Corporate Governance

Swiss Re’s corporate governance forms the basis for sustainable management of the Swiss Re Group.

Overview

The Board of Directors introduces a corporate governance framework which fosters sustainable oversight and management.

“Corporate governance needs to be embedded in a company’s culture.”

Walter B. Kielholz

Chairman of the Board of Directors

Swiss Re’s corporate governance adheres to the SIX Swiss Exchange’s Directive on Information Relating to Corporate Governance, including its annex. It is also in line with the principles of the Swiss Code of Best Practice for Corporate Governance (Swiss Code) of September 2014, issued by economie-suisse, the Swiss business federation. Swiss Re also conforms to the Swiss Financial Market Supervisory Authority (FINMA) provisions on corporate governance, risk management and internal control systems. Swiss Re’s corporate governance furthermore complies with applicable local rules and regulations in all jurisdictions where it conducts business. The Board of Directors regularly assesses the Group’s corporate governance against relevant best practice standards as well as new stakeholder demands. It monitors corporate governance developments globally and it considers the relevant studies and surveys on corporate governance. Information on compensation of and loans to members of the Board of Directors and the Group Executive Committee (Group EC) is included in the Compensation Report of this Financial Report and their shareholdings in Swiss Re are shown in the notes to the Swiss Re Ltd financial statements.

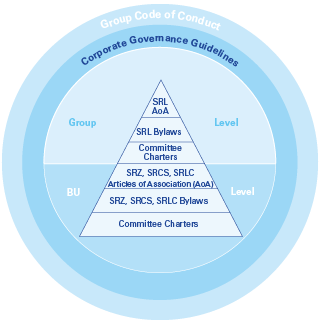

Swiss Re’s corporate governance framework

Swiss Re Ltd’s Board of Directors is responsible for oversight, while the Group EC is responsible for managing operations. This structure maintains effective mutual checks and balances between these top corporate bodies. Our corporate governance principles and procedures are defined in a series of documents governing the oversight, organisation and management of the company. These include at the Group level:

- the Group Code of Conduct, outlining our compliance framework and setting out the basic ethical and legal principles and policies we apply globally;

- the Corporate Governance Guidelines (Guidelines), setting forth the Group’s governance framework, principles, processes and requirements, ensuring consistent and fitted corporate governance across the Group;

- the Articles of Association of Swiss Re Ltd (SRL), defining the legal and organisational framework of the Group’s holding company SRL, (available at www.swissre.com/about_us/corporate_governance/corporate_regulations.html);

- the SRL&Group Bylaws, defining the governance structure for SRL and within the Group including the responsibilities of the Board of Directors, Chairman, Vice Chairman, Lead Independent Director, Board committees, Group EC, Group CEO and of the other individual Group EC members including the Regional Presidents, as well as the relevant reporting procedures; and

- the Board Committee Charters, outlining the duties and responsibilities of the Board committees.

Swiss Re’s governance documents

In addition, they include at the Business Unit level:

- the Articles of Association of Swiss Reinsurance Company Ltd (SRZ), Swiss Re Corporate Solutions Ltd (SRCS) and Swiss Re Life Capital Ltd (SRLC), defining the legal and organisational framework of the Business Unit (BU) top-level companies SRZ, SRCS and SRLC;

- the SRZ, SRCS, SRLC&Business Unit Bylaws, defining the governance structure and principles in line with the SRL&Group Bylaws for SRZ, SRCS and SRLC and their respective BUs Reinsurance, Corporate Solutions and Life Capital; and

- the Board Committee Charters, outlining the duties and responsibilities of the board committees of SRZ, SRCS and SRLC.

2016 key focus areas

Enhanced corporate governance framework for SRLC and the Business Unit Life Capital

Underscoring its evolution, SRLC’s and the Business Unit Life Capital’s corporate governance framework has been aligned where appropriate in 2016 to Group and other Business Units’ standards, requirements and processes. While the SRLC Board of Directors is responsible for oversight, it has delegated the management of SRLC and the Business Unit Life Capital to the Life Capital Executive Committee (Life Capital EC). The Life Capital EC has delegated certain responsibilities to individual Life Capital EC members, to the Life Capital Management team and the Life Capital Finance, Risk and Investment Committee.

Comprehensive revision of the Bylaws in 2016

In line with the Board of Directors’ efforts in monitoring corporate governance best practice and developments as well as to continuingly improve our Bylaws, the Board of Directors regularly reviews the Bylaws at Group and Business Unit level.

The Board of Directors therefore revised the SRL&Group Bylaws and SRZ, SRCS, SRLC&Business Unit Bylaws comprehensively in 2015/2016 with the following aims:

- Implementation of corporate governance changes based on the new Group Target Operating Model; and

- alignment with the latest best practice corporate governance standards and with stakeholders’ demands.

Crisis management and EVM training

In 2016, the Board of Directors undertook further efforts to enhance its expertise, with an emphasis on Economic Value Management (EVM) and crisis management.

- The Board of Directors held an in-depth educational session on EVM.

- The Board members participated in a full-day workshop on crisis management, together with the members of the Group EC and representatives of significant subsidiaries of the Swiss Re Group. The workshop participants were asked to respond to crisis situations by applying the Group Recovery Plan, one of Swiss Re’s key instruments to manage capital and liquidity in severe adverse financial conditions. The session included comprehensive simulations of stress scenarios, considering large loss events, financial market disruptions and adverse political developments. The fact that real figures, including Swiss Re’s own consolidated balance sheet, were used for the simultations, was seen as particularly valuable.

Highlights 2016/2017

Board of Directors

- Sir Paul Tucker was elected as a new member to the Board of Directors by the shareholders at the Annual General Meeting which took place in Zurich on 22 April 2016.

- Mathis Cabiallavetta, Hans Ulrich Maerki and Jean-Pierre Roth did not stand for re-election.

- The Annual General Meeting 2016 re-elected Walter B. Kielholz for a further one-year term of office as Chairman of the Board of Directors.

- Raymond K.F. Ch’ien, Renato Fassbind, Mary Francis, Rajna Gibson Brandon, C. Robert Henrikson, Trevor Manuel, Carlos E. Represas, Philip K. Ryan and Susan L. Wagner were individually re-elected by the Annual General Meeting 2016 for a further one-year term of office as members of the Board of Directors.

- The Annual General Meeting 2016 re-elected Renato Fassbind, C. Robert Henrikson and Carlos E. Represas as members and elected Raymond K.F. Ch’ien as new member of the Compensation Committee, all members for a one-year term of office.

- The Board of Directors nominated Jay Ralph, Joerg Reinhardt and Jacques de Vaucleroy to be proposed to the Annual General Meeting 2017 for election as new members of the Board of Directors, whereas Carlos E. Represas will not stand for re-election.

Group EC

- Christian Mumenthaler became Group CEO as of 1 July 2016, succeeding Michel Liès, who retired.

- Moses Ojeisekhoba was appointed CEO Reinsurance as of 1 July 2016, succeeding Christian Mumenthaler.

- Jayne Plunkett was appointed CEO Reinsurance Asia and Regional President Asia as of 1 July 2016, succeeding Moses Ojeisekhoba. With that appointment she also became a member of the Group EC.

- Thierry Léger was appointed CEO Life Capital and joined the Group EC as a member as of 1 January 2016.

- Edouard Schmid will become Group Chief Underwriting Officer and a member of the Group EC as of 1 July 2017, succeeding Matthias Weber who has decided to step down as Group Chief Underwriting Officer.

Revised Code of Conduct implemented in 2016

Swiss Re believes that it can only accomplish sustainable success if our stakeholders recognise us as a trustworthy partner that pursues legitimate goals using legitimate means.

Swiss Re’s Code of Conduct provides key principles that guide Swiss Re in making responsible decisions and achieving results using the highest ethical standards.

Swiss Re’s Code of Conduct is built on the five Swiss Re Corporate Values, which are the heart of everything we do:

- Integrity

- Team Spirit

- Passion to Perform

- Agility

- Client Centricity

The Corporate Values are put in action by the Leadership as well as Personal Imperatives. They represent the behaviours that strongly reinforce and advance our business goals. They provide a solid basis for assessing our performance and they reward each of us for not only what we achieve, but how we achieve it.

Swiss Re’s Code of Conduct was revised in 2016 with the particular aim to make it short and easy to understand while meeting the requirements of an increasingly complex business, regulatory and legal environment. It can be found on: files.swissre.com/codeofconduct/index.html