Natural catastrophes and climate change

Natural catastrophes are a key risk in our property and casualty (P&C) businesses. The damage caused by floods, storms, earthquakes and other natural disasters can affect millions of lives and the economies of entire countries. In 2016, the total worldwide economic losses from natural and man-made catastrophes were estimated at USD 175 billion — of these, USD 54 billion were insured.

Having access to effective re/insurance protection against natural catastrophes creates significant benefits for our clients – as well as society at large. In 2016, we received USD 2.5 billion of P&C Reinsurance premiums for natural catastrophe covers (for losses larger than USD 20 million); this was equivalent to approximately 15% of total premiums in this business segment.

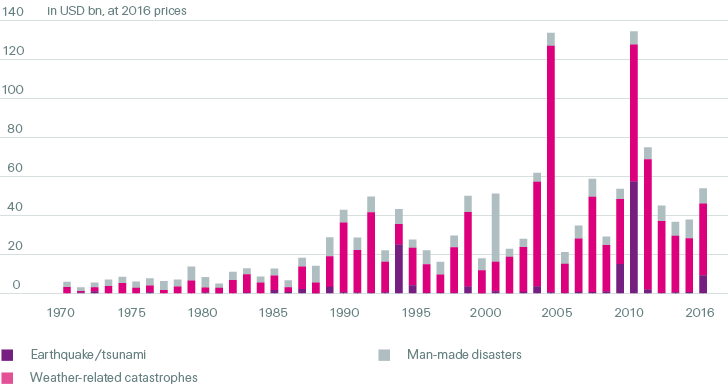

Insured catastrophe losses, 1970–2016

Source: Swiss Re Economic Research & Consulting

The impact of climate change

USD

2.5 billion

Natural catastrophe premiums

in our P&C Reinsurance business

(2015: USD 2.6 billion)

On average, both economic and insured losses caused by natural catastrophes have increased steadily over the past 20 years. The key reasons have been economic development, population growth, urbanisation and a higher concentration of assets in exposed areas.

This general trend will continue. But crucially, losses will be further aggravated by climate change. The scientific consensus is that a continued rise in average global temperatures will have a significant effect on weather-related natural catastrophes. According to the Special Report on Extremes (SREX, 2012) and the Fifth Assessment Report (AR5, 2014) published by the Intergovernmental Panel on Climate Change (IPCC), a changing climate gradually leads to shifts in the frequency, intensity, spatial extent, duration and timing of extreme weather events.

If climate change remains unchecked, the relative importance of the main drivers will thus gradually shift, with climate change accounting for an increasingly large share of natural catastrophe losses.

As a matter of fact, we first identified the potential mid- to long-term impact of climate change on our natural catastrophe business – and on society in general – almost 30 years ago. In response, we declared it a priority issue and introduced a comprehensive climate change strategy resting on four pillars:

- Advancing our knowledge and understanding of climate change risks, quantifying and integrating them into our risk management and underwriting frameworks where relevant;

- Developing products and services to mitigate – or adapt to – climate risk;

- Raising awareness about climate change risks through dialogue with clients, employees and the public, and advocacy of a worldwide policy framework for climate change;

- Tackling our own carbon footprint and ensuring transparent annual emissions reporting.

Understanding the risk

To assess our P&C businesses accurately and to structure sound risk transfer solutions, we need to clearly understand the economic impact of natural catastrophes and the effect of climate change. This is why we invest in proprietary, state-of-the-art natural catastrophe models and regularly collaborate with universities and scientific institutions to review underlying parameters.

It is important to note that while the effect of climate change will increase gradually over the coming decades, most of our business is renewed annually and our risk models are refined every few years. Risks are normally covered for 12 months (up to five years for cat bonds). Thus, for risk management and underwriting purposes, our models provide an estimate of the current risk, and reinsurance premiums do not reflect expected loss trends over the next decades. But as natural catastrophe losses continue to rise as a result of the different factors described above, our models will gradually reflect this trend, since they are updated and refined at regular intervals.

Natural catastrophes constitute one of the core modelled risks in Swiss Re’s risk landscape. Specifically, they are one of three categories in which we classify and model our P&C insurance risks (the other two being man-made and geopolitical risks). These P&C insurance risks arise from the coverage we provide to our clients for property, liability, motor, accident plus specialty risks.

Our proprietary integrated risk model is an important tool for managing the business: we use it to determine the economic capital required to support the risks on our books as well as to allocate risk-taking capacity to the different lines of business.

The four weather-related perils with the highest gross annual expected loss per end of 2016 are shown in the table below:

| Download |

Weather-related peril |

Annual expected loss |

North Atlantic hurricane |

550 |

European windstorm |

180 |

US tornado |

180 |

Japanese tropical cyclone |

90 |

Together, these four perils account for approximately two-thirds of our gross annual expected losses from weather-related perils.

We also carry out insurance risk stress tests on a regular basis to estimate the potential funding requirements stemming from extreme loss events. The basis for these calculations is the risk posed by a single event with a 200-year return period (ie with a likelihood of 0.5% over the next year). Major exposures include the following four natural catastrophe scenarios: Atlantic hurricanes, European windstorms, Californian earthquakes and Japanese earthquakes, of which the former two are prone to be affected by climate change. For further details, See Insurance risk.

In our asset management, we measure our exposure to carbon emissions investments in listed equities and corporate bonds in a systematic manner. In order to mitigate the risk of stranded assets, we have also adopted a policy to avoid investments in companies where a substantial part of their revenues is stemming from thermal coal.

Developing products and services

With some of our re/insurance products we aim to support two objectives: mitigation of climate change and adaptation to it.

Mitigation: By “mitigation” we mean efforts to reduce CO2 emissions. Renewable energy projects are key to this. To date our product development has focused on offshore wind, which is considered one of the most promising renewable energy sources. However, these infrastructures present highly complex risks because the technology is developing rapidly and there is little loss history to rely upon for underwriting purposes. Our Corporate Solutions Business Unit takes a special interest in offshore wind, as we have both the large capacity and the technical expertise to assess and manage the complex risks associated with it (see example in the box below and Helping wind farms bring their projects to life).

Adaptation to climate change requires effective risk transfer instruments that help our clients to cope with some of its effects. As we continuously adjust our natural catastrophe and weather solutions to reflect changes in the underlying risk, both are suitable for this purpose. On this page we describe some recent examples of such products, along with two corresponding commitments we have made.

Awareness raising and advocacy

We regularly share our insights into the risks created by climate change through our publications and stakeholder events, and have supported efforts to form a reliable international policy framework, eg by taking part in the United Nations’ COP conferences.

Recently we have contributed to regulatory developments that aim to increase transparency regarding climate-related risks and opportunities. For example, we have provided a member of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD), to which we refer in this section of our Financial Report. Starting from the premise that climate change creates physical, liability and transition risks, the TCFD aims to develop consistent and effective financial disclosures that will allow stakeholders to properly assess the climate risks faced by companies and to take appropriate actions.

We were also present at the launch event of the Sustainable Insurance Forum for Supervisors, held by the California Department for Insurance and the UN Environment Programme. The Forum’s goal is to promote cooperation on critical sustainable insurance challenges, such as climate change. Insurance regulators and supervisors are increasingly exploring how these factors impact their goals of ensuring the safety, soundness and accountability of the sector. For the first time, the Forum provides an international platform to share experience and explore common approaches.

Rentel offshore wind farm

In 2016, Swiss Re Corporate Solutions signed two new offshore wind farm projects as co-lead insurer. One of them is Rentel (www.rentel.be) in the Belgian North Sea, situated approximately 34 km from Zeebrugge and 40 km from Ostend. It is being developed by a consortium of eight Belgian shareholders with a strong track record in offshore wind, who joined forces in a strategic competence centre. The insurance cover offers Rentel compensation for material damage and loss of profit both in the construction phase and the first three years of the farm’s operational phase.

Rentel will comprise 42 wind turbines of 7.35 megawatts each, in total producing 309 megawatts at peak. The turbines are connected to an offshore transformer station from which the power will be transmitted to an onshore substation at Zeebrugge and then fed into the grid. The electricity generated by the wind farm will be sufficient to supply approximately 285 000 households with climate-friendly energy. Construction has started in early 2017 and is expected to becompleted by the end of 2018.

Tackling our carbon footprint

The fourth pillar of our climate strategy focuses on the emissions from our own operations. Through our pioneering Greenhouse Neutral Programme we almost halved our emissions per employee between 2003 and 2013 and set off all remaining emissions. Our new target, valid until 2020, is to keep our per-capita emissions stable at the 2013 level even as we continue to pursue an ambitious strategy in high growth markets. In the present second phase of the Greenhouse Neutral Programme, our emissions accounting and reporting covers the following sources: heating (Scope 1), power consumption (Scope 2) and several activities along our supply chain (Scope 3). You can track the development of these emissions since 2013 in the table below.

CO2 emissions per employee (full-time equivalent, FTE), Swiss Re Group

| Download |

|

20131 kg/FTE |

20151 kg/FTE |

2016 kg/FTE |

Change in % since 2015 |

Change in % since 2013 |

||||||

|

|||||||||||

Power2 |

824 |

858 |

877 |

2.2 |

6.4 |

||||||

Heating |

378 |

303 |

305 |

0.7 |

–19.3 |

||||||

Business travel |

3 713 |

3 736 |

4 109 |

10.0 |

10.7 |

||||||

Copy paper |

40 |

28 |

24 |

–14.3 |

–40.0 |

||||||

Waste |

50 |

44 |

41 |

–6.8 |

–18.0 |

||||||

Water |

12 |

13 |

12 |

–7.7 |

0 |

||||||

Technical gases |

27 |

24 |

21 |

–12.5 |

–22.2 |

||||||

Commuting3 |

1 250 |

1 150 |

1 150 |

0 |

–8.0 |

||||||

Total |

6 294 |

6 156 |

6 539 |

6.2 |

3.9 |

||||||

In 2016, total CO2 emissions per employee (FTE) increased by 6.2% and were thus 3.9% higher than in 2013. The main reason was a significant rise in business travel, which outweighed further gains we have made in reducing our energy intensity. A second factor was that we created new jobs in countries where power consumption is carbon intensive at present, eg in India. This situation is one of the reasons why we helped to establish the Climate Group’s RE100 initiative (see below).

Switching to renewable energy is one of two main measures we have taken to reach our emissions reduction goals. Approximately 84% of the power we purchased in 2016 across the Group came from renewable energy sources. We are committed to raising this figure to 100%, but in some of the countries where we want to grow, reliable supplies of renewable energy are lacking. As a founding member of the RE100 initiative (theRE100.org) we work together with a number of like-minded companies to improve this situation, by talking to policy-makers and regulators at the national and sub-national level. The RE100 group grew further in 2016 and now includes more than 80 of the world’s largest companies.

Becoming more energy efficient in our own operations has been the second key measure of our Greenhouse Neutral Programme. Our goal is to continuously reduce energy intensity by at least 2% per year. Recently we stepped up our efforts to create flexible office environments that offer our employees optimal working conditions while at the same time using space and resources more effectively. In combination with moving into more energy-efficient buildings, this enabled us to further reduce our energy intensity by 3.8% in 2016, resulting in a decrease of 18.5% since 2013.

For full details of our CO2 emissions and underlying environmental data, please refer to the 2016 Corporate Responsibility Report.