Significant shareholders and shareholder structure

Under the Financial Markets Infrastructure Act (FMIA), anyone holding shares in a company listed on the SIX Swiss Exchange is required to notify the company and the SIX Swiss Exchange if its direct or indirect holding reaches, falls below or exceeds the following thresholds: 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights pursuant to the entry into the commercial register, whether or not the voting rights can be exercised*. Notifications must also include financial instruments, regardless of whether cash or physically settled, constituting a purchase or a sale position. Upon receipt of such notifications, the company is required to inform the public by publishing within two trading days the notification on the electronic platform of the SIX Swiss Exchange.

The following table provides a summary of the current disclosure notifications of major shareholders holding more than 3% of the voting rights:

Significant shareholders

| Download |

Shareholder1 |

Number of shares |

% of voting rights and share capital |

Creation of the obligation to notify |

||||

|

|||||||

|

|

|

|

||||

BlackRock, Inc. |

18 218 4922 |

5.06 |

10 October 2016 |

||||

|

|

|

|

||||

In addition, Swiss Re Ltd and Group companies held, as of 31 December 2016, directly and indirectly, 34 093 834 shares, which includes 5 542 500 shares repurchased under the public share buy-back programme Swiss Re Ltd launched on 4 November 2016. The public share buy-back programme was completed on 9 February 2017. This represents 9.47% of voting rights and share capital. Neither Swiss Re Ltd nor the Group companies can exercise the voting rights of these shares. All notifications received in 2016 are published at www.swissre.com/investors/shares/disclosure_of_shareholdings/ For further details on the past share buy-back programmes please visit: www.swissre.com/investors/shares/share_buyback/

* According to Article 120 (1) FMIA anyone who directly or indirectly or acting in concert with third parties acquires or disposes shares or acquisition or sale rights relating to shares of a company with its registered office in Switzerland whose equity securities are listed in whole or in part in Switzerland, or of a company with its registered office abroad whose equity securities are mainly listed in whole or in part in Switzerland, and thereby reaches, falls below or exceeds the thresholds of 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights, whether exercisable or not, must notify this to the company and to the stock exchanges on which the equity securities are listed. According to Article 120 (3) FMIA, anyone who has the discretionary power to exercise the voting rights associated with equity securities in accordance with Article 120 (1) FMIA is also subject to the notification. The person or group is obliged to make a notification in writing to the company (issuer) and the stock exchange no later than four trading days after the creation of the obligation to notify (conclusion of a contract).

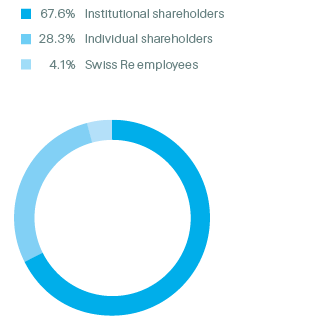

Registered shareholders by type

as of 31 December 2016

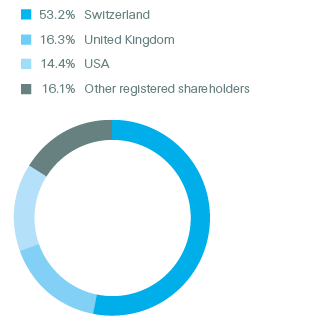

Registered shareholdings by country

as of 31 December 2016

Shareholder structure

Registered — unregistered shares

| Download |

As of 31 December 2016 |

Shares |

in % |

||

|

||||

Registered shares1 |

193 711 538 |

53.8 |

||

Unregistered shares1 |

132 267 189 |

36.7 |

||

Shares held by Swiss Re |

28 551 334 |

7.9 |

||

Share Buy-back Programme |

5 542 500 |

1.6 |

||

Total shares issued |

360 072 561 |

100.0 |

||

Registered shares with voting rights by shareholder type

| Download |

As of 31 December 2016 |

Shareholders |

in % |

Shares |

in % |

Individual shareholders |

76 602 |

87.8 |

54 870 537 |

28.3 |

Swiss Re employees |

6 503 |

7.4 |

7 955 764 |

4.1 |

Total individual shareholders |

83 105 |

95.2 |

62 826 301 |

32.4 |

Institutional shareholders |

4 162 |

4.8 |

130 885 237 |

67.6 |

Total |

87 267 |

100.0 |

193 711 538 |

100.0 |

Registered shares with voting rights by country

| Download |

As of 31 December 2016 |

Shareholders |

in % |

Shares |

in % |

Switzerland |

75 653 |

86.7 |

103 057 224 |

53.2 |

United Kingdom |

1 434 |

1.6 |

31 494 230 |

16.3 |

USA |

1 385 |

1.6 |

28 006 420 |

14.4 |

Other |

8 795 |

10.1 |

31 153 664 |

16.1 |

Total |

87 267 |

100.0 |

193 711 538 |

100.0 |

Registered shares with voting rights by size of holding

| Download |

As of 31 December 2016 |

Shareholders |

in % |

Shares |

in % |

Holdings of 1–2 000 shares |

80 810 |

92.6 |

31 550 558 |

16.3 |

Holdings of 2 001–200 000 shares |

6 366 |

7.3 |

58 796 579 |

30.3 |

Holdings of > 200 000 shares |

91 |

0.1 |

103 364 401 |

53.4 |

Total |

87 267 |

100.0 |

193 711 538 |

100.0 |

Cross-shareholdings

Swiss Re has no cross-shareholdings in excess of 5% of capital or voting rights with any other company.