Swiss Re’s risk appetite framework

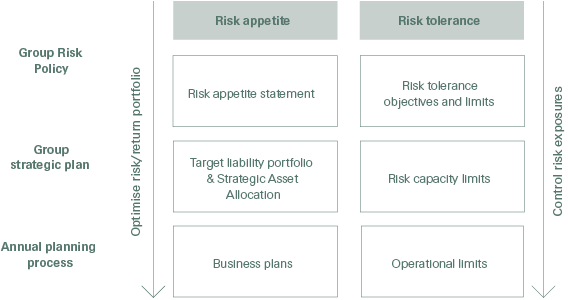

Our risk appetite framework establishes the overall approach through which we practice controlled risk-taking throughout the Group. The framework is set out in our Group Risk Policy and consists of two inter-linked components:

- Risk appetite provides guiding principles on acceptable risks and describes the aggregate level and types of risk that we wish to take or avoid in pursuit of the Group’s strategy.

- Risk tolerance represents the aggregate amount of risk that the Group is willing to accept within the constraints imposed by its capital and liquidity resources, strategy, risk appetite and regulatory and rating agency requirements.

The risk appetite framework plays a particularly important role in the context of business strategy and planning discussions: the risk appetite statement facilitates discussions about where and how the Group should deploy its capital, liquidity and other resources under a risk-return view, while the risk tolerance sets clear boundaries to risk-taking.

During strategic planning and target-setting, Risk Management provides an opinion on the proposed strategy and targets to the Group EC and ultimately the Group Board of Directors. The opinion focuses on the risk impact of the proposed strategy and the risks related to its implementation. The strategic plan, risk appetite and capital allocation ambition are expressed in a target portfolio for the Group’s assets and liabilities, which should ultimately deliver the Group’s targeted performance.

In the context of the annual planning process, ie during the phase of operational and financial planning, Risk Management reviews and challenges plan assumptions and assesses the risks and feasibility related to implementing the proposed plan. It provides transparency on the detailed risk implications of the plan and tests its adherence to risk appetite and risk tolerance.

In addition, Risk Management proposes risk capacity limits that ensure compliance with the overall risk appetite and tolerance. The risk capacity limits represent an aggregated constraint to risk-taking and seek to ensure that Group-wide accumulation risks remain within acceptable levels. They allow for risk monitoring and hence also for risk controlling during the subsequent execution of the plan. In addition to the risk capacity limits proposed by Risk Management, the Group EC also sets operational limits, which the business monitors and controls in day-to-day management.