swiss Re made LPP grants in 2017 consistent with this rationale. The LPP is generally part of total compensation (see Leadership Performance Plan for a detailed description of the LPP).

The LPP 2014 award was granted on 1 April 2014 and vested on 31 March 2017. The RSU component is measured against an ROE performance condition. At the end of each year, the performance is assessed and one third of the RSUs are locked in within a range of 0% to 100%. At the end of the three-year period, the total number of units locked in vests. For the LPP 2014 the average performance factor for the RSUs was 99.7% for the three-year period.

The PSU component is based on relative TSR, measured against a pre-defined basket of peers, and vests within a range of 0% to 200%. For the LPP 2014 the performance factor for the PSUs was 81% for the three-year period.

The table below gives an overview of the RSU and PSU performance achievement for the previous LPP plan years:

LPP plan year |

Performance period remaining as of 31 December 2017 |

RSU average performance factor for the three-year period |

PSU performance factor for the three-year period |

2012 |

Closed |

99.7% |

200.0% |

2013 |

Closed |

99.7% |

60.0% |

2014 |

Closed |

99.7% |

81.0% |

2015 |

— |

to be determined |

to be determined |

2016 |

1 year |

to be determined |

to be determined |

2017 |

2 years |

to be determined |

to be determined |