Significant shareholders and shareholder structure

Under the Swiss Federal Act on Stock Exchanges and Securities Trading (SESTA), anyone holding shares in a company listed on the SIX Swiss Exchange is required to notify the company and the SIX Swiss Exchange if their direct or indirect holding reaches, falls below or exceeds the following thresholds: 3%, 5%, 10%, 15%, 20%, 25%, 33⅓%, 50% or 66⅔% of the voting rights entered into the commercial register, whether or not the voting rights can be exercised. Notifications must also include financial instruments, regardless of whether cash or physically settled, constituting a purchase or a sale position. Upon receipt of such notifications, the company is required to inform the public by publishing within two trading days the notification on the electronic platform of the SIX Swiss Exchange. The following table provides a summary of the current disclosure notifications.

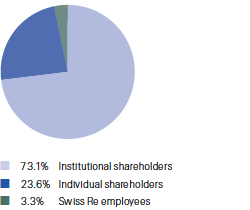

Registered shareholders by type

as of 31 December 2013

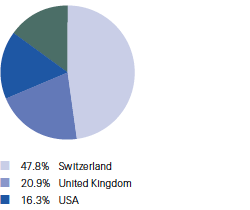

Registered shareholdings by country

as of 31 December 2013

Significant shareholders

| Download |

|

Shareholder1,2 |

Number of |

% of voting rights and share capital |

Creation of the obligation to notify |

||||

|

|||||||

|

Franklin Resources, Inc. |

18 277 452 |

4.93 |

2 August 2012 |

||||

|

Warren E. Buffett and Berkshire Hathaway Inc. |

11 262 000 |

3.10 |

10 June 2011 |

||||

|

BlackRock, Inc. |

11 134 246 |

3.09 |

26 September 2011 |

||||

In addition, Swiss Re Ltd and Group companies held, as of 31 December 2013, directly and indirectly, 28 512 910 shares, representing 7.7% of voting rights and share capital. Neither the company nor the Group companies can exercise the voting rights of the own shares they hold themselves. All notifications received in 2013 are published at http://www.swissre.com/investors/shares/disclosure_of_shareholdings/ and http://www.six-exchange-regulation.com/obligations/disclosure/major_shareholders_en.html.

Shareholder structure

Registered – unregistered shares

| Download |

|

As of 31 December 2013 |

Shares |

in % |

||

|

||||

|

Shares registered in the share register1 |

198 483 183 |

53.5 |

||

|

Unregistered shares1 |

143 710 838 |

38.8 |

||

|

Shares held by Swiss Re |

28 512 910 |

7.7 |

||

|

Total shares issued |

370 706 931 |

100.0 |

||

Registered shares with voting rights by shareholder type

| Download |

|

As of 31 December 2013 |

Shareholders |

in % |

Shares |

in % |

|

Individual shareholders |

60 796 |

89.7 |

46 779 046 |

23.6 |

|

Swiss Re employees |

3 354 |

4.9 |

6 557 054 |

3.3 |

|

Total individual shareholders |

64 150 |

94.6 |

53 336 100 |

26.9 |

|

Institutional shareholders |

3 656 |

5.4 |

145 147 083 |

73.1 |

|

Total |

67 806 |

100.0 |

198 483 183 |

100.0 |

Registered shares with voting rights by country

| Download |

|

As of 31 December 2013 |

Shareholders |

in % |

Shares |

in % |

|

Switzerland |

61 002 |

90.0 |

94 859 733 |

47.8 |

|

United Kingdom |

502 |

0.7 |

41 511 686 |

20.9 |

|

USA |

466 |

0.7 |

32 337 043 |

16.3 |

|

Other |

5 836 |

8.6 |

29 774 721 |

15.0 |

|

Total |

67 806 |

100.0 |

198 483 183 |

100.0 |

Registered shares with voting rights by size of holding

| Download |

|

As of 31 December 2013 |

Shareholders |

in % |

Shares |

in % |

|

Holdings of 1–2 000 shares |

62 055 |

91.5 |

25 706 046 |

13.0 |

|

Holdings of 2 001–200 000 shares |

5 662 |

8.4 |

54 880 325 |

27.6 |

|

Holdings of > 200 000 shares |

89 |

0.1 |

117 896 812 |

59.4 |

|

Total |

67 806 |

100.0 |

198 483 183 |

100.0 |

Cross-shareholdings

Swiss Re has no cross-shareholdings in excess of 5% of capital or voting rights with any other company.