Natural catastrophes and climate change

Natural catastrophes are a key risk in our Property & Casualty (P&C) business. The damage caused by floods, storms, earthquakes and other natural disasters can affect millions of lives and the economies of entire countries. In 2015, the total worldwide economic losses from natural and man-made catastrophes were estimated at USD 92 billion – of these, USD 37 billion were insured.

Having access to effective re/insurance protection against natural catastrophes creates significant benefits for our clients – as well as society at large. In 2015, we received USD 2.6 billion of P&C Reinsurance premiums for natural catastrophe covers (for losses larger than USD 20 million); this was equivalent to 17% of total premiums in this business segment.

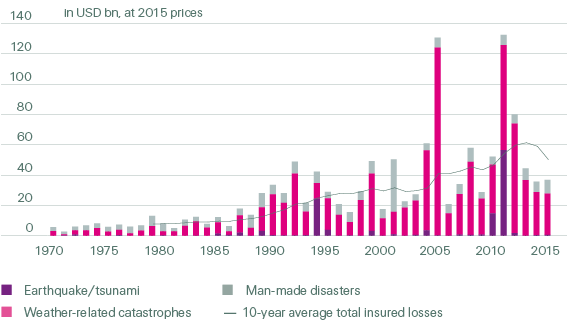

Insured catastrophe losses, 1970–2015

Source: Swiss Re Economic Research & Consulting

The impact of climate change

USD 2.6 billion

Natural catastrophe premiums in our P&C Reinsurance business

(2014: USD 2.9 billion)

On average, both economic and insured losses caused by natural catastrophes have increased steadily over the past 20 years. The key reasons have been economic development, population growth, urbanisation and a higher concentration of assets in exposed areas.

This general trend will continue. But crucially, losses will be further aggravated by climate change. The scientific consensus is that a continued rise in average global temperatures will have a significant effect on weather-related natural catastrophes. According to the Special Report on Extremes (SREX, 2012) and the Fifth Assessment Report (AR5, 2014) published by the Intergovernmental Panel on Climate Change (IPCC), a changing climate gradually leads to shifts in the frequency, intensity, spatial extent, duration and timing of extreme weather events.

If climate change remains unchecked, the relative importance of the main drivers will thus gradually shift, with climate change accounting for an increasingly large share of natural catastrophe losses.

In view of the potential impact of climate change on our business in the medium- to long-term, we made it a priority issue more than 20 years ago and formed a comprehensive climate change strategy with four pillars:

- Advancing our knowledge and understanding of climate change risks, quantifying and integrating them into our risk management and underwriting frameworks where relevant;

- Developing products and services to mitigate — or adapt to — climate risk;

- Raising awareness about climate change risks through dialogue with clients, employees and the public, and advocacy of a worldwide policy framework for climate change;

- Tackling our own carbon footprint and ensuring transparent annual emissions reporting.

First offshore wind farm in the US

In 2015, we insured a number of offshore wind projects in different countries, including the Block Island Wind Farm in the US (dwwind.com/project/block-island-wind-farm/). Developed by Deepwater Wind, this is the country’s first-ever offshore wind facility. The project is situated in the Atlantic Ocean, approximately three miles from Block Island, Rhode Island, where there are strong and steady winds. Thanks to its expertise and proximity to the client, Swiss Re Corporate Solutions was appointed as the project’s lead insurer and provides both a Construction All Risk (CAR) and a Delay in Start-Up (DSU) cover.

Construction of the wind farm is underway and is scheduled to be completed by the end of 2016. Our client, GE Wind (formerly Alstom), is building five powerful, highly efficient turbines that will generate a total capacity of 30 megawatts. The wind farm will give the inhabitants of Block Island access to reliable as well as renewable electricity for the first time. So far, they have had to use diesel generators, which are inefficient and cause substantial air pollution. The power not used on Block Island will be transmitted to the mainland through a 21-mile long cable under the ocean floor.

Understanding the risk

To assess our Property & Casualty business accurately and to structure sound risk transfer solutions, we need to clearly understand the economic impact of natural catastrophes and the effect of climate change. This is why we invest in proprietary, state-of-the-art natural catastrophe models and regularly collaborate with universities and scientific institutions.

While the effect of climate change will increase gradually over the coming decades, most of our business is renewed annually and our risk models are refined every few years. Risks are normally covered for 12 months (up to five years for cat bonds). Thus, reinsurance premiums do not reflect expected loss trends over the next decades. Rather, for underwriting and risk management purposes, our models provide an estimate of the current risk. But as natural catastrophe losses continue to rise as a result of the different factors described above, our forward-looking models will gradually reflect this trend, since they are updated and refined at regular intervals.

Through the Economics of Climate Adaptation (ECA) methodology we also analyse the effects of climate change on a longer timescale, which enables us to provide our clients with strategic advice and integral risk assessments of natural disasters and climate adaptation. ECA studies quantify today’s climate risks, the potential increase of populations and assets at risk due to economic development, plus the additional risk posed by climate change, with a time horizon of up to 30 years. In a second step, our studies identify cost-effective measures to adapt to these risks.

In 2015, we completed two new ECA studies, both at the request of the German Development Bank (KfW). For San Salvador, El Salvador, we found that strengthening the buffer capacity of ecosystems through reforestation can reduce flood risk in poorer neighbourhoods by up to USD 50 million over three decades. The study for the city of Barisal, Bangladesh revealed that reinforcing river embankments effectively protects citizens and reduces local flood risks by more than 50%, also under future climate scenarios. Both ECA studies thus give decision-makers important information needed to integrate climate adaptation with economic development, paving the way for sustainable growth.

Developing products and services

With some of our re/insurance products we aim to support two objectives: mitigation of climate change and adaptation to it.

Mitigation: By “mitigation” we mean efforts to reduce CO2 emissions. Renewable energy projects are key to this. To date our product development has focused on offshore wind, which is considered one of the most promising renewable energy sources. However, these infrastructures present highly complex risks because the technology is developing rapidly and there is little loss history to rely upon for underwriting purposes. Our Corporate Solutions Business Unit takes a special interest in offshore wind, as we have both the large capacity and the technical expertise to assess and manage the complex risks associated with it (see example above).

Adaptation to climate change requires effective risk transfer instruments that help our clients to cope with some of its effects. As we continuously adjust our natural catastrophe and weather solutions to reflect changes in the underlying risk, both are suitable for this purpose. In Expanding re/insurance protection we describe some recent examples of such products, along with two corresponding commitments we have made.

Awareness raising and advocacy

We regularly share our insights into the risks created by climate change through our publications and stakeholder events, and support efforts to form a reliable international policy framework, eg by taking part in the United Nations’ COP conferences.

In 2015, we also partnered with Standard & Poor’s in a special project to quantify the impact of natural catastrophes and climate change on sovereign ratings. Based on a sample of 38 countries, our simulations indicate that natural disasters (earthquakes, tropical storms, floods and winter storms) of a severity that is likely to occur once every 250 years can indeed weaken the affected sovereign’s rating. Moreover, climate change can be expected to increase this impact by 20% on average. The expected effect is strongest in emerging countries and especially in the event of earthquakes and tropical storms: the most severe of these disasters could lead to a downgrade of around 1.5 notches. However, the study also found that this potential effect can be significantly reduced by catastrophe insurance.

Tackling our carbon footprint

The fourth pillar of our climate strategy focuses on the emissions from our own operations. Through our pioneering Greenhouse Neutral Programme we halved our emissions per employee between 2003 and 2013 and set off all remaining emissions. Our new commitment, valid until 2020, is to keep our per capita emissions stable at the 2013 level even as we continue to pursue an ambitious strategy in high growth markets. As part of our new commitment, we have also extended the scope of our emissions accounting and reporting to include five additional emission sources.

After an increase in 2014, total CO2 emissions per employee (FTE, full-time equivalent) dropped by 4% during 2015, mainly driven by a further reduction in the energy intensity of our offices and decreases in the emissions from commuting and business travel. The latter was due to the fact that our employees made fewer business trips in carbon-intense flight classes, even though the total distances they travelled increased slightly on average. (Detailed data for all reported emission sources will be disclosed in the 2015 Corporate Responsibility Report.)

Key environmental data, Swiss Re Group

| Download |

|

|

2013 |

2014 |

2015 |

Change in % |

||

|

|||||||

Total CO2 emissions per employee |

kg/FTE1 |

6 645 |

6 723 |

6 433 |

–3.2% |

||

Energy intensity (power consumption & heating) |

kWh/FTE1 |

6 515 |

6 019 |

5 442 |

–16.5% |

||

Switching to renewable energy is one of two main measures we have taken to reach our emissions reduction goals. Approximately 87% of the power we purchased in 2015 across the Group came from renewable energy sources. We are committed to raising this figure to 100%, but in some of the countries where we want to grow, reliable supplies of renewable energy are lacking. As a founding member of the RE100 initiative (theRE100.org) we work together with a number of like-minded companies to improve this situation, by talking to policy-makers and regulators at the national and sub-national level. The RE100 group grew substantially in 2015 and now includes some of the largest companies in the world.

Becoming more energy efficient in our own operations has been the second key measure of our Greenhouse Neutral Programme. Our goal is to continuously reduce energy intensity by at least 2% per year. Recently we stepped up our efforts to create flexible office environments that offer our employees optimal working conditions while at the same time using space and resources more effectively. In combination with moving into more energy-efficient buildings, this enabled us to further reduce our energy intensity by 16% between 2013 and 2015. In 2015, the two measures contributed to workplace cost savings of 4%.