Key information

Good 2016 results were supported by a continued solid underwriting performance.

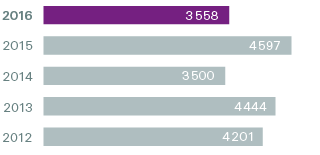

Net income

(USD millions)

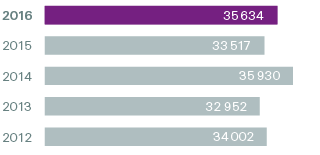

Shareholders’ equity

(USD millions)

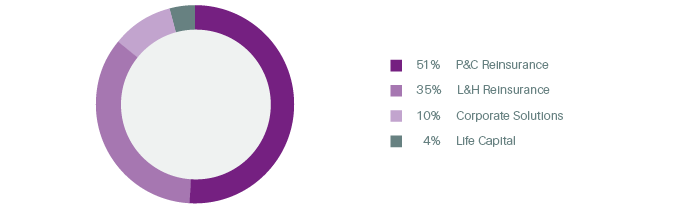

Net premiums and fees earned by business segment, 2016

(Total: USD 33.2 billion)

Proposed regular dividend per share for 2016

(CHF)

4.85

(CHF 4.60 for 2015)

A summary of our strengths

Well positioned

Swiss Re is well positioned to face industry challenges and seize opportunities.

A risk knowledge company

We are a risk knowledge company, investing in research and development and technology to support our clients and differentiate from the competition.

A successful capital allocator

We have been a successful capital allocator, using our knowledge-based approach to access the most attractive risk pools and target an optimal portfolio of assets and liabilities.

Focused on performance

We aim to achieve our Group financial targets and deliver sustainable shareholder value.