Value Alignment Incentive

Purpose

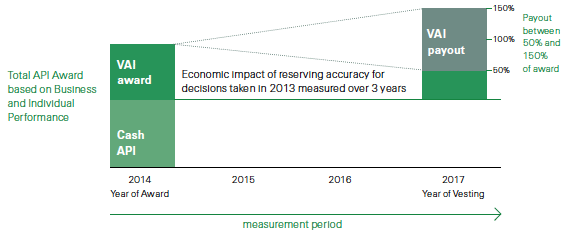

The VAI is a mandatory deferral of a portion of the API adding a time component to variable compensation. This supports the Group’s business model by aligning a substantial portion of variable compensation with sustained long-term results. The aim is to ensure that the ultimate value of the deferred variable compensation through VAI, though awarded for short-term performance, is significantly affected by the longer-term performance of the line of business and the Group.

Plan duration

The VAI supports a longer-term perspective by directly linking awards to performance over a three-year period.

Structure

The higher the API, the greater the portion of variable compensation that remains at risk through the VAI, as shown in the table below.

Portion of API that remains at risk

| Download |

|

|

Deferral into VAI |

|

Group CEO |

50% of API |

|

Group EC members |

45% of API |

|

GMB members |

40% of API |

|

All other employees |

50% of the amount at or above USD 100 000 up to a maximum of 40% of API |

The payout factor of the VAI is based on the underwriting year EVM results. EVM is used to evaluate, price, reserve and steer the business decisions within Swiss Re. As EVM recognises all cash flows associated with a contract upfront, measuring the VAI over the following three years enables a reduction of VAI if performance is lower than expected; conversely, if performance is higher than expected, a premium will apply. The VAI tracks the EVM profit margin development over the subsequent three years after grant. EVM profit margin is the ratio of EVM profit to EVM capital. The average EVM profit margin over the three-year measurement period is used to determine the final payout factor. The payout factor is a linear function that ranges from 50% (for an average EVM profit margin development of –15%) to 150% (for an average EVM profit margin development of +15%).

Value Alignment Incentive – 2013 results measured over 3 years

VAI awards granted prior to 2012 contained an additional mark-up element as compensation for the time value of money. This mark-up has been eliminated for awards starting with the VAI 2011 (awarded in 2012) onwards.

EVM results, additional targets and non-financial performance factors are taken into consideration in the Asset Management VAI each year to set annual payout factors. The annual payout factors are then averaged over the three-year measurement period to determine the final payout factor. The payout factor is still a linear function that ranges from 50% to 150%.

Settlement

At the end of the deferral period, VAI will be settled in cash. For the full three-year performance measurement period, forfeiture conditions apply. Additionally, clawback provisions apply in the event of any downward financial restatement which is caused or partially caused by the VAI participant’s fraud or misconduct. In this case, the company is entitled to seek repayment of any vested and settled award.